In 2024, global oil drilling activity remained intensely concentrated, with just a few countries shouldering most of the world’s rig operations. The United States leads overwhelmingly, operating 589 active rigs, which is more than the next five countries combined and represents roughly 33% of the global total. Canada and Iran trail far behind in second and third place, with 162 and 117 rigs respectively. A clear trend emerges as Middle Eastern giants, Kuwait, UAE, Saudi Arabia, Iraq, and Oman, populate the top 10, showcasing the region’s continued strategic investment in upstream oil development. These five countries alone control 335 active rigs, reaffirming the region’s central role in global energy supply chains.

In Africa, Nigeria stands out, ranking 15th globally with 31 active rigs, far ahead of peers like Libya (18) and Egypt (23). Its position reflects both the scale of its reserves and its persistent drive to remain competitive amid global transitions. Interestingly, the top 10 countries account for more than 75% of the 1,802 active rigs globally, leaving the rest of the world with a significantly smaller footprint.

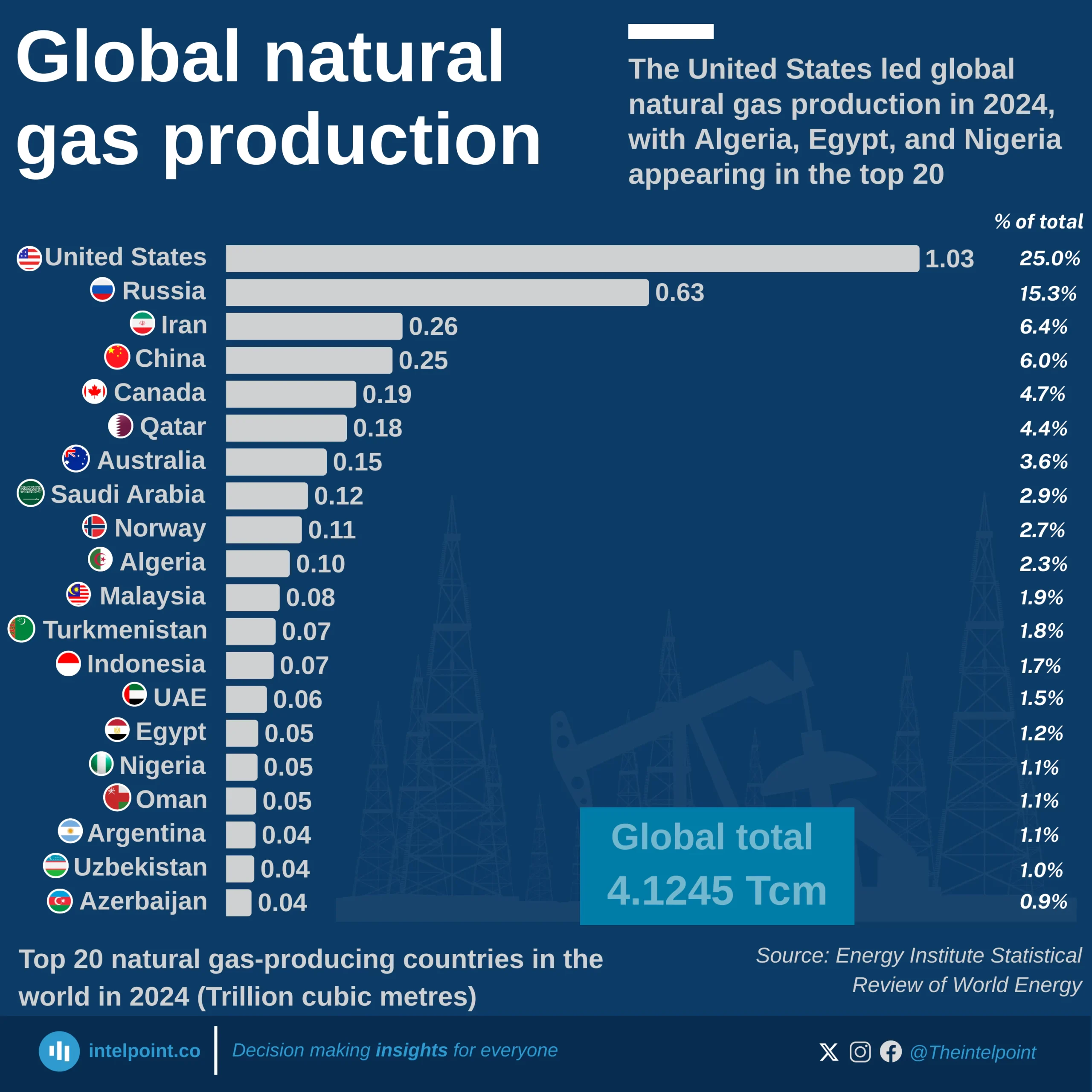

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.