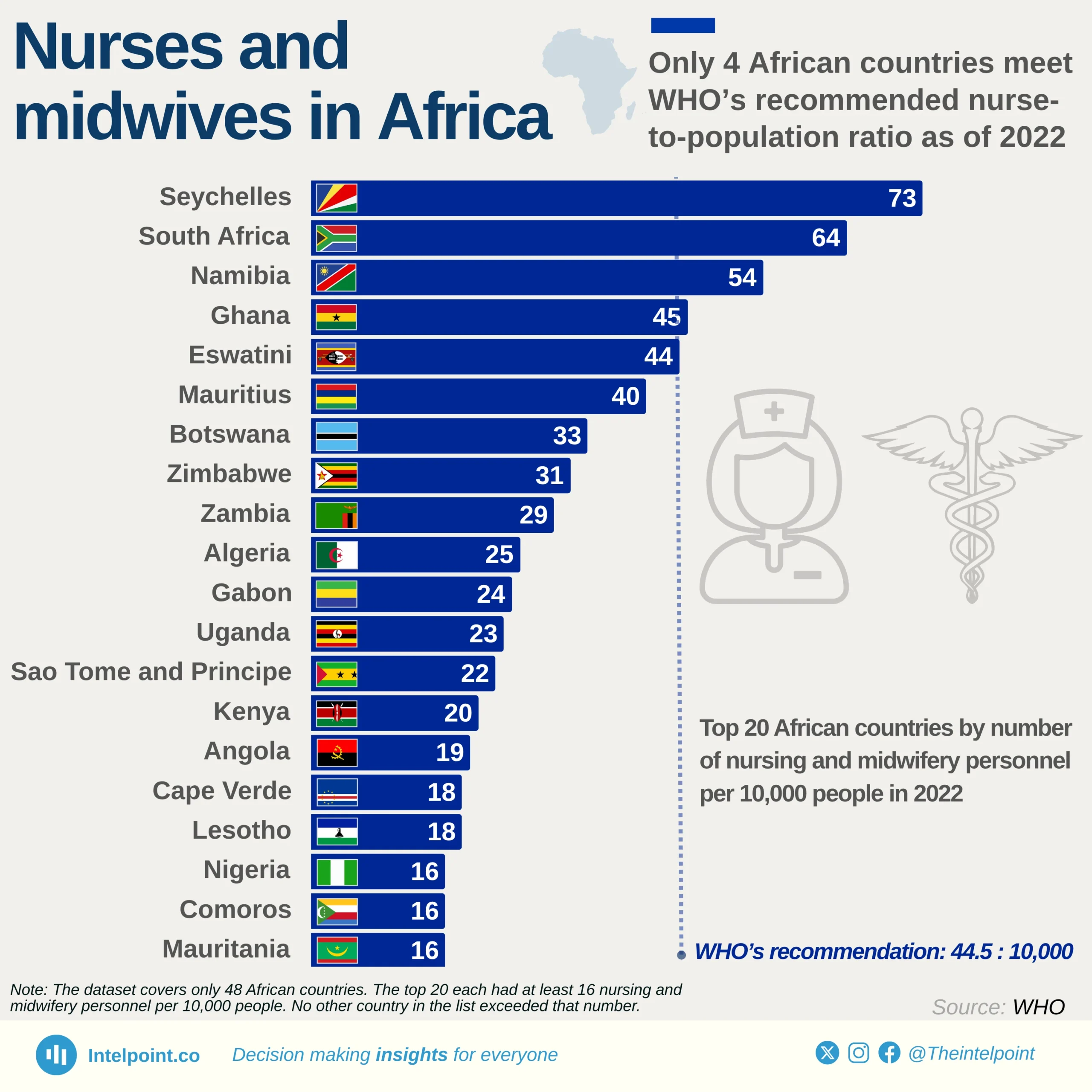

By 2030, the world’s nursing workforce is projected to expand significantly to 35.9 million, marking a major increase driven by global investment in healthcare personnel.

But this growth will not be evenly spread.

Projections show the Western Pacific Region leading with 9.7 million nurses — a reflection of strong policy frameworks and training systems. The Americas (8.9M) and Europe (8.2M) are close behind, continuing long-standing investment in healthcare staffing.

South-East Asia is projected to reach 5.5 million nurses, showing steady gains but still falling short relative to its population needs.

In contrast, Africa and the Eastern Mediterranean face major challenges, with only 2.1 million and 1.5 million nurses respectively projected by 2030. These low figures raise alarms about healthcare equity, especially in regions facing climate shocks, disease outbreaks, and fragile systems.

The key insight: even as the global nursing stock grows, where nurses are located — and whether they stay — will define the future of health systems.

Equitable policies, funding, and support systems must keep pace with these projections if the global workforce is to meet tomorrow’s needs.