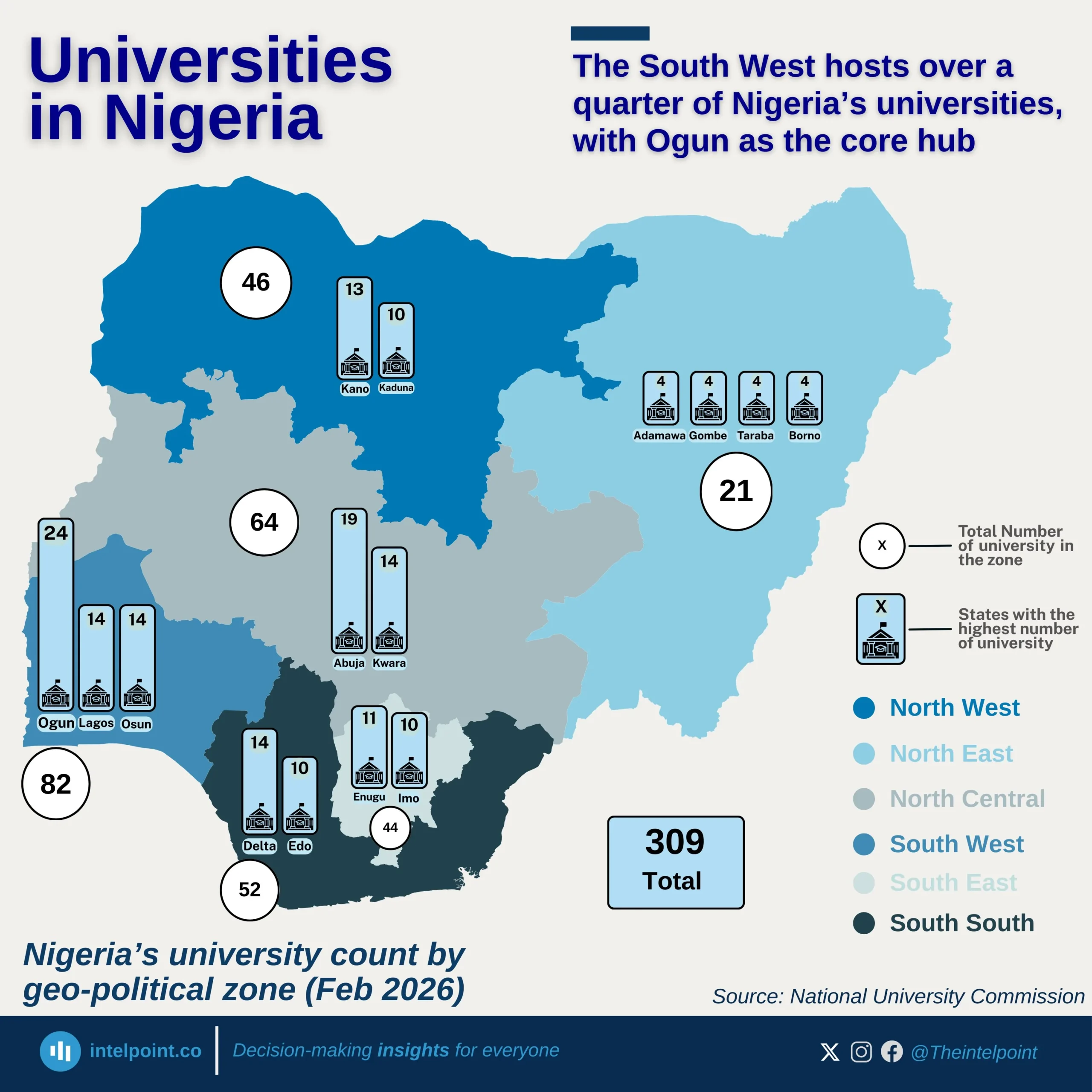

Student loan demand across Nigeria paints a clear picture of regional imbalance. As of May 2025, the North West leads the nation with 167,639 student loan applications, followed closely by the North East with 134,359. Together, these two zones make up a significant share of the national total, revealing strong uptake in the northern region, possibly reflecting greater institutional mobilisation, awareness, or need.

In contrast, southern zones like the South East (29,097) and South South (39,774) show much lower figures, raising questions about access, outreach, or trust in the loan programme in those regions. The South West, though the most engaged in the South with 104,079 applications, still falls far behind its northern counterparts.