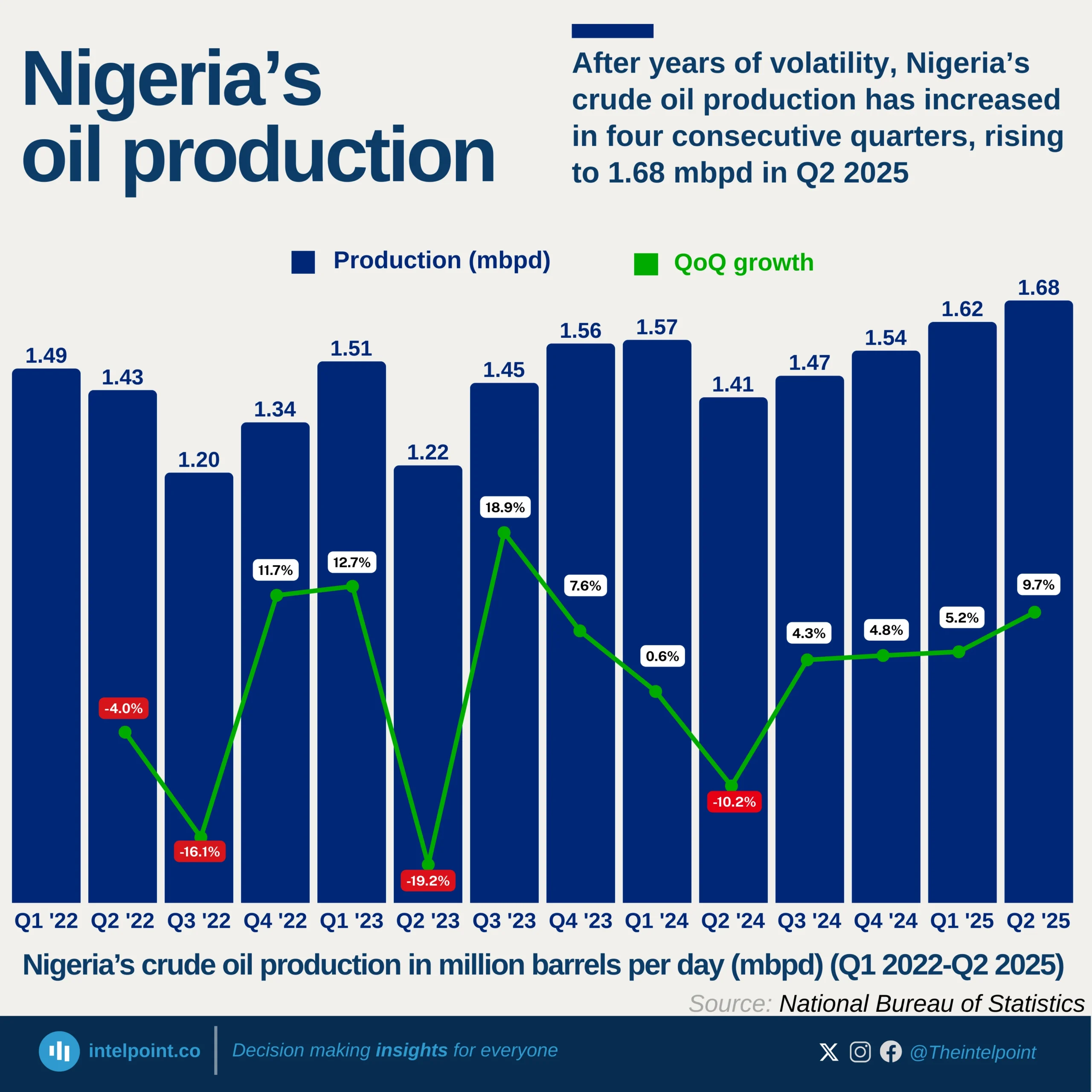

In 1993, the United States imported 269.9 million barrels of crude oil and petroleum products from Nigeria. After reaching its peak (425.4 million barrels) in 2005, imports fluctuated between increase and decrease before finally decreasing consistently to 61.4 million barrels in 2024. The steep decline reflects both supply-side and demand-side shifts in global oil markets over the past decade.

On the demand side, the US experienced a major rise in domestic crude production (the “shale boom”), which reduced dependence on light, sweet imports like many Nigerian grades. The US's crude production growth since the late 2000s made domestic barrels cheaper and logistically easier for many US refineries than some imported streams. Nigeria, which was regularly a top five US crude oil supplier in earlier decades, ranked ninth among the U.S.'s suppliers in 2024, illustrating shifting supply patterns.

