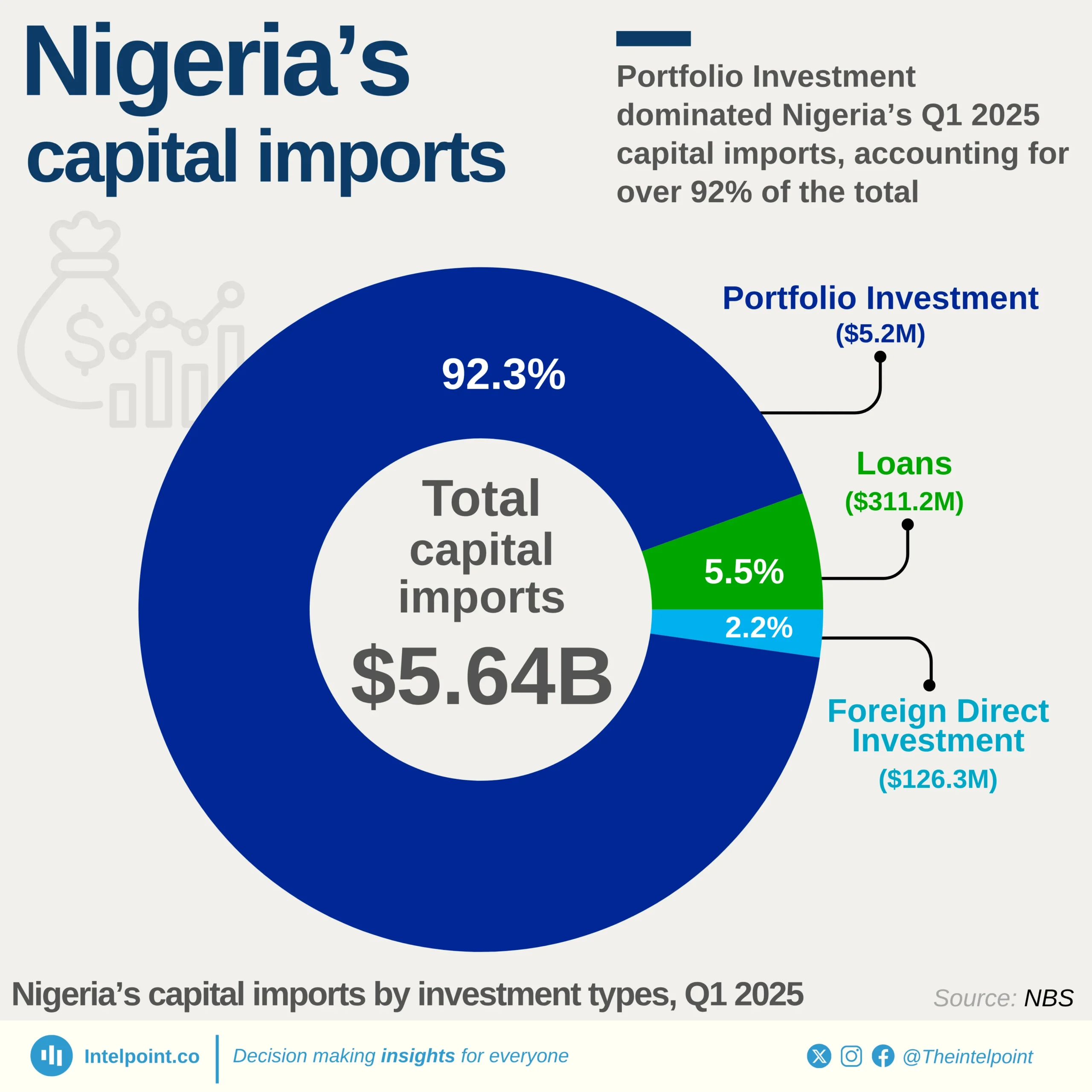

Nigeria’s portfolio investment landscape in Q1 2025 was overwhelmingly dominated by money market instruments, which pulled in $4.2 billion, representing 81% of the total $5.2 billion in portfolio investment. This suggests investors are prioritising short-term, low-risk financial instruments in response to domestic and global uncertainties.

Bond investments followed, with $877.4 million (16.8%), indicating a moderate appetite for medium-term exposure. Meanwhile, equity investments contributed only $117.33 million (2.3%), underscoring weak investor confidence in the Nigerian stock market or preference for more liquid options.