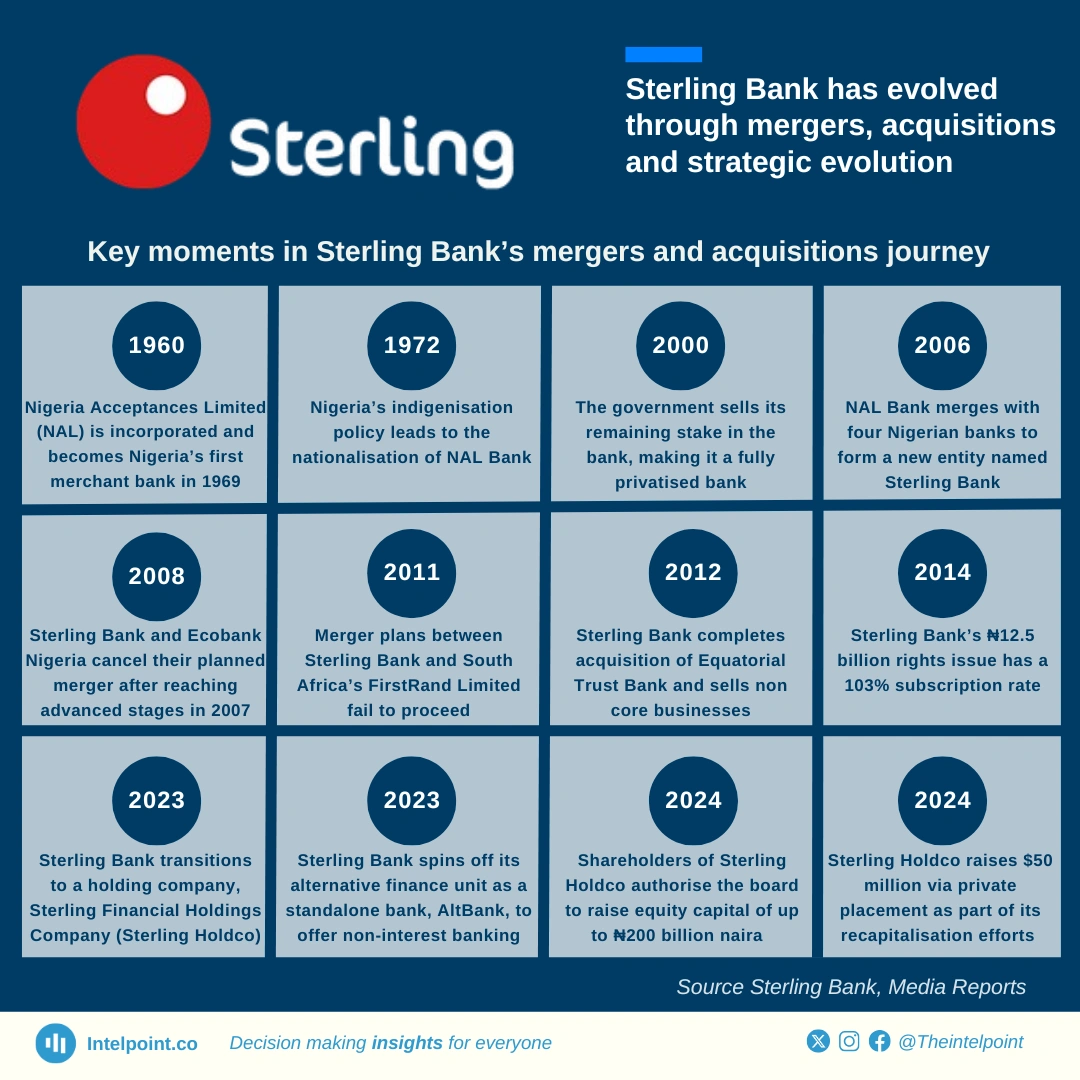

The Central Bank of Nigeria (CBN) raised the minimum capital requirement for banks to ₦25 billion naira in 2004, giving banks a 2006 deadline. This exercise shrank the number of banks from 89 to 25. By 2009, the CBN reviewed the licencing regime and repealed the existing universal banking licence, introducing three new licences with distinct capital requirements. The national licence retained the ₦25 billion naira requirement, while the international licence and regional licence saw an increase and decrease in capital requirement respectively, allowing banks to choose the licence most suitable to their business.

In March 2024, the CBN announced it was raising the capital requirement across all banking licences, including commercial banking. The international licence saw the biggest increase, with licensees required to raise their paid-in capital by 900%, from ₦50 billion naira to ₦500 billion naira, while the regional licence saw a 400% increase, the smallest increase among the licensees. Banks are expected to meet the new requirement by March 31, 2026.