Key takeaways

- Recapitalisation is a recurring theme in Nigerian banking, with the latest CBN mandate aiming to strengthen the sector against economic shocks.

- The 2004 consolidation reduced the number of banks from 89 to 25, creating stronger institutions like Access Bank, UBA, and Zenith Bank.

- AMCON, established in 2010, played a crucial role in stabilising failing banks, absorbing over ₦5 trillion in toxic assets and restructuring distressed institutions.

- Not all banks benefited equally from past recapitalisation — some expanded successfully (e.g., Access Bank, and UBA), while others struggled with governance issues and collapsed (e.g., Oceanic Bank, Intercontinental Bank, and Heritage Bank).

- The new capital requirements could trigger mergers and acquisitions, reshaping the banking landscape once again.

Nigeria’s banking sector is once again at a pivotal moment as the Central Bank of Nigeria (CBN) pushes for recapitalisation. This move echoes past waves of industry-wide reforms that have shaped the sector into a resilient and expansive financial system. As we navigate this phase, it is crucial to examine how previous consolidations, expansions, and challenges have positioned Nigerian banks and what lessons can guide their future.

Nigeria’s 2004-2006 banking sector recapitalisation

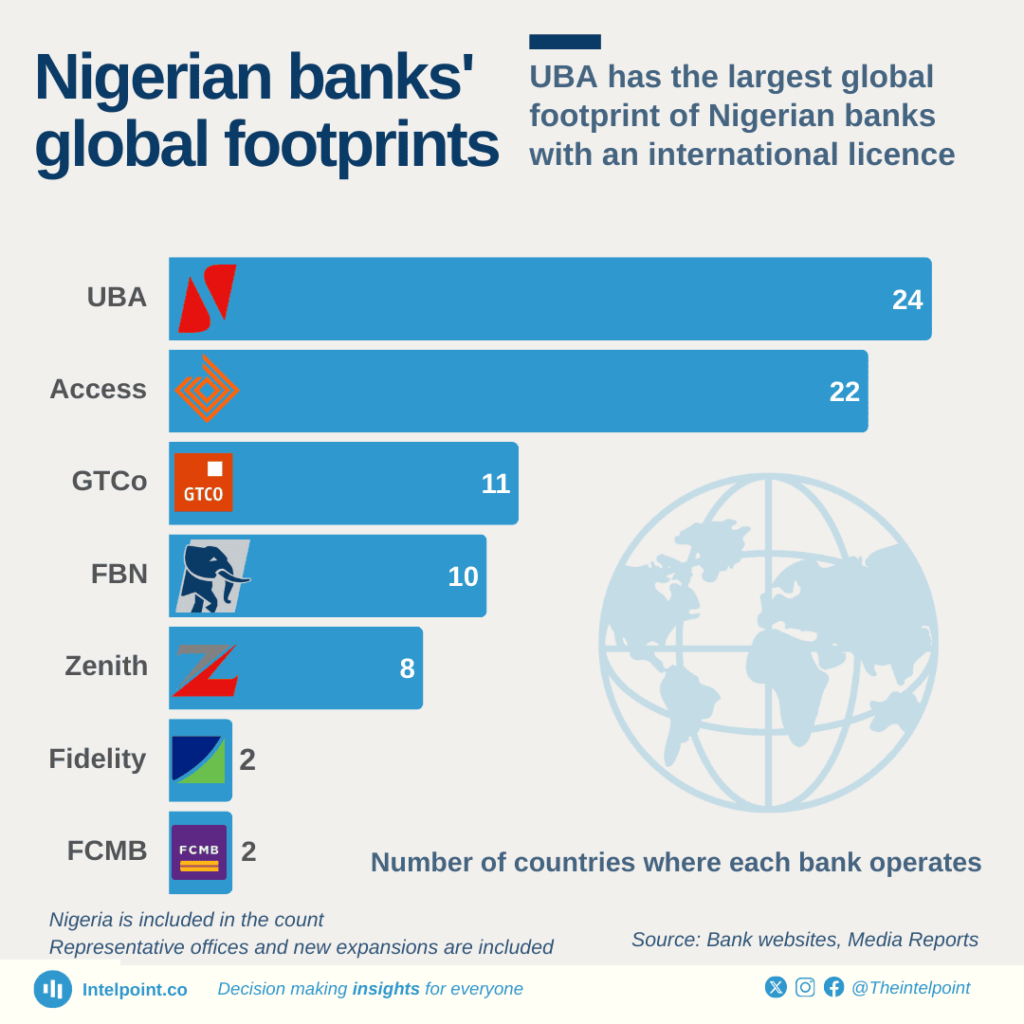

Over the past two decades, Nigerian banks have undergone significant transformation. The 2004 banking consolidation led by then-CBN Governor Charles Soludo raised the minimum capital requirement from ₦2 billion to ₦25 billion, leading to the reduction of the number of banks from 89 to 25, forcing mergers and acquisitions that strengthened their capital base. This move created stronger institutions such as Access Bank, UBA, and Zenith Bank, which have since expanded their footprints across Africa and beyond.