On the supply side in Nigeria, production and export volumes have been periodically constrained by operational disruptions such as pipeline theft, sabotage, and infrastructure outages. Nigeria’s strategic move towards domestic refining has also changed export flows. The Dangote Refinery began processing in January 2024 and has redirected some barrels that previously went to export markets. Nigeria’s historical strength supplying light, sweet crude matched many US refinery needs in past decades, but the growth of the US's light shale blends changed that technical and economic fit. The product mix shifted too, with Dangote and other refiners exporting refined products (e.g. jet fuel, gasoline), the US sometimes imports refined product from Nigeria rather than crude oil.

Looking forward, whether US imports from Nigeria remain low will depend on Nigeria’s ability to sustain and export surplus barrels after meeting Dangote’s demand, US refinery configurations and maintenance cycles, and global crude oil pricing and freight economics.

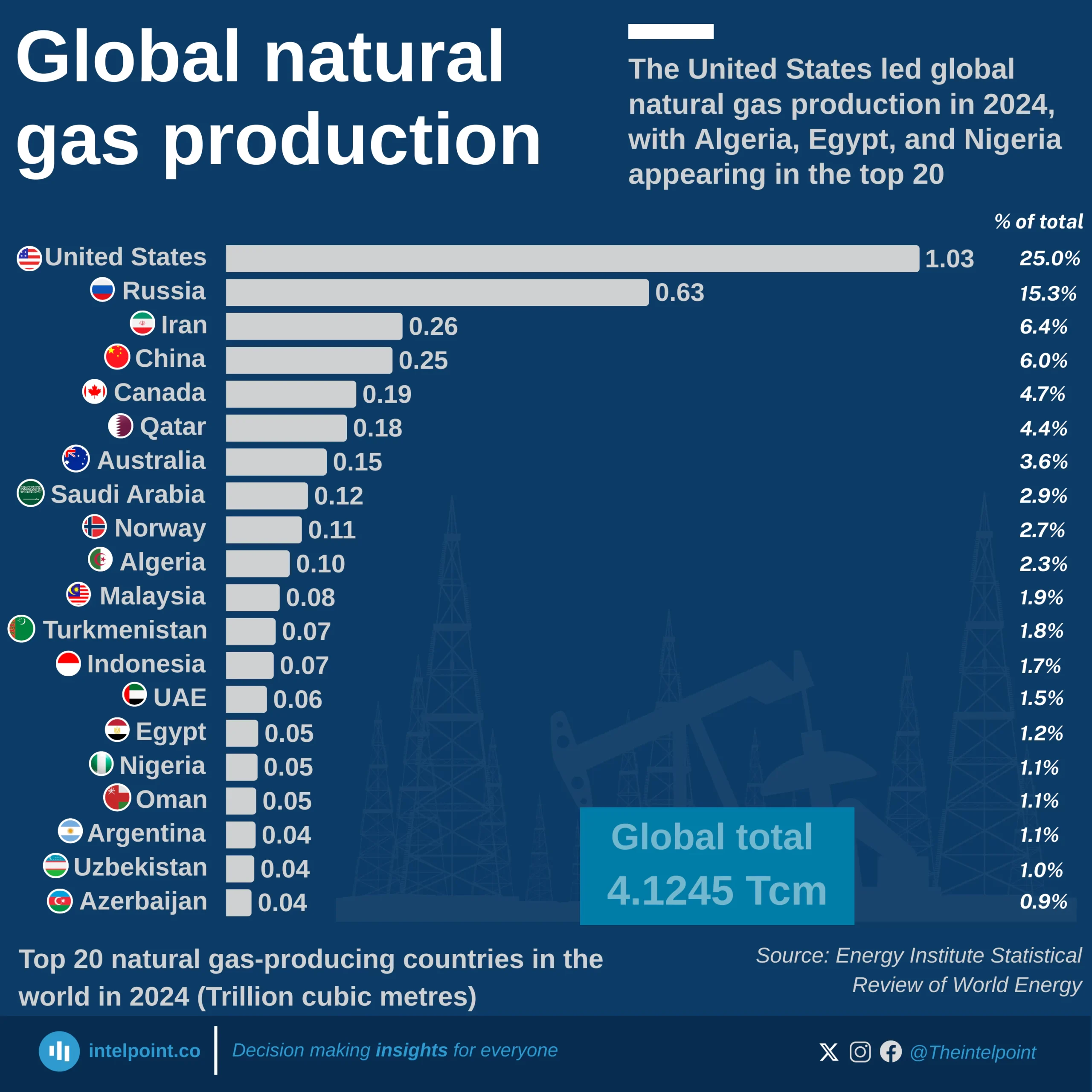

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.