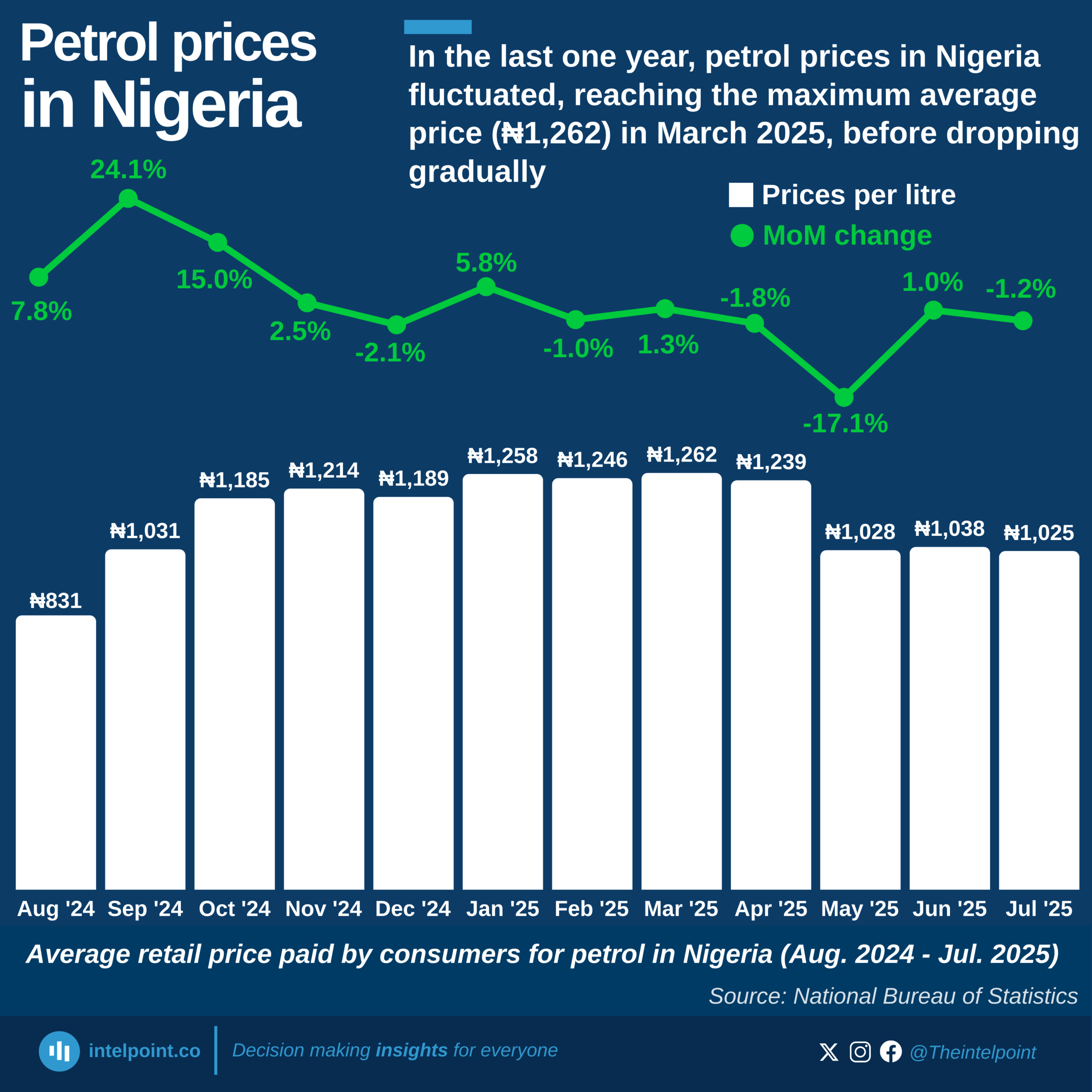

Nigeria's fuel consumption trend over the past decade reveals a shift in 2023, triggered by the removal of fuel subsidy. From a peak of 66.7 million litres per day in 2022, average daily consumption fell sharply to 47.5 million litres in 2023—a 29% plunge. Although it rose slightly to 51.8 million litres in 2024, consumption remains well below previous highs, indicating a significant change in fuel usage habits nationwide.

