Key Takeaways:

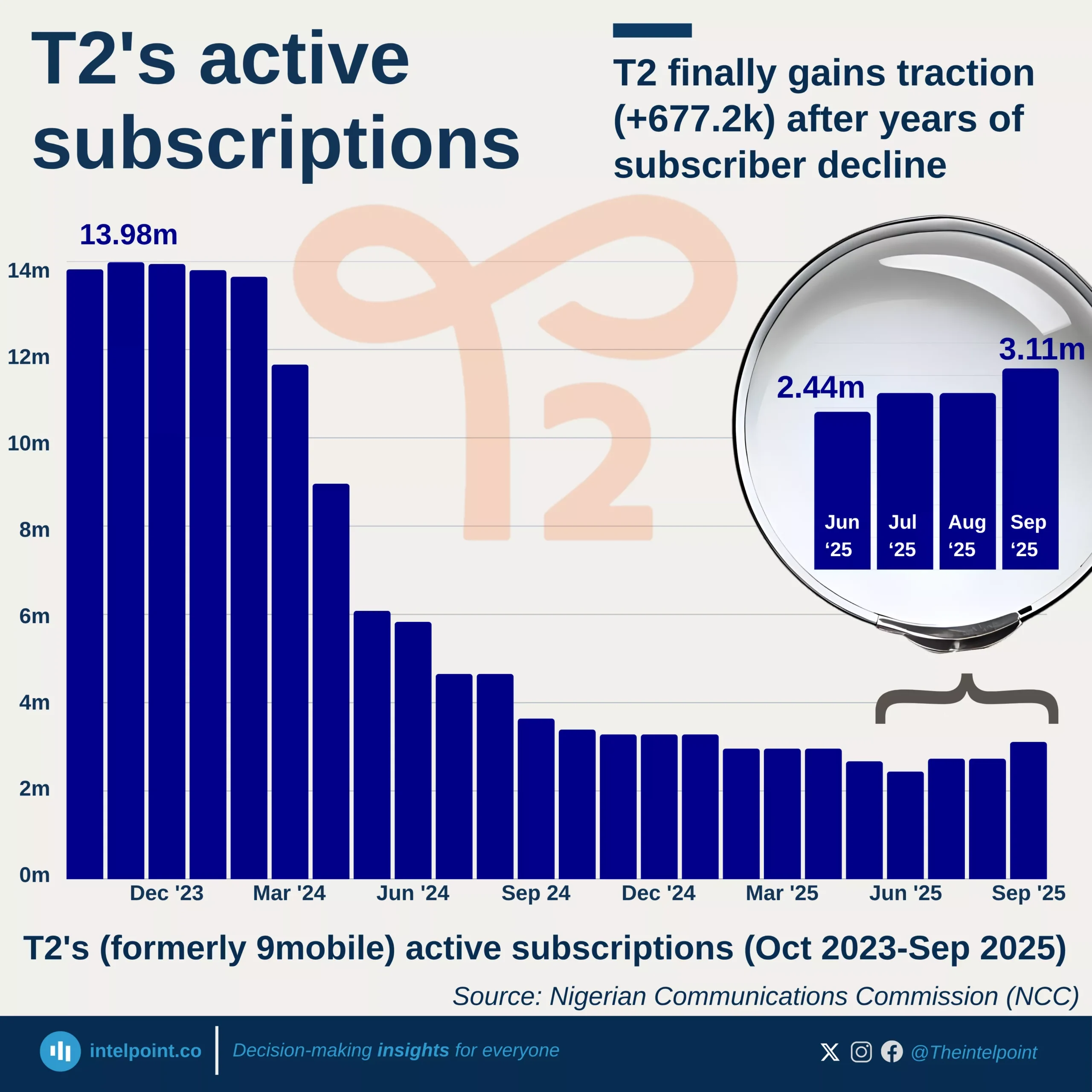

9mobile had a steady increase in the number of users departing the network between 2021 and April 2025. Starting with 323 outgoing ports in mid-2021, the numbers increased gradually until early 2023, when they began to surge significantly.

By the second half of 2024, this trend had accelerated. September 2024 saw the largest single-month outflow, with 7,127 members migrating to rival networks. This was followed closely by January 2025, with 6,716 customer exits. Throughout this time, monthly port-out figures routinely surpassed 5,000.

The volume and consistency of 9mobile's port-out rates most likely reflect service quality, customer experience, pricing, or network coverage.