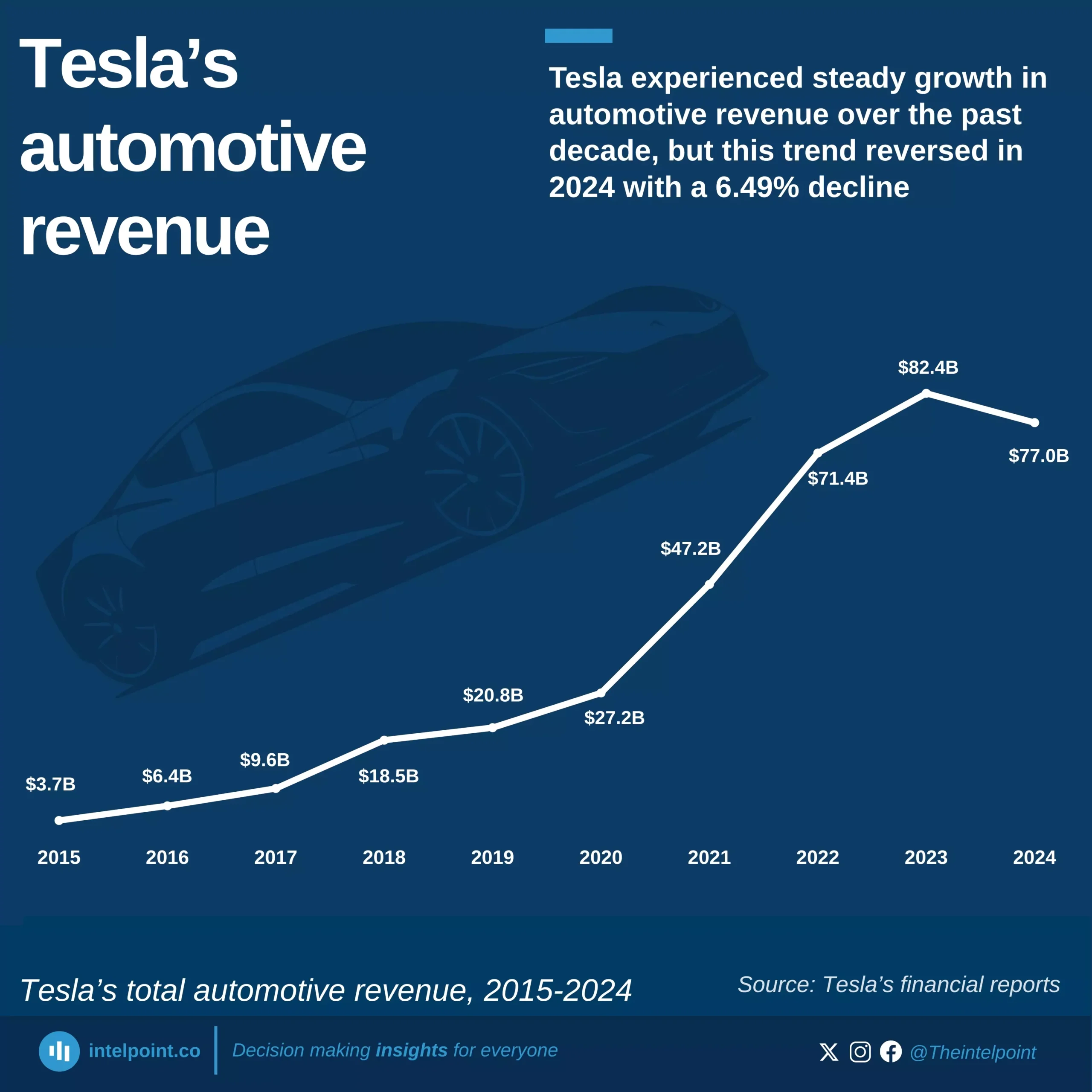

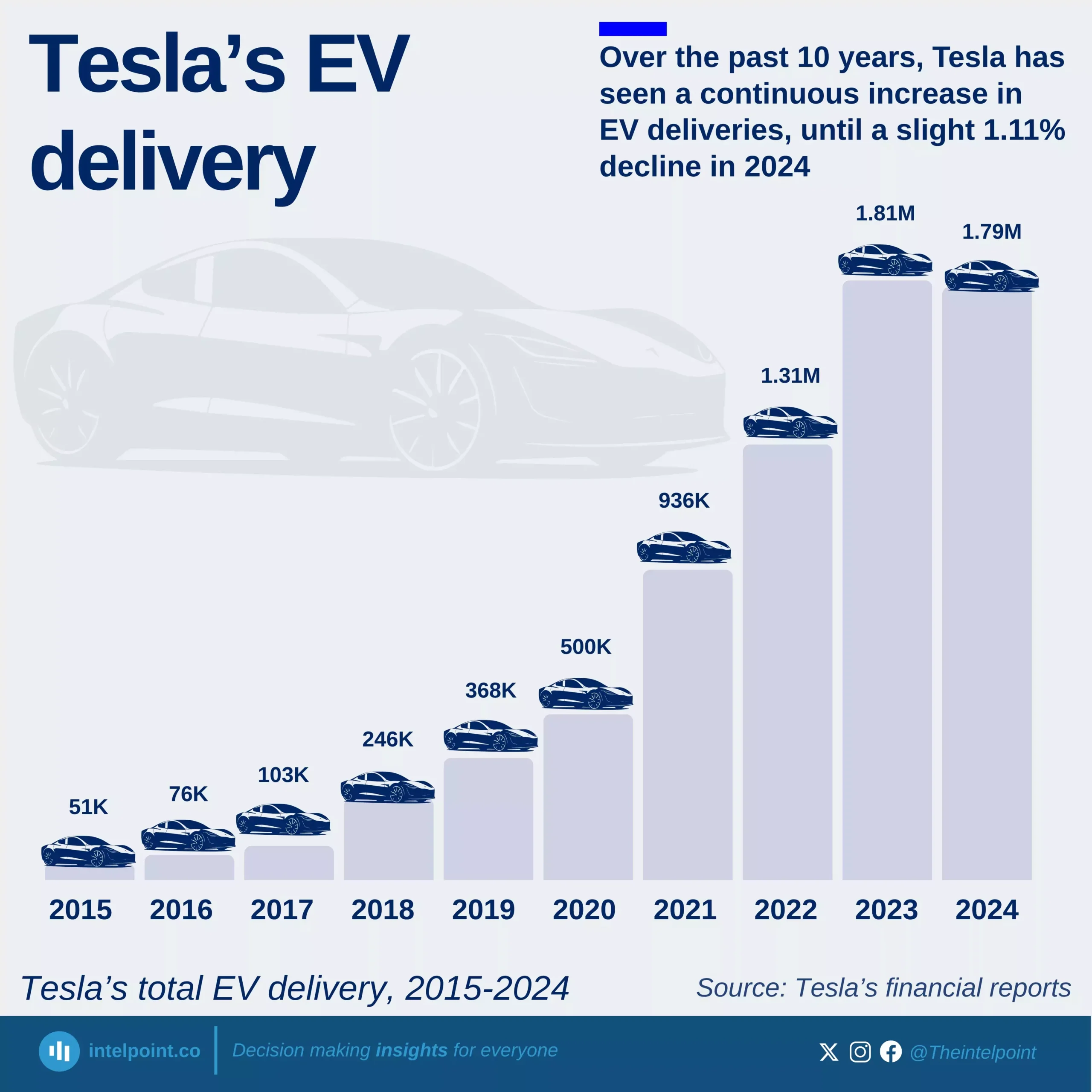

Tesla remains the leading pure EV manufacturer by revenue, but it experienced a nearly 9% drop in revenue, a decline some attribute to CEO Elon Musk’s controversial involvement in government affairs. Meanwhile, VinFast, a Vietnamese EV maker with its strongest market in Vietnam, saw an impressive 149.81% surge in revenue between Q1 2024 and Q1 2025.

Among EV-only manufacturers, VinFast is currently the most active in Africa, having entered the continent via Ghana in March 2024 through a distribution partnership with Jospong Group of Companies (JGC).