This sudden drop reflects more than just a policy change—it highlights how economic incentives and price signals can rapidly alter consumer behaviour. Before subsidy removal, artificially low prices encouraged heavy consumption, masking the true demand. After the subsidy was lifted, the spike in pump prices made users more cost-conscious, leading to reduced usage.

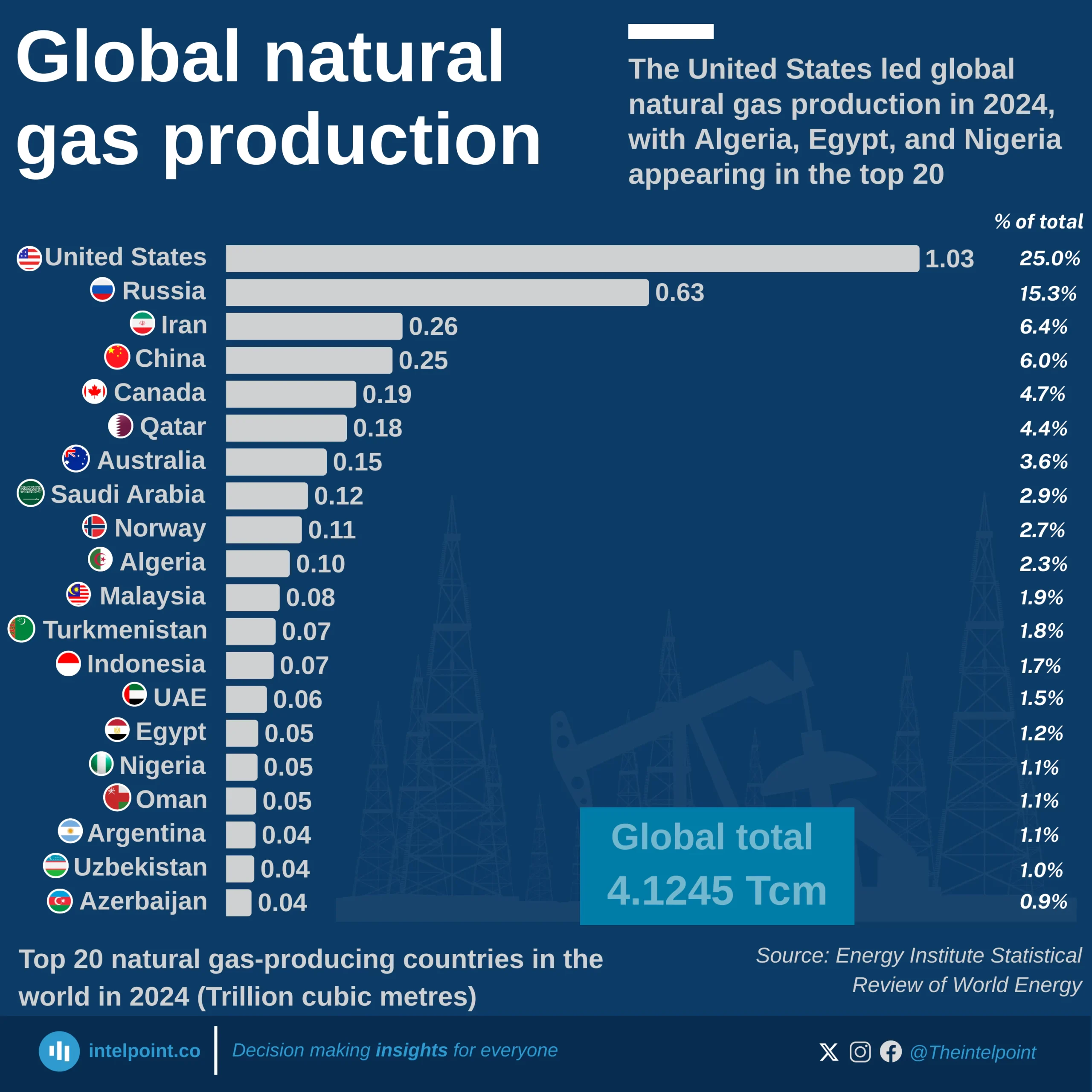

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.