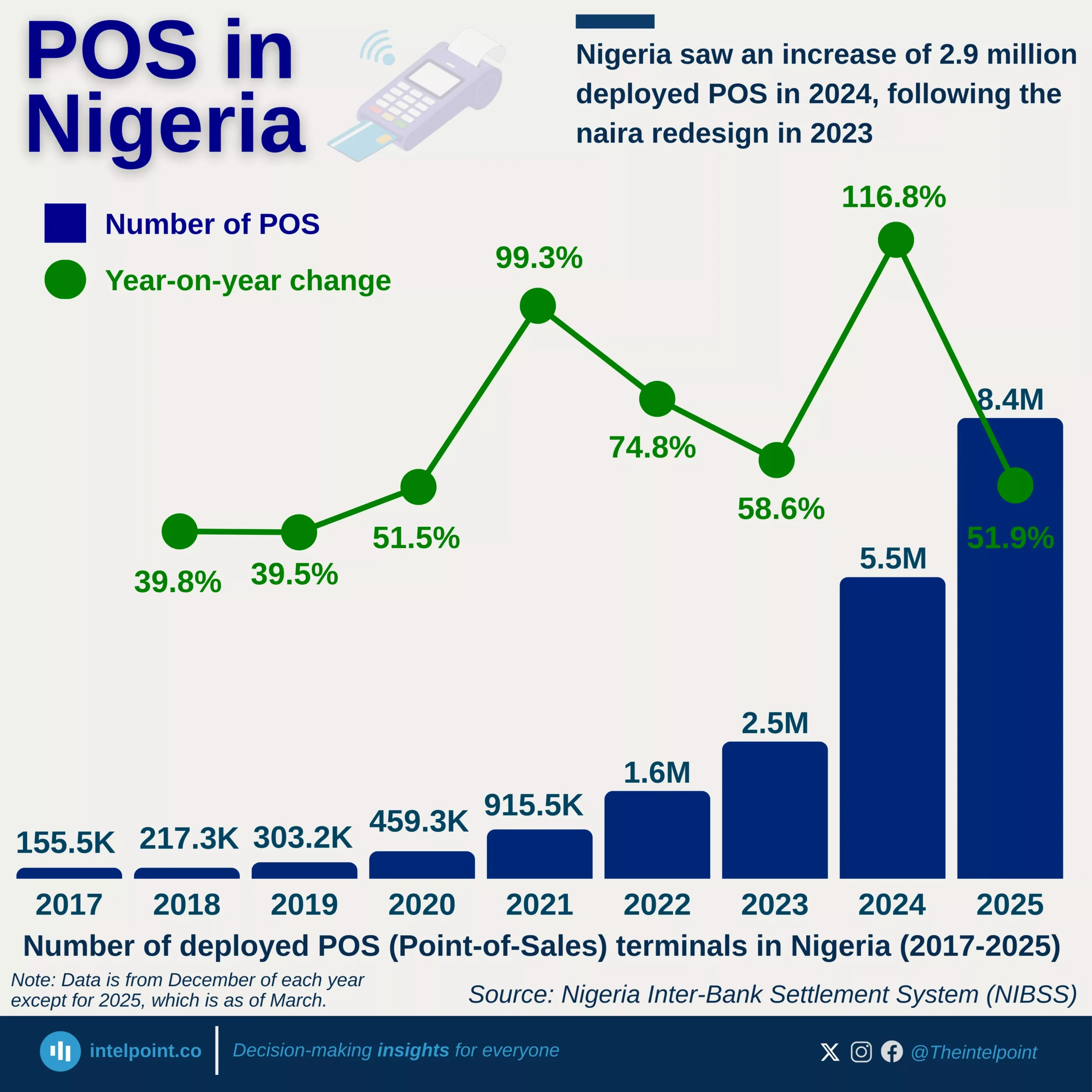

The way people make payments is changing globally, and Nigeria is not left out. In just four years, Nigeria’s cash transactions have plunged from 91% of total transaction value in 2019 to 55% in 2023. This drastic decline highlights the rapid adoption of digital payments, mobile banking, and fintech solutions in the country. By 2027, the value of cash transactions is projected to shrink even further to 42%, signaling a trend toward a cashless economy.

This shift isn’t just happening in Nigeria. Countries like Mexico, Thailand, Japan, Germany, and Brazil are also experiencing a steady drop in cash usage. While the global average of cash transactions was 26% in 2019, it fell to 16% by 2023 and is forecasted to reach just 11% by 2027. The numbers tell a compelling story – the world is moving away from physical cash, and businesses, financial institutions, and individuals must adapt to stay ahead.