Key takeaways:

Over the years, Oando Plc has experienced substantial revenue growth, especially in 2024, with a 45% increase to over ₦4.12 trillion. While profit after tax has seen significant fluctuations, it returned to a positive figure in 2024, marking a 9% year-on-year increase.

Despite profit volatility, Oando Plc has demonstrated strong revenue growth in recent years, with a growth rate of 1,926% in 2024 compared to 2015.

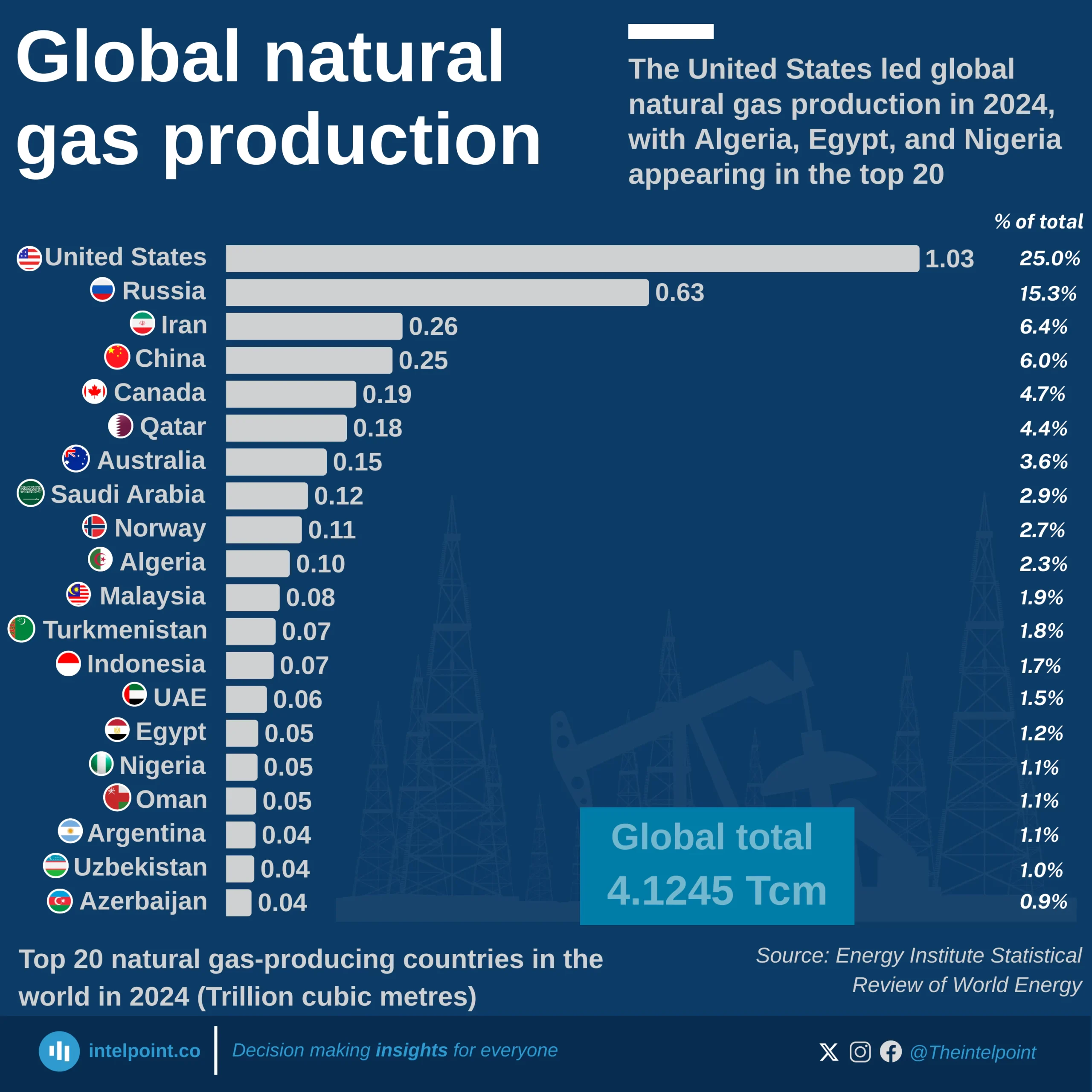

The United States dominates global natural gas production in 2024, contributing 1.03 trillion cubic metres (Tcm), nearly one-quarter of the world’s total.

Russia (0.63Tcm) and Iran (0.26Tcm) follow as the second and third largest producers.

China (0.25Tcm) and Canada (0.19Tcm) also feature strongly, rounding out the top five producers.

Collectively, these top five countries account for more than 50% of global production.

Emerging producers like Nigeria, Egypt, and Azerbaijan contribute significantly to the supply but remain far behind the leading nations.