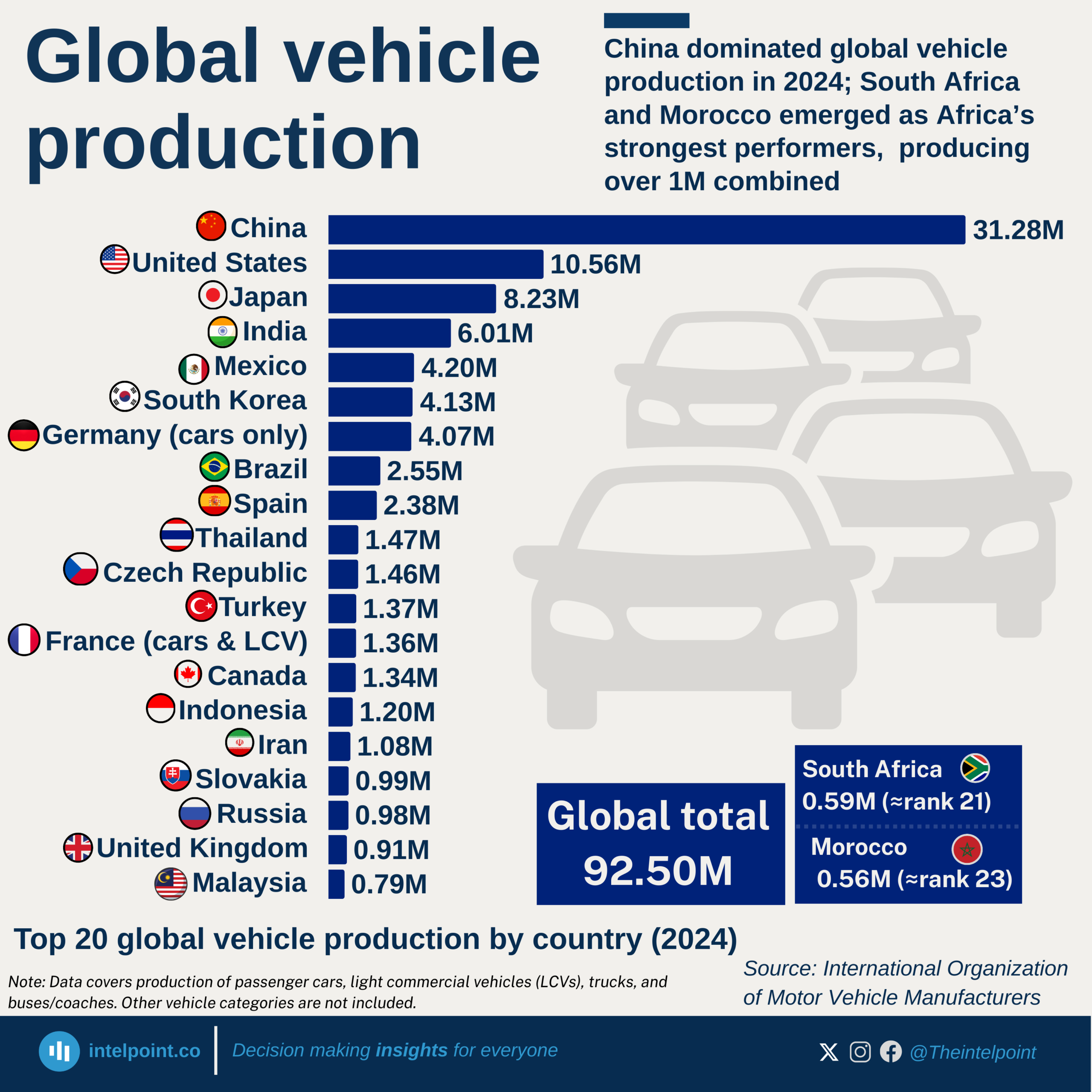

While electric vehicle (EV) adoption across Africa remains uneven, recent developments suggest growing momentum on the continent. A major signal came on May 27, 2025, when Tesla, the world’s leading pure EV manufacturer formally registered its presence in Casablanca, Morocco, with an initial capital of $2.75 million. This move marks Tesla’s first official entry into the African market, and the company’s ambitions appear to extend beyond vehicle sales, possibly hinting at local infrastructure investments and regional partnerships.

