Key takeaways:

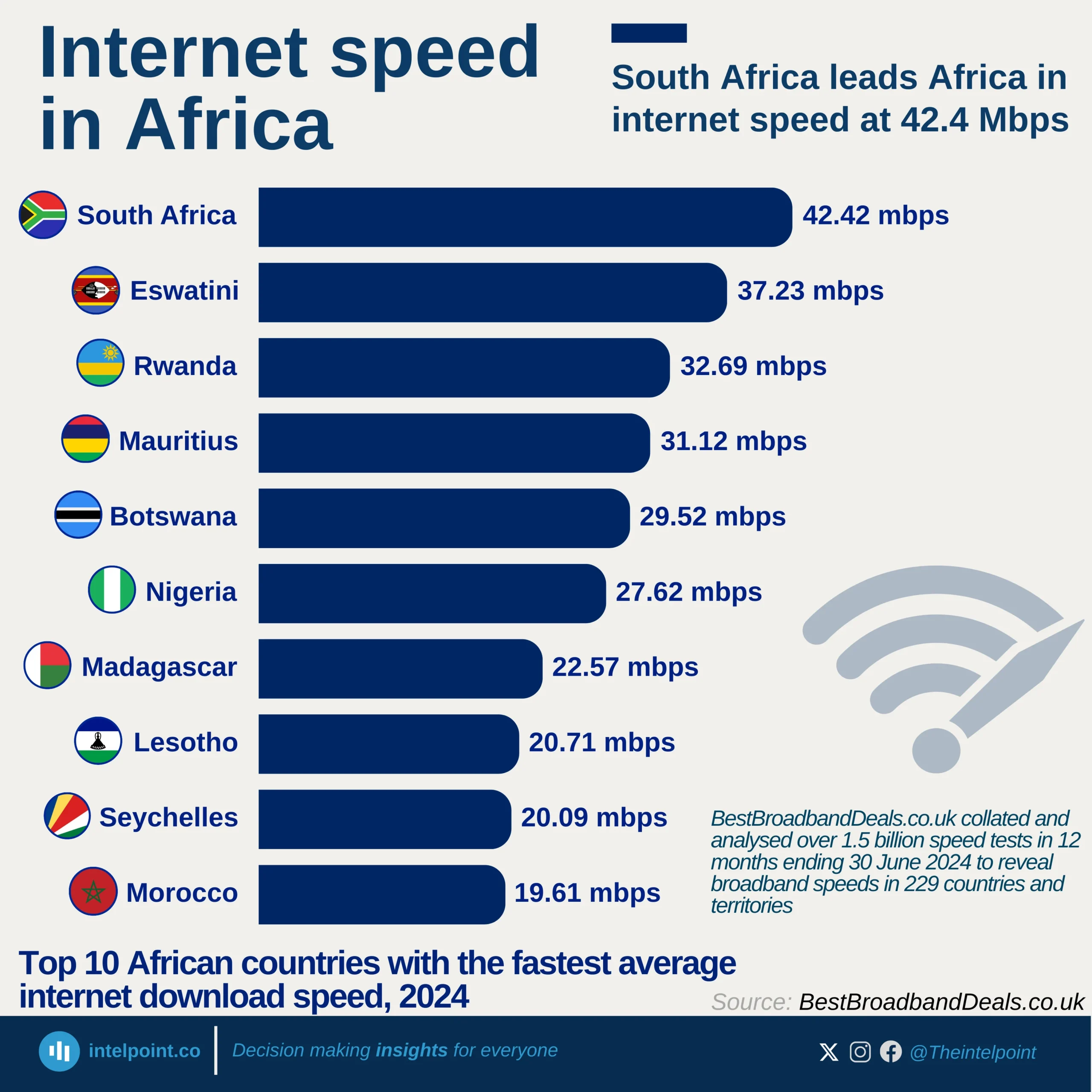

Throughout 2024, Nigeria's internet data usage exhibited a notable increase, starting at 721,522 terabytes (TB) in January and reaching 973,455.35 TB by December. This indicates a growth rate of 35% from January to December. Despite a general upward trend for most of the year, there was a decline in February, reaching 694,804.54 TB, which was the lowest figure for the year, along with a minor decrease in September to 850,249.09 TB.

The latter half of 2024 indicated that the country’s monthly usage consistently exceeded 800,000 TB, contrasting with the first half of the year. The most pronounced increase happened between November and December 2024, when consumption rose by nearly 95,000 TB, hitting an all-time high of 973,455.35 TB. This remarkable increase indicated a significant upturn in digital activities as the year drew to a close.