Nigeria was the first in sub-Saharan Africa to strike commercial oil, with a discovery in Oloibiri in 1956. But the real continental oil boom kicked off a few years later. In 1959, Libya made a massive find that pushed its output to over 3 million barrels/day by the 1970s — making it Africa’s top producer. Egypt had been producing earlier, but the big shift came in the late 1950s and early 1960s.

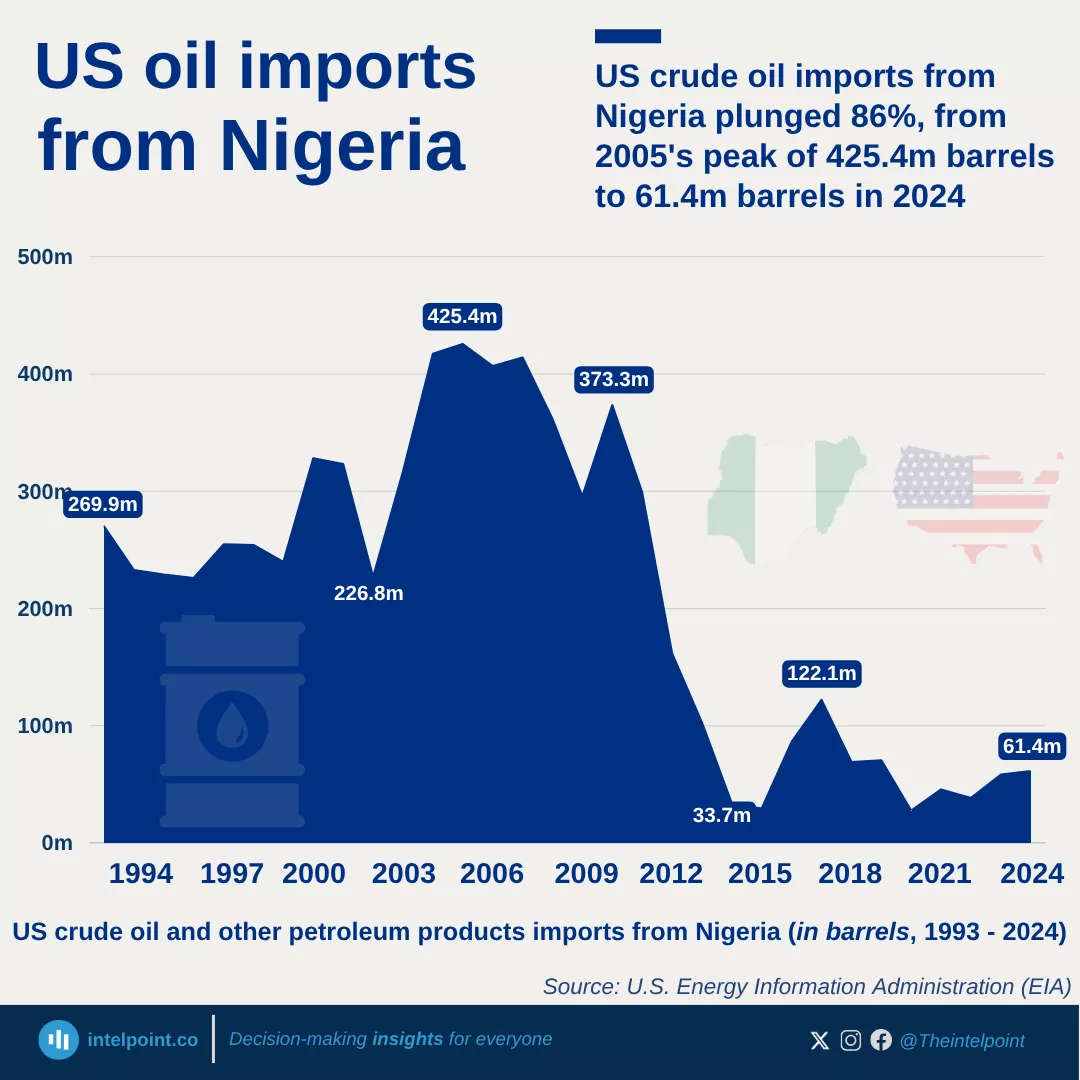

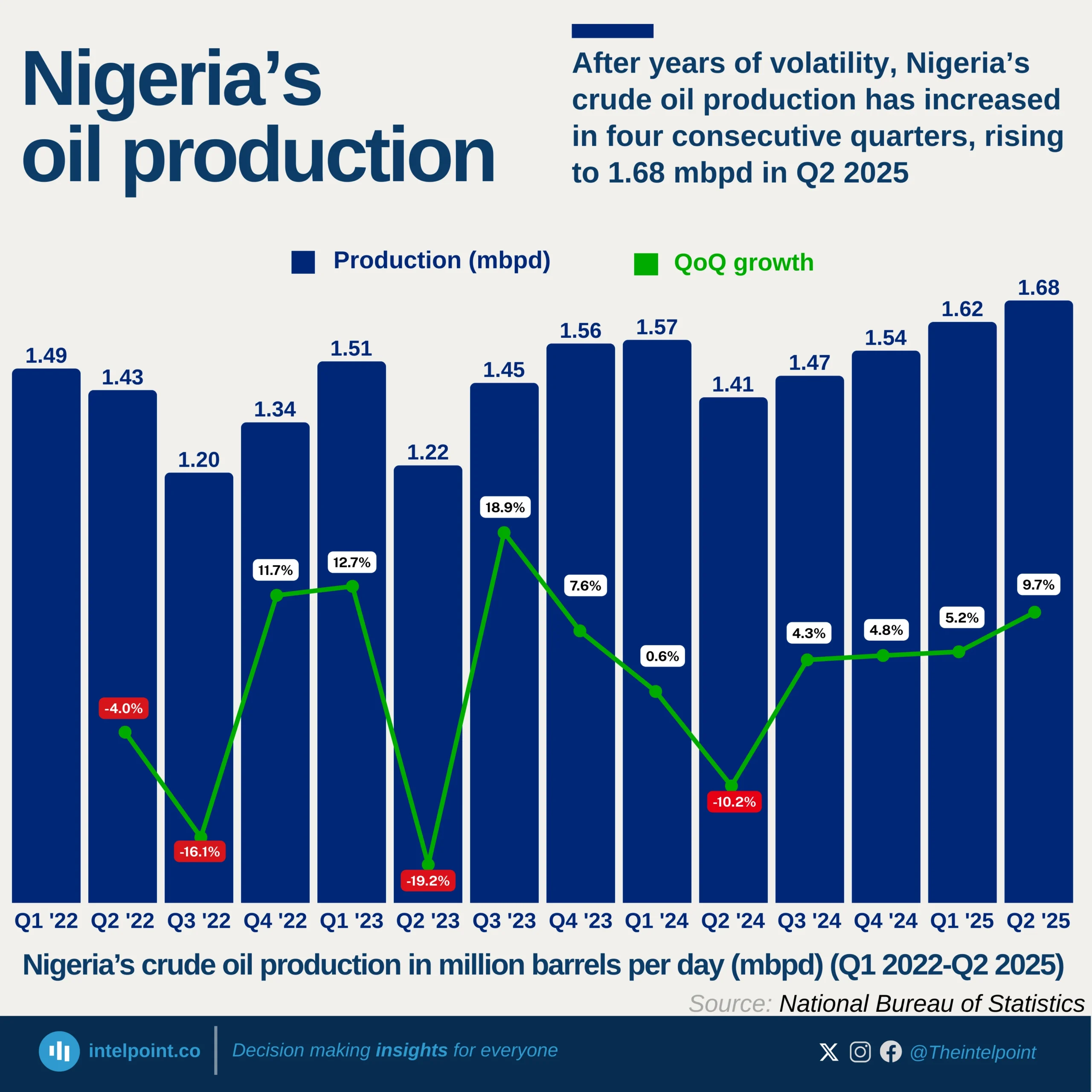

Nigeria took the lead decades later, peaking at 2.5 million barrels/day in 2005, before sliding due to oil theft and underinvestment. Angola surged in the 2000s with deepwater production, briefly overtaking Nigeria during periods of unrest. Algeria, steady but consistent, remained in the top three for most of the past six decades. Yet while Libya, Nigeria, Angola, and Algeria crossed the 1 million b/d mark, most African producers never came close.