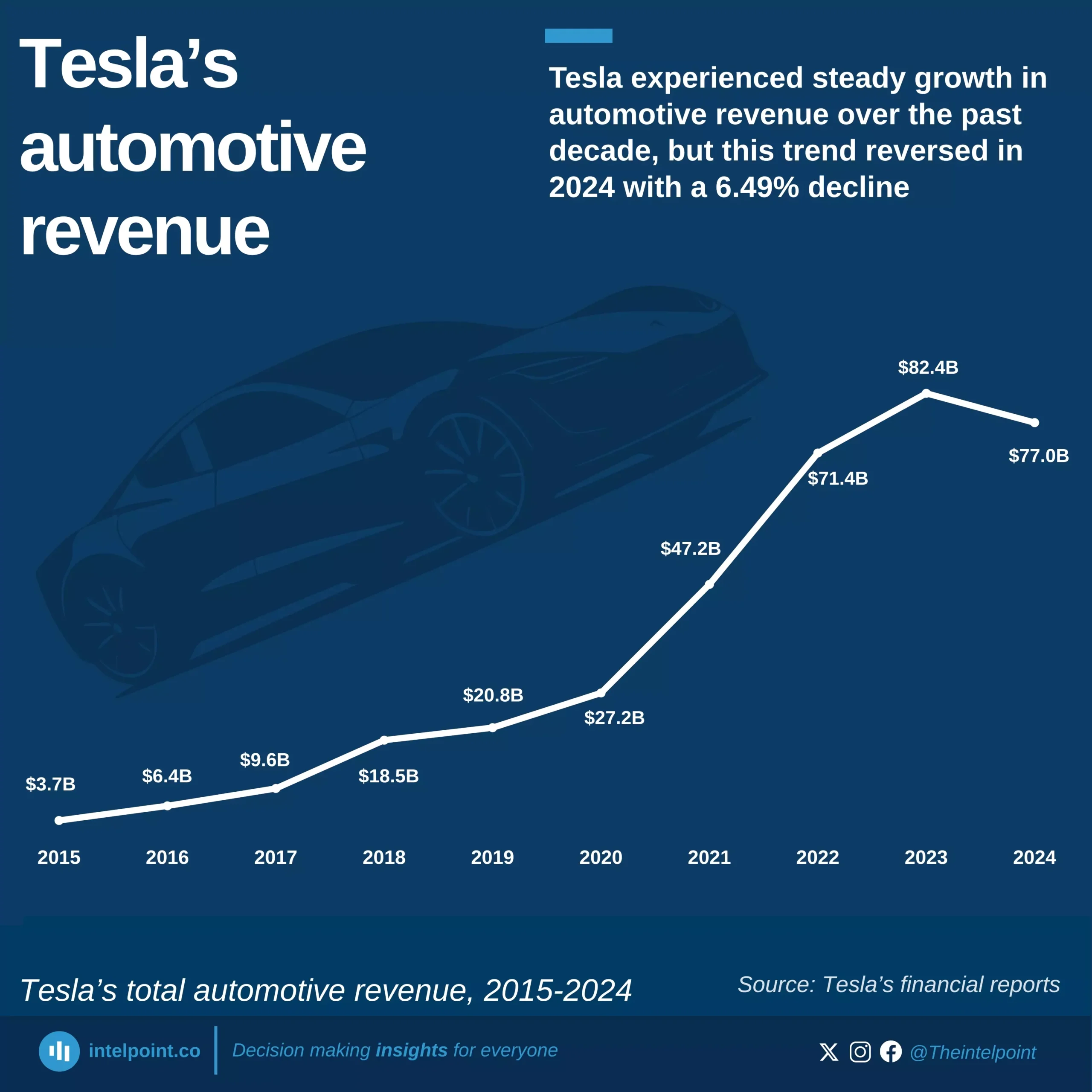

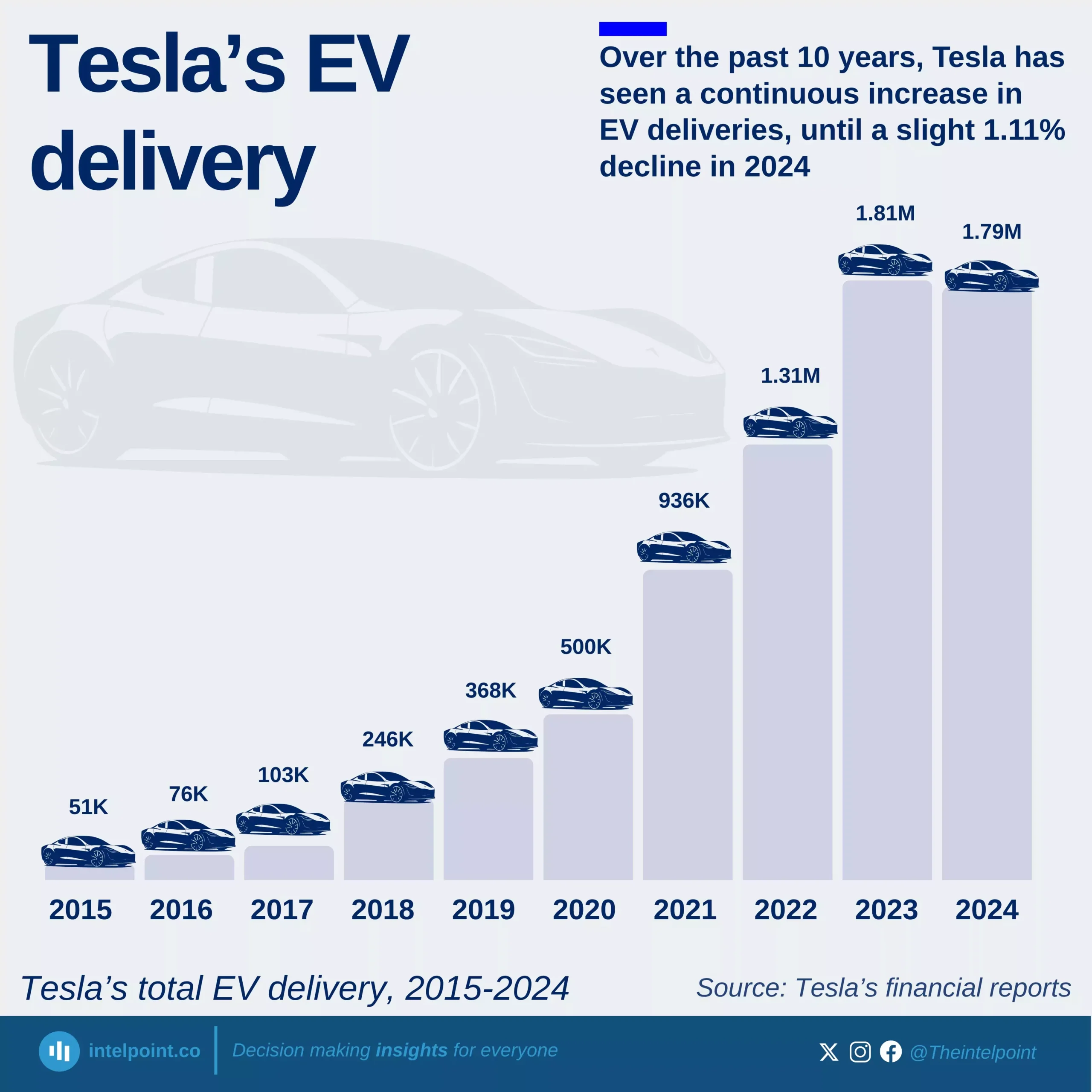

Tesla continues to dominate globally in terms of EV production and sales volume. However, the company saw a notable 13% decline in deliveries over the past year, a dip some analysts link to CEO Elon Musk’s polarizing involvement in political affairs.

