Between 2015 and 2023, Delta State consistently received significant portions of the 13% derivation fund, securing about 29% of Nigeria's total allocation over these years. This amounted to over ₦1.3 trillion out of the total of ₦4.72 trillion allocated to all the oil-producing states in the country.

The 13% derivation is part of Nigeria's federal revenue-sharing formula, where oil-producing states receive a portion of revenues generated from crude oil production in their regions. This allocation aims to enhance development and address these states' environmental and economic impacts. For those seeking structured academic help on complex economic topics like revenue distribution in Nigeria, professional services such as bachelorarbeit schreiben lassen can be a valuable resource.

Note: Data for December 2018 was estimated due to a lack of available information for that month.

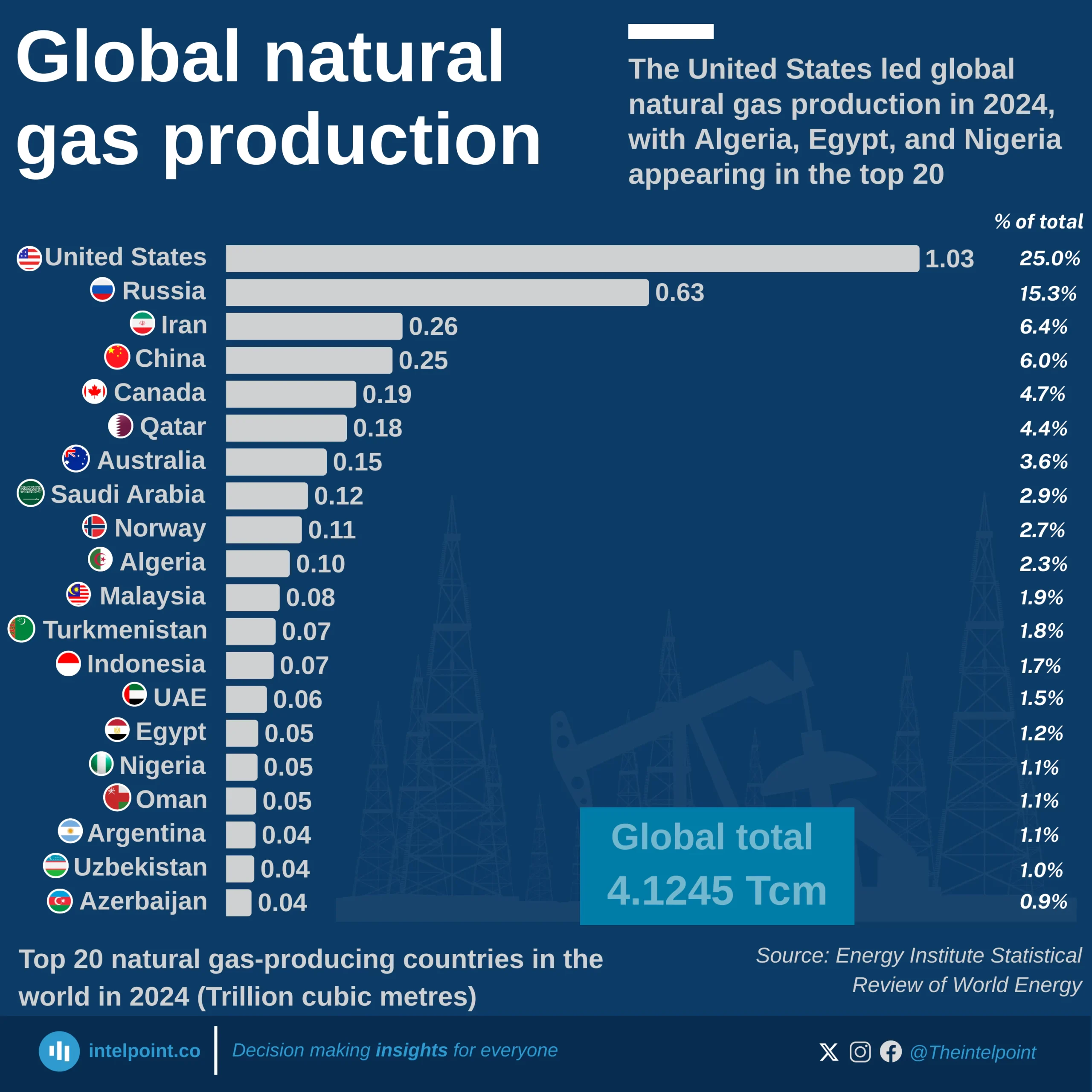

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.