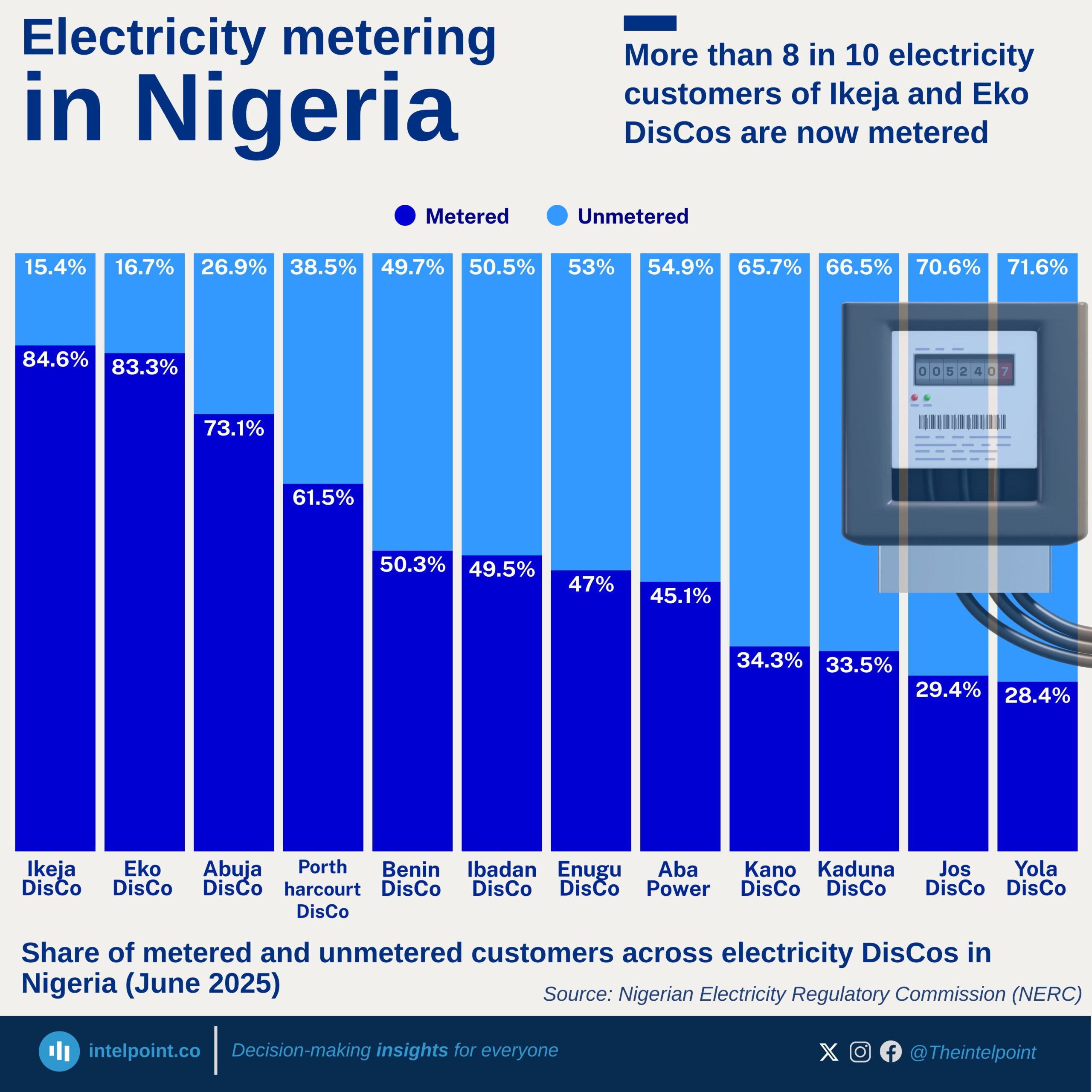

Between Q4 2024 and Q1 2025, the number of metered electricity customers in Nigeria changed in unexpected ways across different regions. Kano DisCo recorded the most dramatic surge in meter deployment, with a 330.75% increase, growing from just 1,226 (in Q4 2024) to 5,281 customers (in Q1 2025). This improvement reflects an urgent acceleration in coverage, especially in states where previous metering rates were alarmingly low. Other DisCos like Jos and Aba also showed solid improvements, more than doubling their numbers in one quarter. On the flip side, some of the top-performing DisCos like Ikeja and Enugu recorded sharp declines in meter deployment for the quarter.

Millions of Nigerians are still dealing with "crazy bills" every month—estimated charges that don’t match actual usage. Seeing areas like Kano, Jos, and Aba make aggressive improvements in meter installations offers hope. It shows that progress is possible and that DisCos can respond when there's pressure, funding, or a regulatory push.

Interestingly, even though Ibadan leads in total numbers with over 42,000 meters deployed in Q1 2025, its growth was only 15.09%, showing steady but not extraordinary progress.