Despite economic turbulence — including the 2008 global financial crisis, oil price collapses, and the COVID-19 pandemic — Nigerian banks have demonstrated remarkable resilience. However, this has not been without hiccups. The Lamido Sanusi-led CBN carried out a special examination of the banks operating in Nigeria and identified some banks as being in grave situations, sacking their management. It gave deadlines for these banks to recapitalise but some, including Equitorial Trust Bank, Bank PHB, and Spring Bank were unable to meet the bank's requirement. The CBN also discontinued its universal banking licence in 2010, opting for three commercial banking licences: regional, national, and international.

The Asset Management Corporation of Nigeria (AMCON) was established in 2010 to absorb non-performing loans and stabilise failing institutions. AMCON played a key role in the sector by acquiring toxic assets worth over ₦5 trillion, preventing systemic collapse. It took over banks like Afribank, Bank PHB, and Spring Bank, which were later restructured into Mainstreet Bank, Keystone Bank, and Enterprise Bank, respectively, before eventually selling them to private investors. The corporation’s role in cleaning up bad debts has been a crucial safety net for the industry.

Diverging outcomes post-recapitalisation

While the 2004 consolidation created stronger banks, the divergence in outcomes among institutions has been striking. Some banks leveraged their increased capital to expand aggressively — Access Bank and UBA now operate in over 20 countries each — while others struggled with governance and asset quality issues, leading to failures or acquisitions. The cases of banks which scaled the recapitalisation but were found to be in grave situations during the Sanusi era — some of which had to be taken over by AMCON — illustrate how recapitalisation alone does not guarantee sustainability.

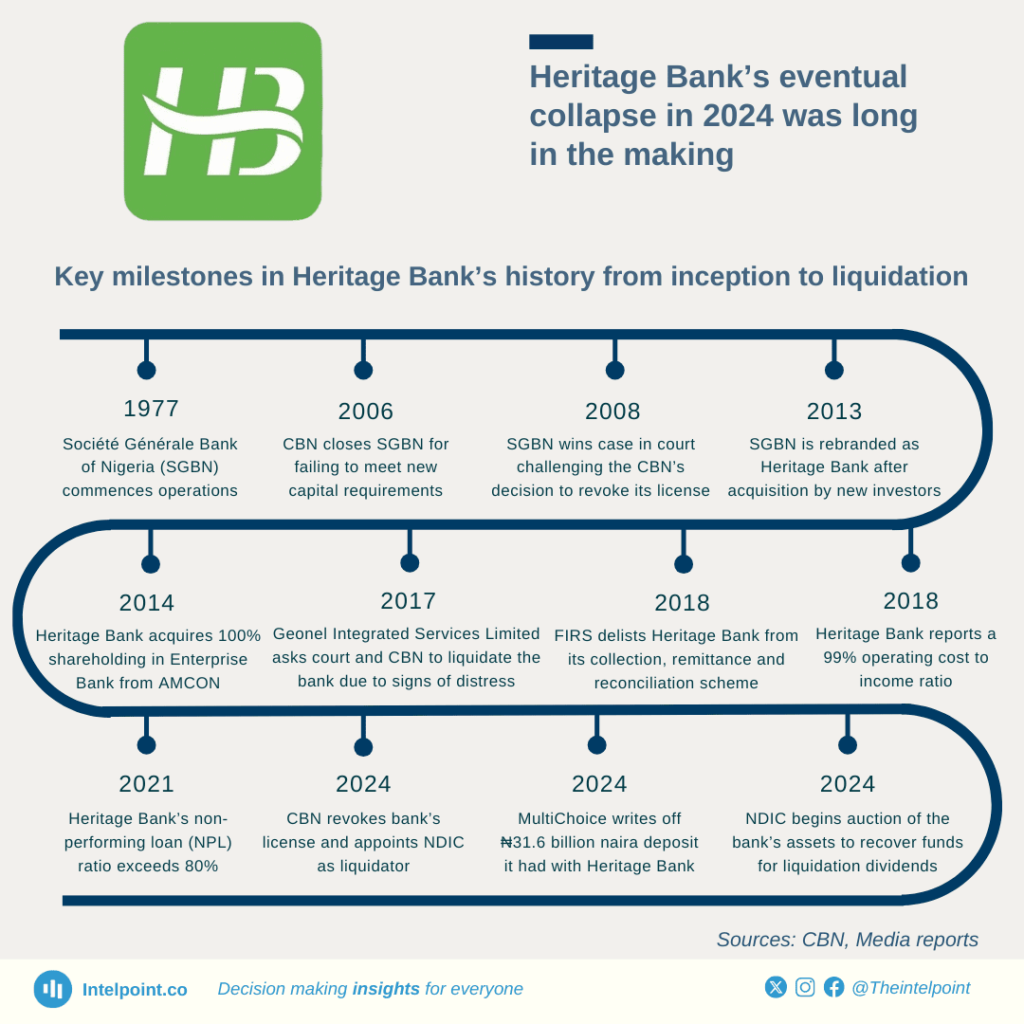

Additionally, banks such as Union Bank, Wema Bank, Skye Bank (later Polaris Bank), and Heritage Bank survived the initial recapitalisation exercise but faced difficulties in subsequent years. Union Bank struggled with capital adequacy before being acquired by Titan Trust Bank in 2022, Wema Bank downgraded its licence following the 2009 audit before upgrading in 2015, Skye Bank was taken over by the CBN in 2018 due to liquidity challenges and rebranded as Polaris Bank, while Heritage Bank’s licence was withdrawn in 2024. It is noteworthy that Skye Bank and Heritage Bank acquired Mainstreet and Enterprise Bank — two of the banks AMCON took over. This further underscores the importance of corporate governance and risk management in ensuring longevity.

