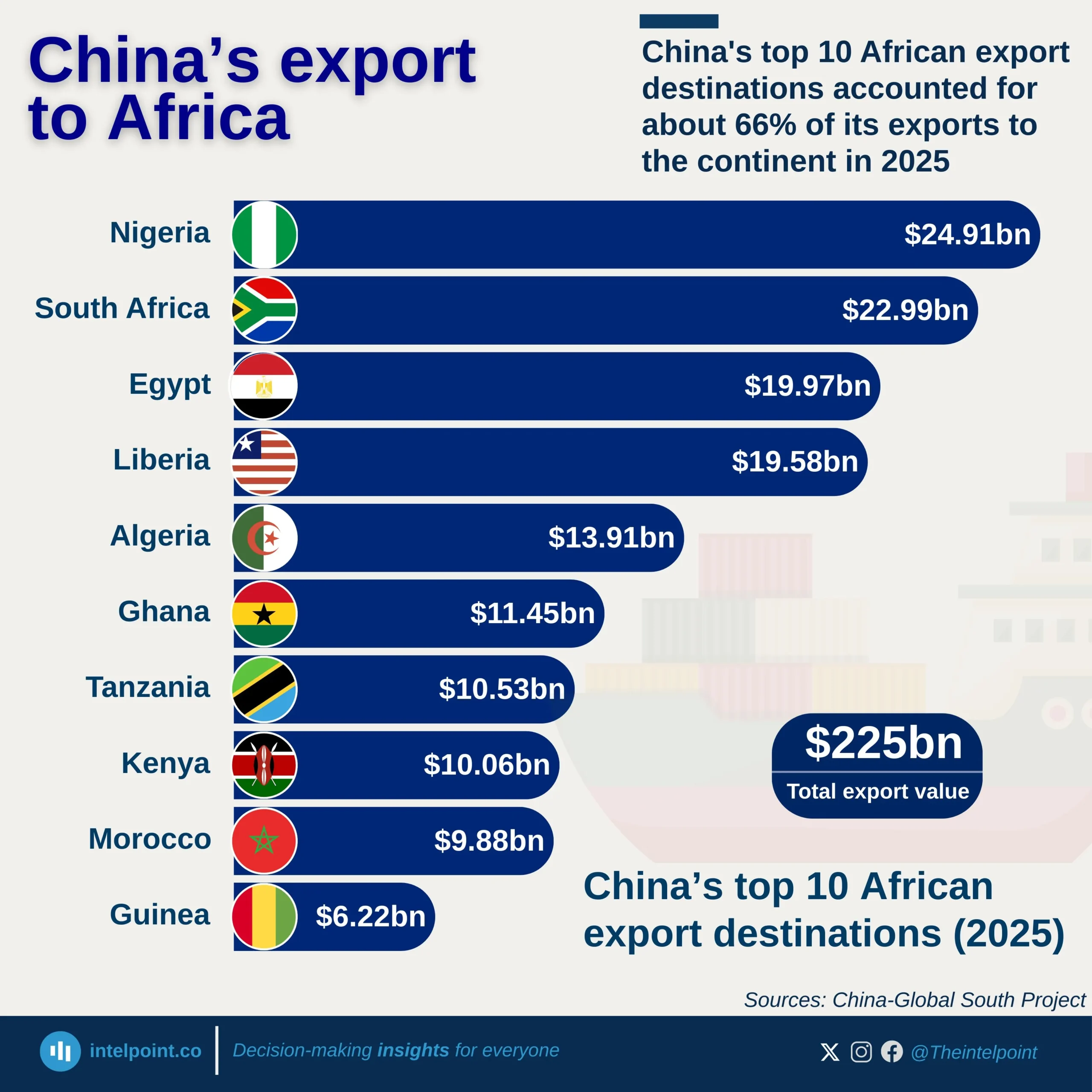

Africa’s trade deficit is largely driven by two countries, Egypt and Morocco, whose combined $50.8 [billion shortfall] exceeds the total trade deficit of the next eight largest contributors. The presence of East African economies like Tanzania and Kenya suggests that multiple regions on the continent struggle with import dependency.