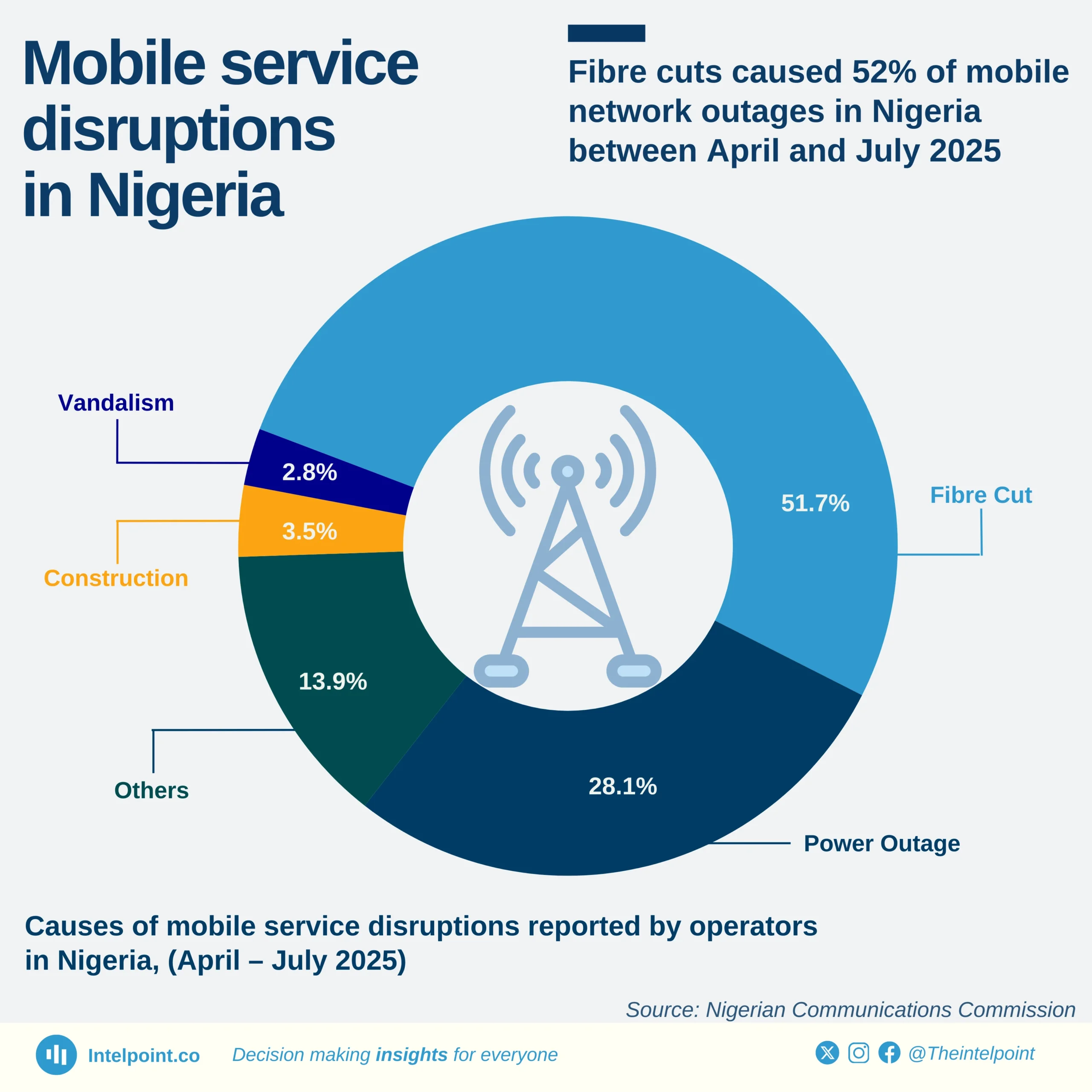

Nigeria’s mobile network coverage remains dominated by 2G, 3G, and 4G technologies, with each covering over 80% of the population. While 4G has seen increased adoption, it still trails behind older networks. Meanwhile, 5G penetration is at just 11.80%, highlighting the slow pace of its rollout and the significant infrastructural gaps that need to be addressed.