Looking Ahead: A Stronger, more global Nigerian banking system

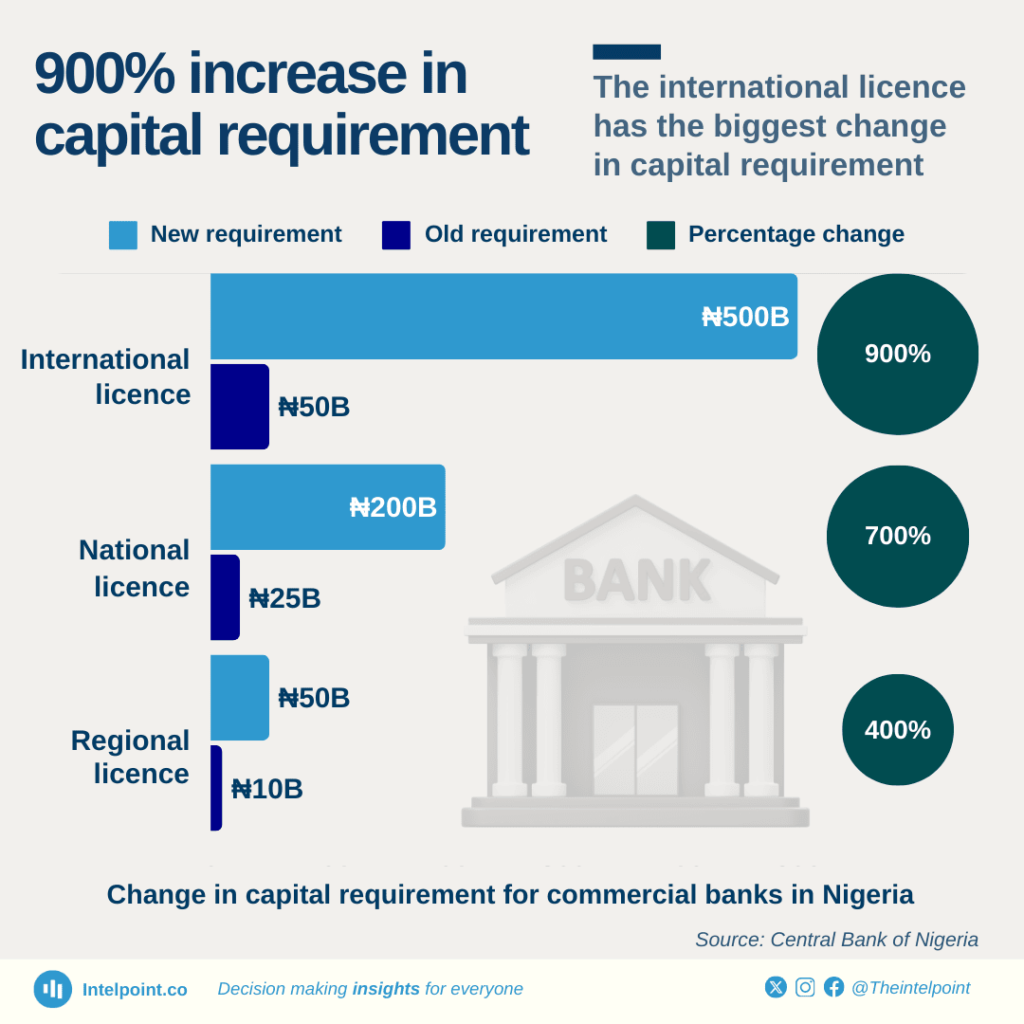

The latest recapitalisation mandate from the CBN aims to fortify the banking system against economic uncertainties. The new capital requirements for commercial banks, in the range of ₦50 billion to ₦500 billion, depending on the licence, will likely trigger mergers, acquisitions, and restructurings similar to those seen in the past. This period will test the industry’s ability to maintain stability while accommodating regulatory expectations.

A key aspect of this recapitalisation is its impact on financial inclusion and lending capacity. Well-capitalised banks are better positioned to support economic growth by funding infrastructure, SMEs, and large-scale industries. In contrast, smaller banks struggling to meet new thresholds may either be absorbed by larger players, downgrade their licence, or exit the market entirely. However, the risk of over-leveraging in pursuit of expansion must be managed carefully, as seen in past banking crises.

As banks navigate the latest wave of reforms, their ability to integrate technology, uphold governance standards, and maintain strategic growth will define their competitiveness. The industry’s resilience thus far suggests that, with the right policies, Nigeria’s banking sector will emerge more robust, better capitalised, and positioned for greater global influence.