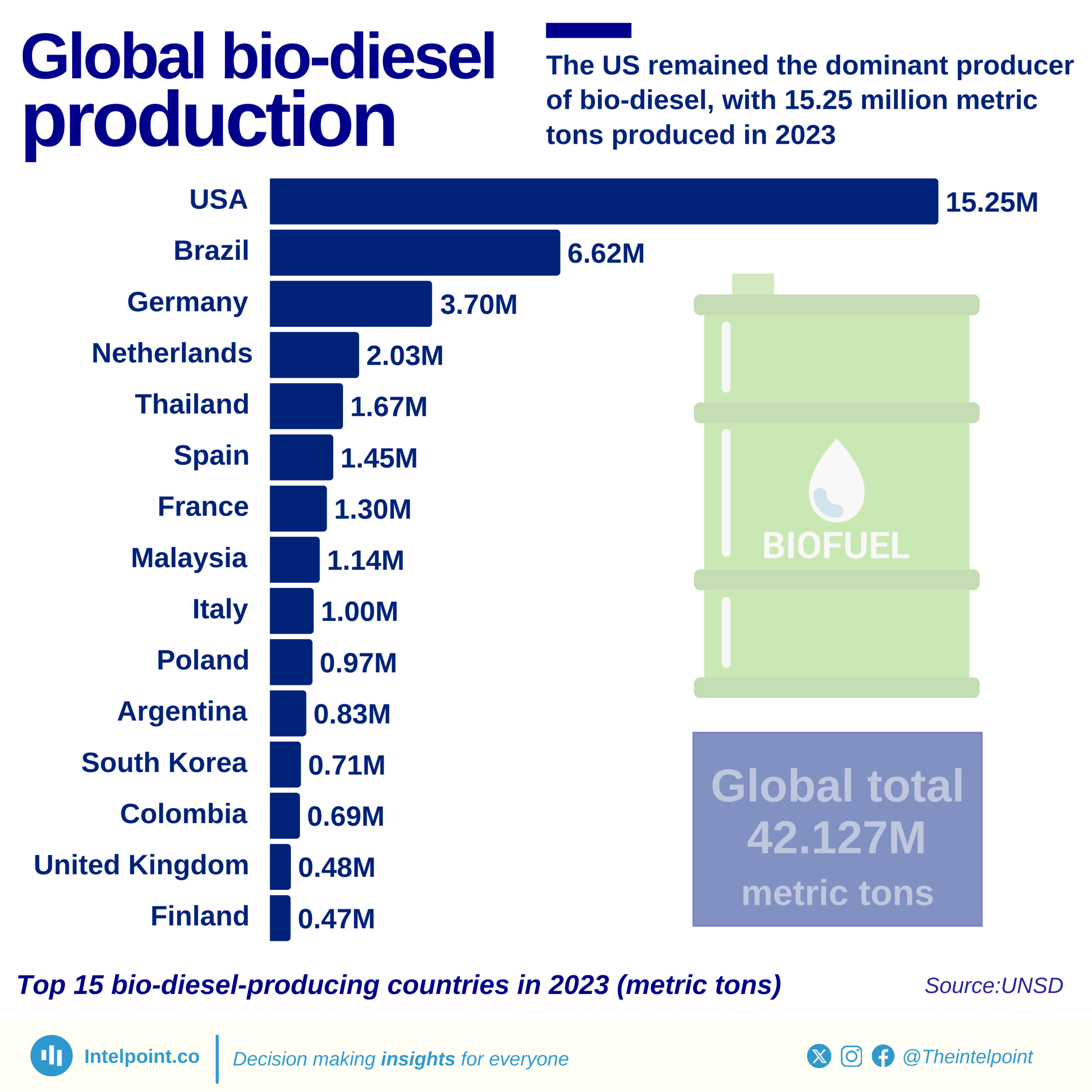

In 2023, the United States of America led the global production of gas oil with a staggering 234,886 metric tons, accounting for 32.4% of global production. In contrast, gas oil production in Africa was extremely limited. Only four African countries managed to produce gas oil. Niger produced 497.2 metric tons, Chad produced 349.7 metric tons, Ghana produced 73.04 metric tons and Zambia produced 40.4 metric tons, which collectively amounted to just 0.13% of the global total.

This stark difference highlights a significant production gap between Africa and other regions. While Africa struggles to meet even a fraction of global production, major producers like the United States of America [dominate] the market.

In terms of imports, Australia stood out in 2023. The country imported 25.1k metric tons of gas oil, making it the largest importer of gas oil globally. This analysis underscores how supply chains are crucial for meeting global energy needs. It can be seen that while some nations focus on production, others rely heavily on imports.