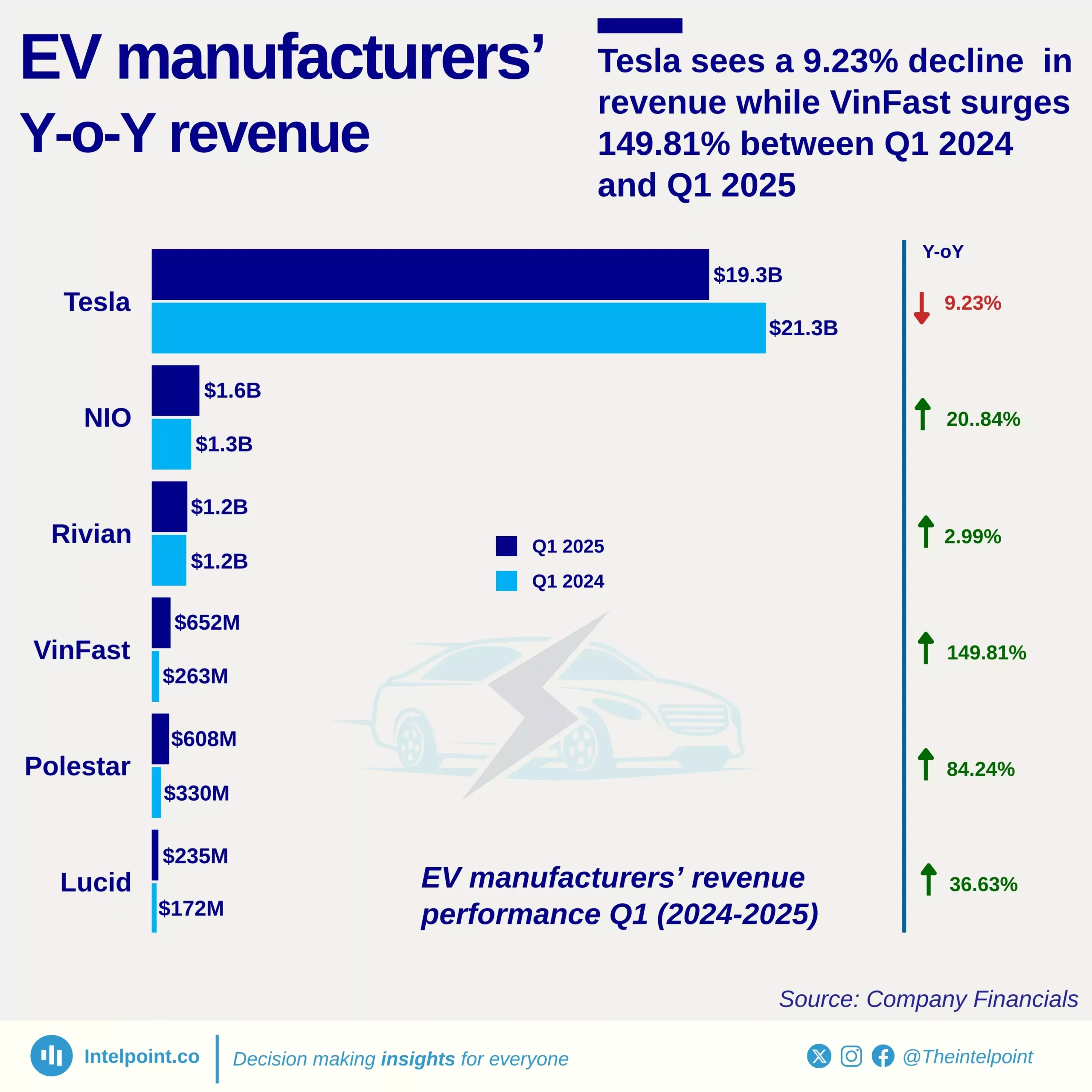

At the same time, other EV players are eyeing Africa’s untapped potential. Vietnamese automaker VinFast, for example, entered Ghana in 2024 through a distribution partnership with the Jospong Group of Companies (JGC). The company has since recorded a staggering 300% increase in vehicle deliveries between Q1 2024 and Q1 2025, reflecting its aggressive push into emerging markets.

As Africa begins to catch the attention of EV giants, these early moves may shape the future of sustainable mobility on the continent one where global innovation meets local opportunity.