Key takeaways:

Seplat Energy Plc has demonstrated impressive financial growth from 2015 to 2024. In 2015, the company reported ₦112.97 billion in revenue and a profit of ₦12.99 billion. However, the year 2016 proved to be tough, with Seplat facing a loss of ₦45.38 billion despite a revenue of ₦63.38 billion.

In 2017, Seplat raised its revenue to ₦138.28 billion and achieved a profit of ₦81.11 billion, which was six times the profit recorded in 2015. This positive trend persisted into 2018, with revenue climbing to ₦228.39 billion, although profit saw a minor decline to ₦44.87 billion—a 45% drop from 2017. In 2019, Seplat continued to perform well, generating revenue of ₦214.16 billion and profits of ₦85.02 billion.

During 2020, the COVID-19 pandemic era, revenue decreased to ₦190.92 billion, and the company incurred a loss of ₦30.71 billion. Despite these reductions, Seplat rebounded in 2021, securing ₦293.63 billion in revenue and ₦46.93 billion in profit.

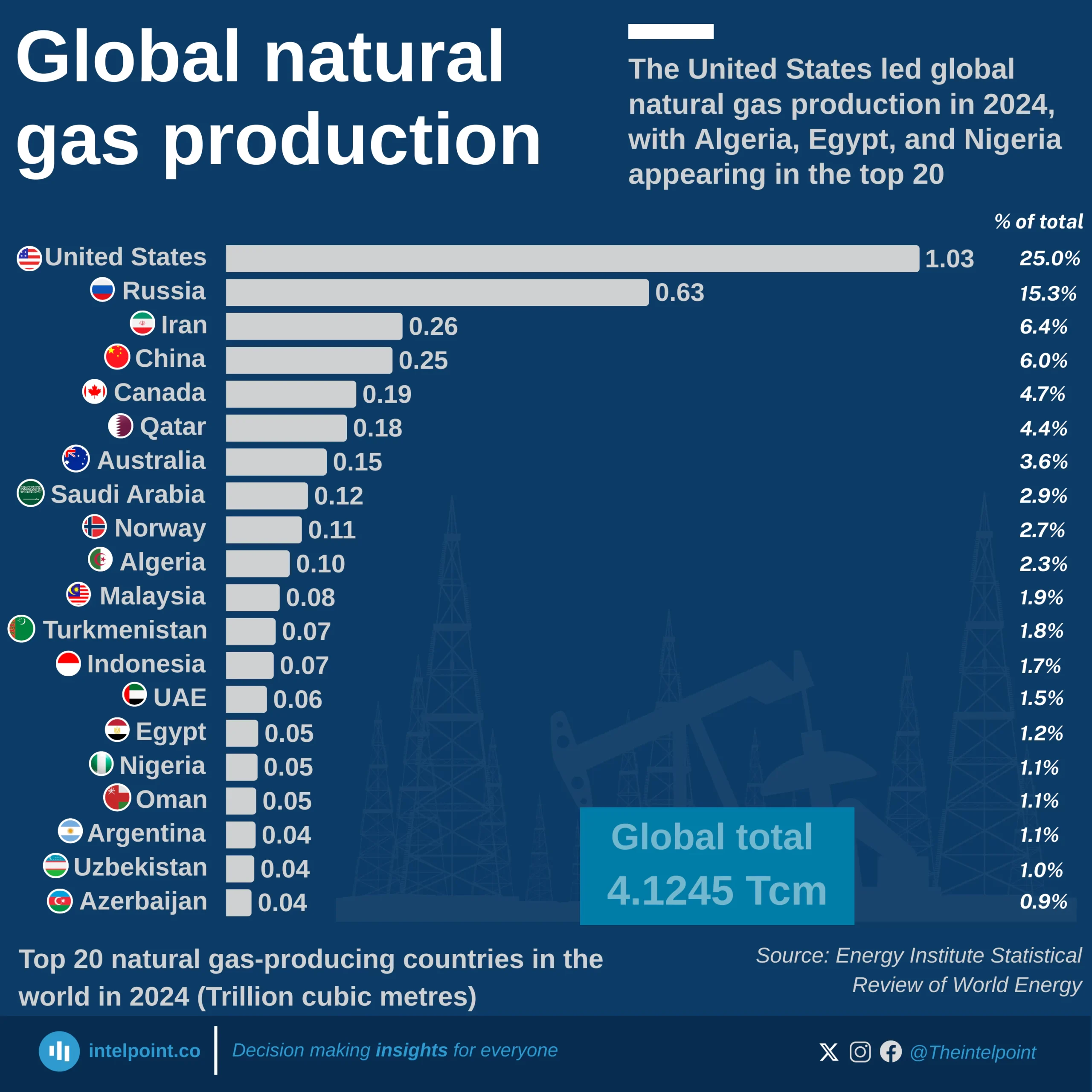

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.