Meta’s financial trajectory continues its upward momentum, with Q1 2025 closing at $42.3 billion in revenue and $16.6 billion in profit, both records for the tech giant’s first-quarter performance. This marks a more-than-threefold increase from its Q1 2018 levels, underlining Meta’s success in expanding product lines, ad services, and user engagement globally.

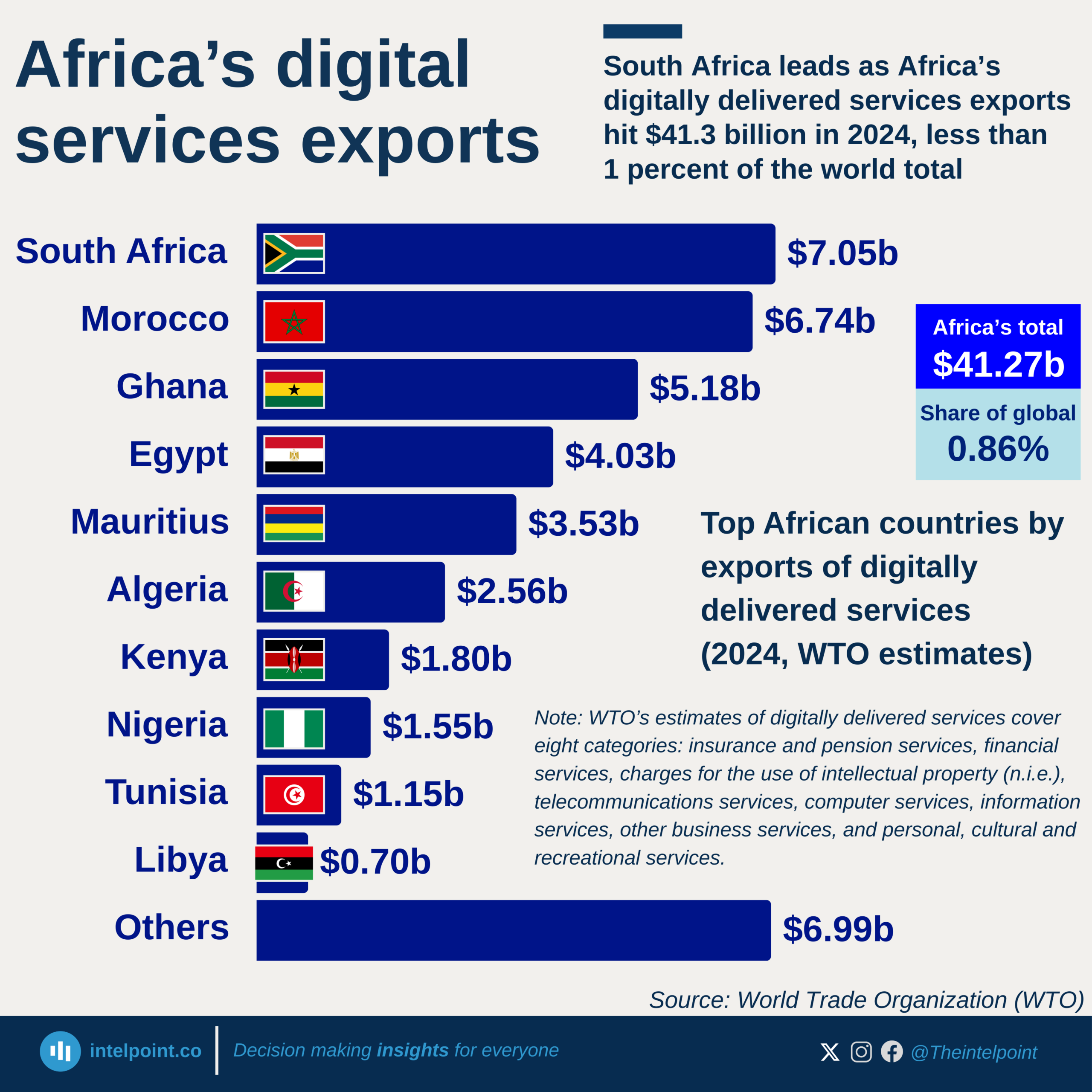

A closer look at regional data shows that while the U.S., Asia Pacific, and Europe remain key contributors, the biggest share of Meta’s revenue, over 50%, now comes from the “Rest of the World.” This signals the shifting gravity of digital influence toward emerging economies.

Although Africa, and Nigeria by extension, is not broken out as a standalone region, its inclusion in this growing “Rest of the World” category shows that user engagement and monetisation on the continent are no longer marginal. With Nigeria ranking among the top countries globally in number of Facebook users, this reflection offers a timely reminder of Africa’s rising digital presence and Meta’s growing reliance on it.