Key Takeaways:

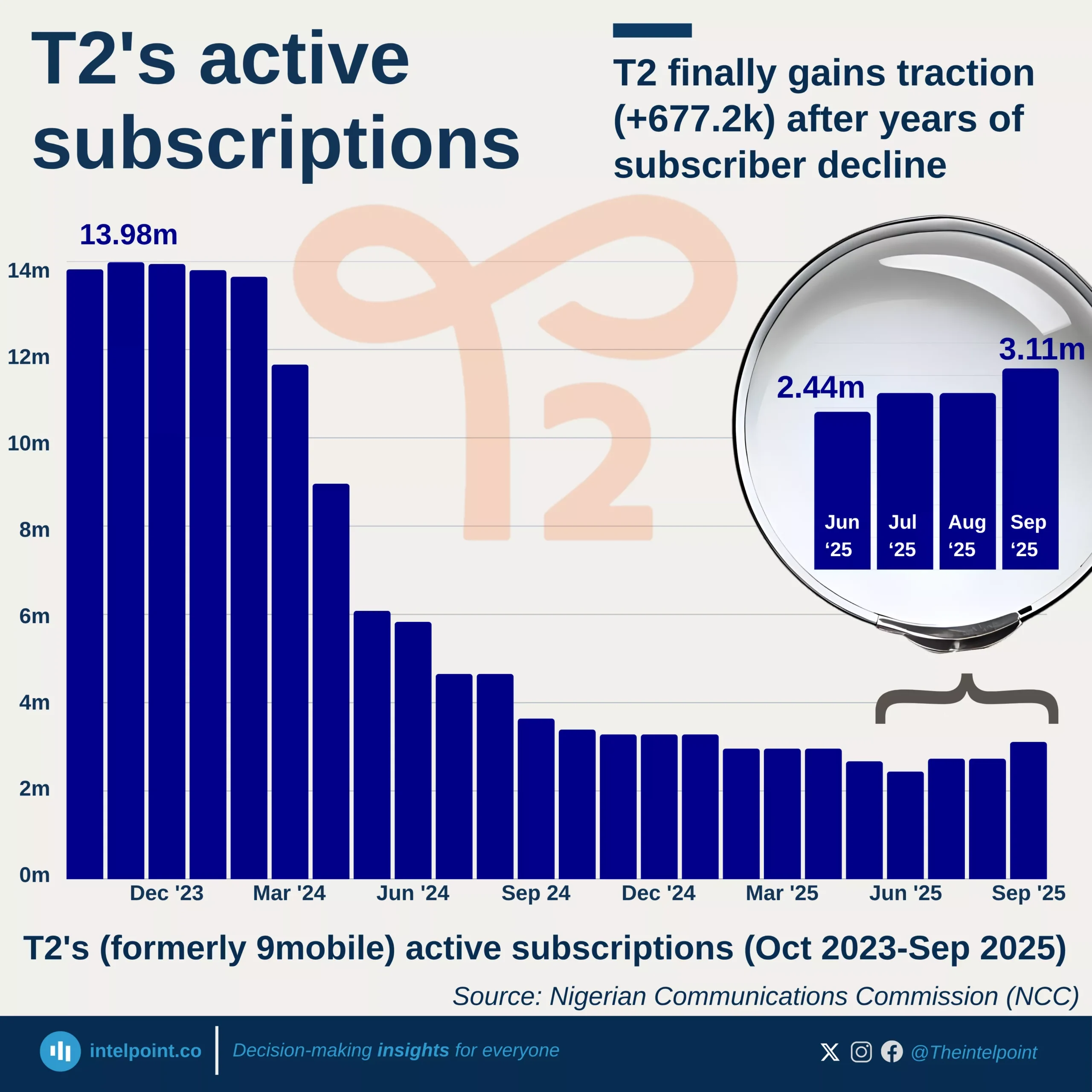

Between June 2021 and April 2025, 9mobile saw a fluctuating but general decline in the number of subscribers transferring from other providers. In mid-2021, 9mobile typically added over 100 new users per month through porting. These figures were moderate when compared to competitors. While the telecom operator's port-in figures remained low through 2021, there was a significant increase in mid-2022, peaking at 324 in June of that year.

However, beginning in July 2022, the numbers began to decline. Despite a temporary and sharp rise in May 2024 (226 port-ins), the numbers declined dramatically to single digits by early 2025. By February 2025, only one user had ported into 9mobile, and by April 2025, only three customers had ported in, a drastic drop of more than 98% from June 2021 levels.