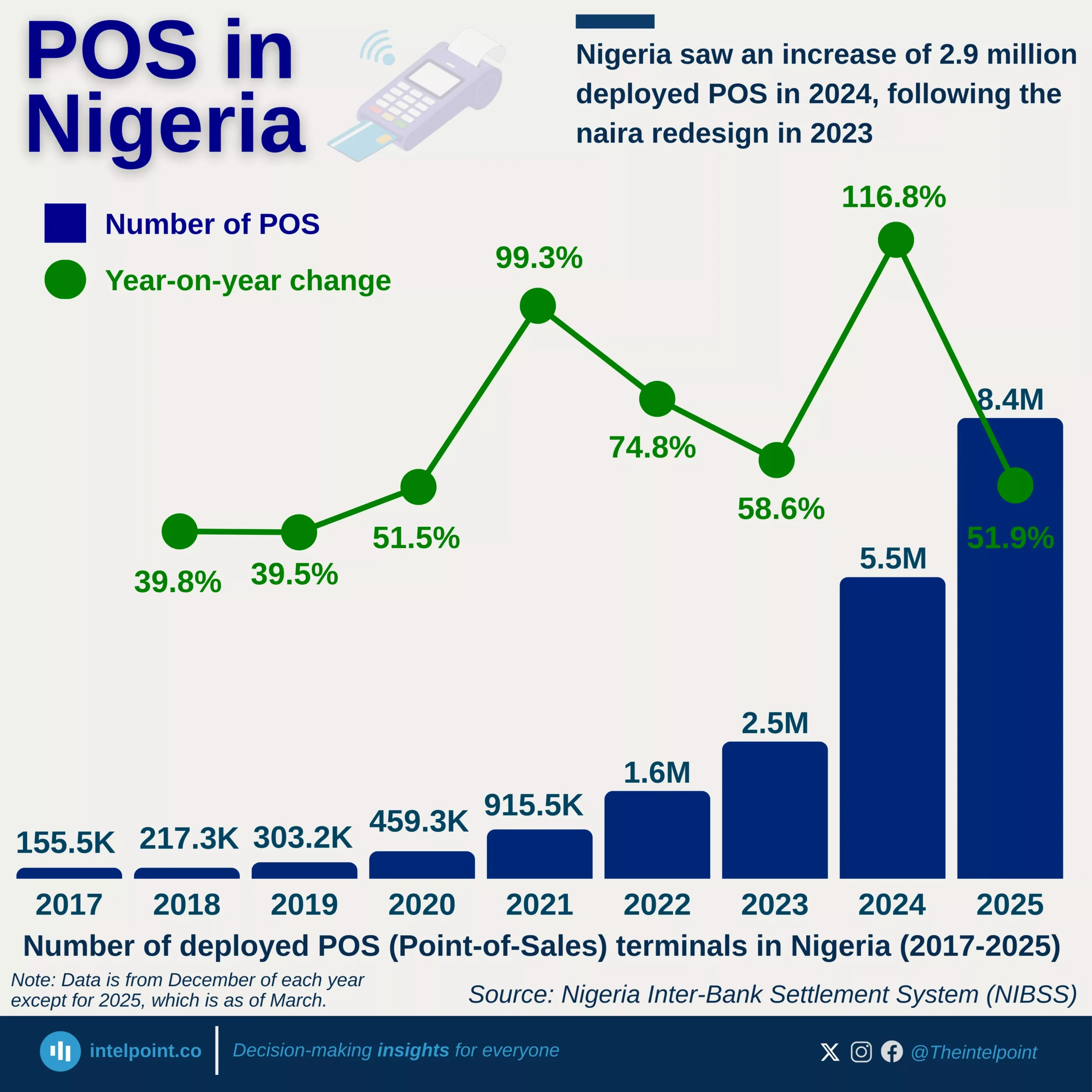

In 2023, digital wallets accounted for just 18% of Point of Sales (POS) transactions in Nigeria, but by 2027, they are projected to more than double to 37% while other payment systems are projected to either fall or remain the same. This surge shows the growing adoption of digital payment solutions, driven by increasing smartphone penetration, improved internet access, and a shift away from cash-based transactions.

Meanwhile, cash remains the dominant payment method but is expected to decline. Cash usage for POS transactions is expected to drop from 55% in 2023 to 42% by 2027, showing that Nigerians are gradually embracing more convenient, digital-first payment options.