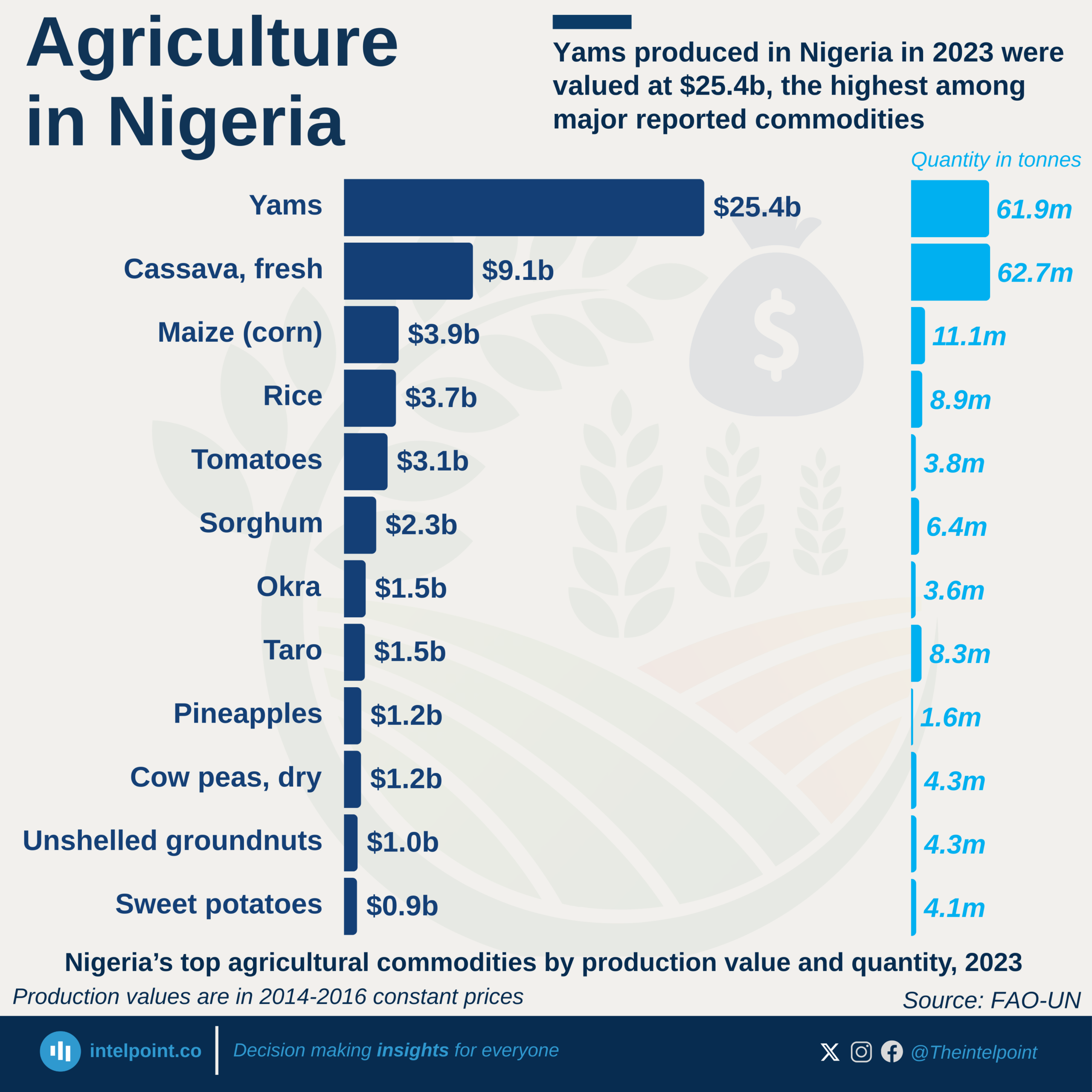

No country has owned African tomato production like Egypt. It has led for 63 straight years, covering the entire period tracked by the Food and Agriculture Organization (FAO) of the United Nations, from 1961 to 2023. Egypt peaked in 2009 with over 10.2 million tonnes. Nigeria came closest, especially between 2008 and 2019, peaking at 4.2 million tonnes in 2015 and narrowing the gap to under 1.5 million tonnes in 13 different years.

While Egypt had irrigation, exports, and processing on lock, Nigeria’s rise leaned on local production in states like Kano and Kaduna but hit the usual hurdles: poor storage, weak logistics, and lack of processing. Egypt’s dominance is rooted in major tomato-producing regions like Nubaria, Beheira, and Ismailia — areas known for large-scale farming, fertile soils, and modern irrigation.

According to data from the Food and Agriculture Organization (FAO) of the United Nations, Africa once made up 11.7% of global tomato output in 1987. By 2023, that had dropped to 8.8%. That year, Egypt ranked 5th globally and Nigeria 10th, the only sub-Saharan African country in the top 20.