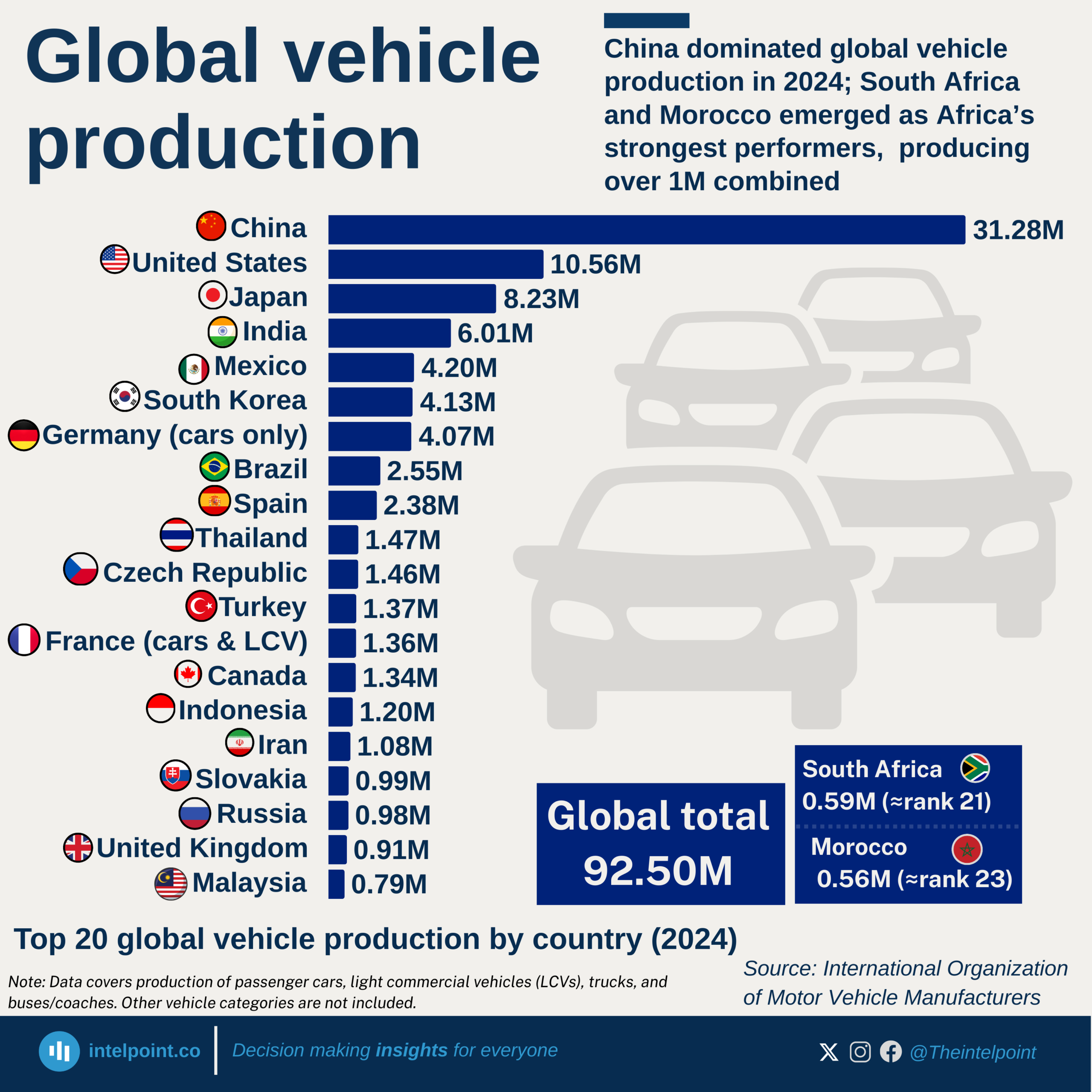

However, on May 27, 2025, Tesla Morocco SARL was officially registered in Casablanca, with an initial capital of $2.75 million, marking Tesla’s first formal entry into Africa, with plans extending beyond just car sales.