Key takeaways:

The average price of kerosene shows a steady upward trend in Nigeria, rising from ₦1,206.1 in May 2023 to ₦2,056.4 by December 2024. This indicates a 70.5% rise over the span of 20 months. From May 2023 to March 2024, the prices increased gradually, with an approximate increase of 12.3% during these 11 months.

The most significant increase in prices happened from June 2024 to September 2024, with an increase from ₦1,555.1 to ₦1,957.4, marking a 25.9% rise within four months. From October to December 2024, the growth rate slowed down, as prices increased by only 5.1% in this period.

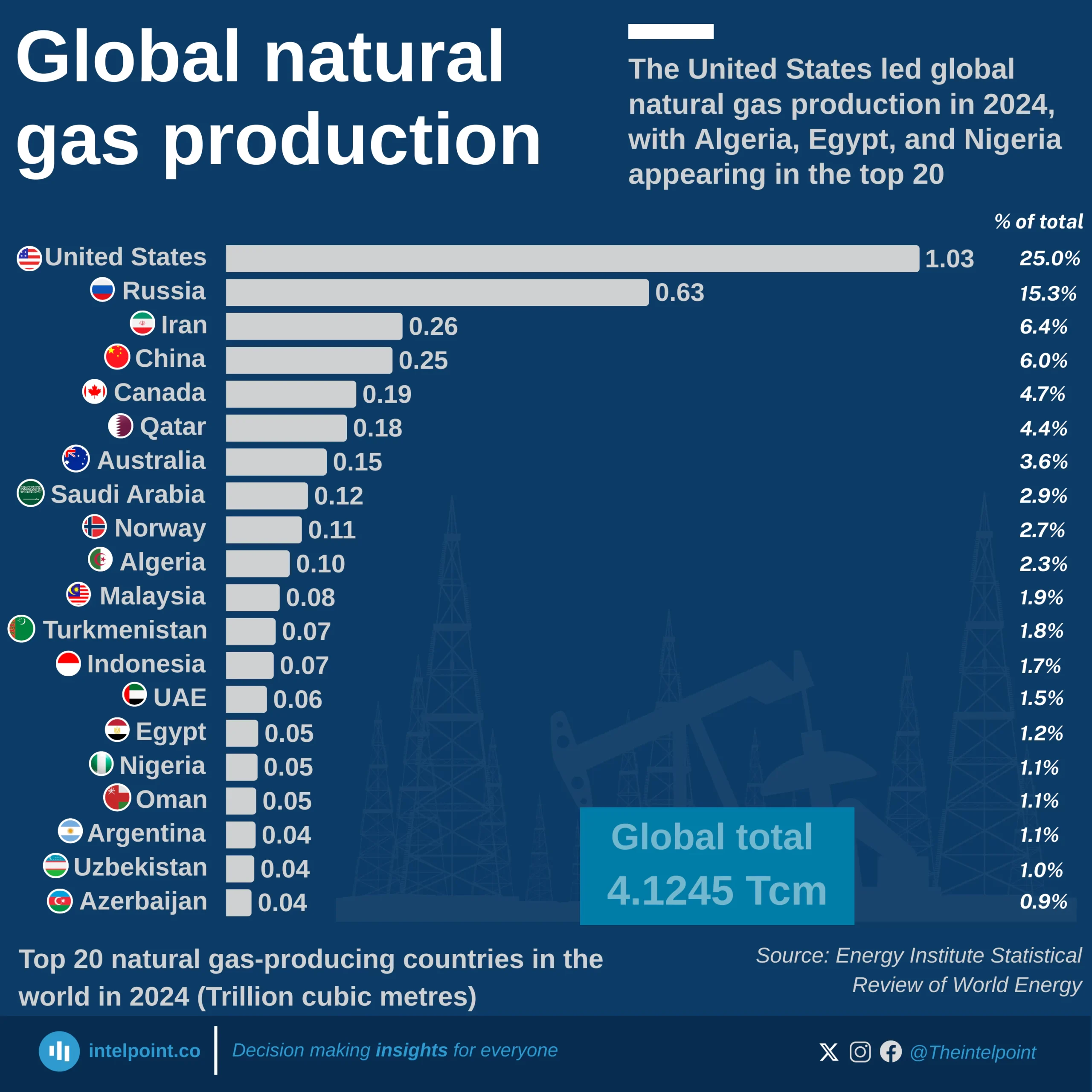

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.