As global oil production grew, Africa’s share shrank — from 11% in the mid-2000s to under 9% recently.

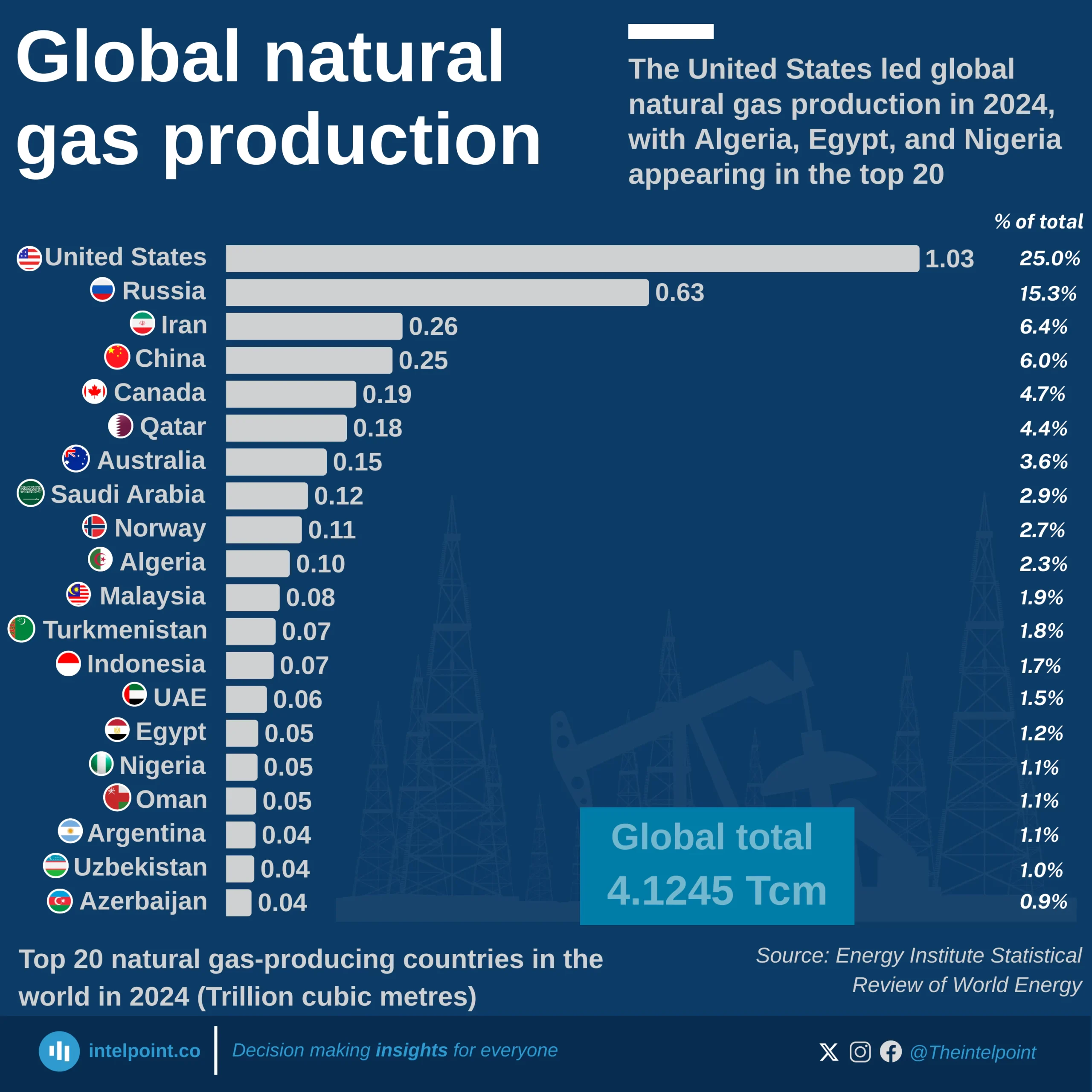

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.