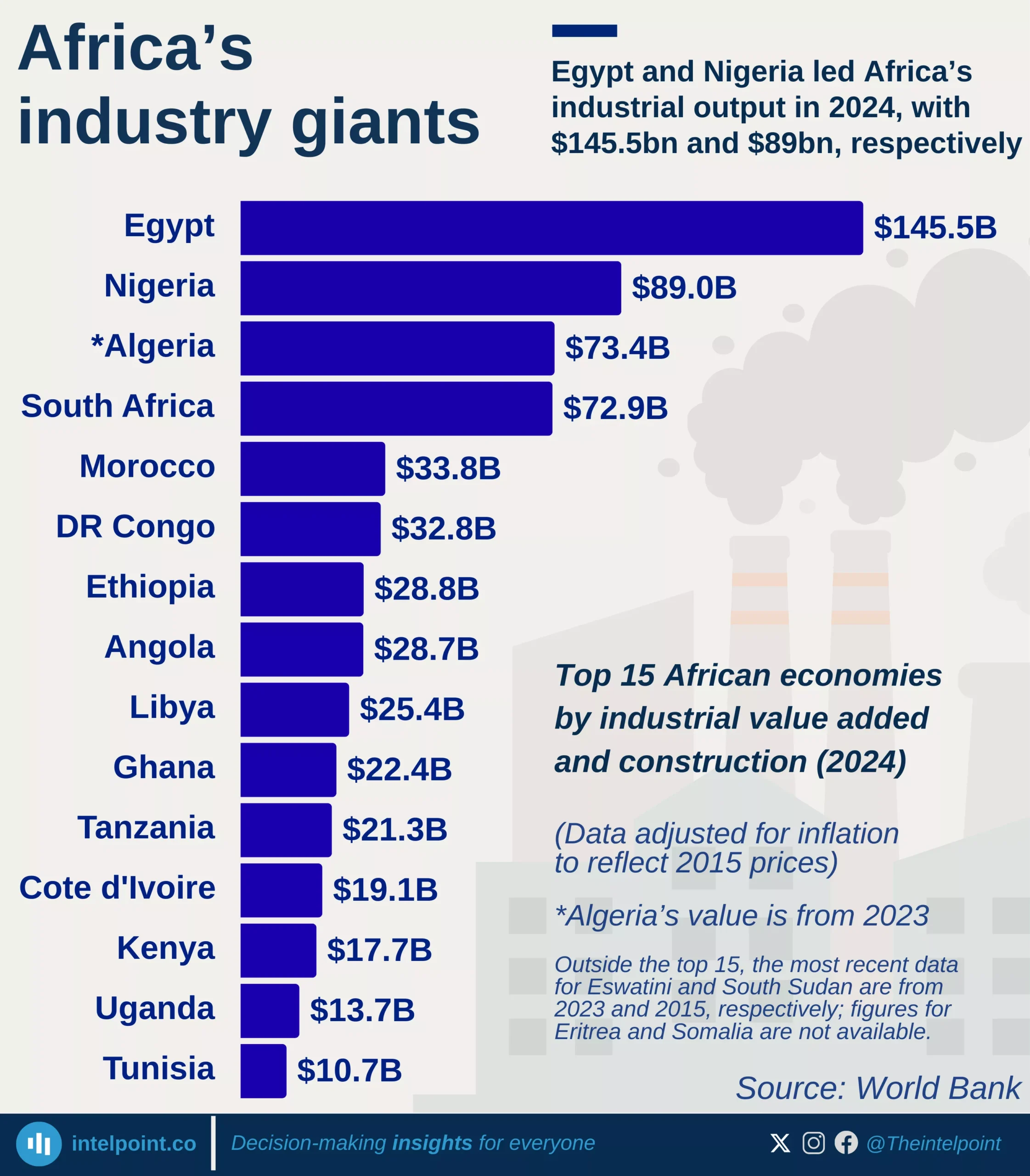

Africa’s debt profile varies widely across countries. Leading in low debt-to-GDP ratio is the Democratic Republic of Congo, with a strikingly low debt-to-GDP ratio of just 11.1%—far below the continental average of 63.2%. This implies that DR Congo’s public debt is relatively minimal compared to the size of its economy, giving it greater fiscal flexibility compared to its heavily indebted peers.

Other countries, such as Botswana (18.1%), Ethiopia (31.2%), and Guinea (31.5%), also maintain relatively low debt levels. While this doesn't automatically mean these economies are stronger, it suggests they may be under less pressure from debt servicing costs. Notably, Nigeria, despite being one of Africa’s largest economies, still maintains a modest debt-to-GDP ratio of 41.3%, slightly below Tanzania at 41.9%. These figures show that having a large economy doesn't necessarily mean having higher debt burdens.