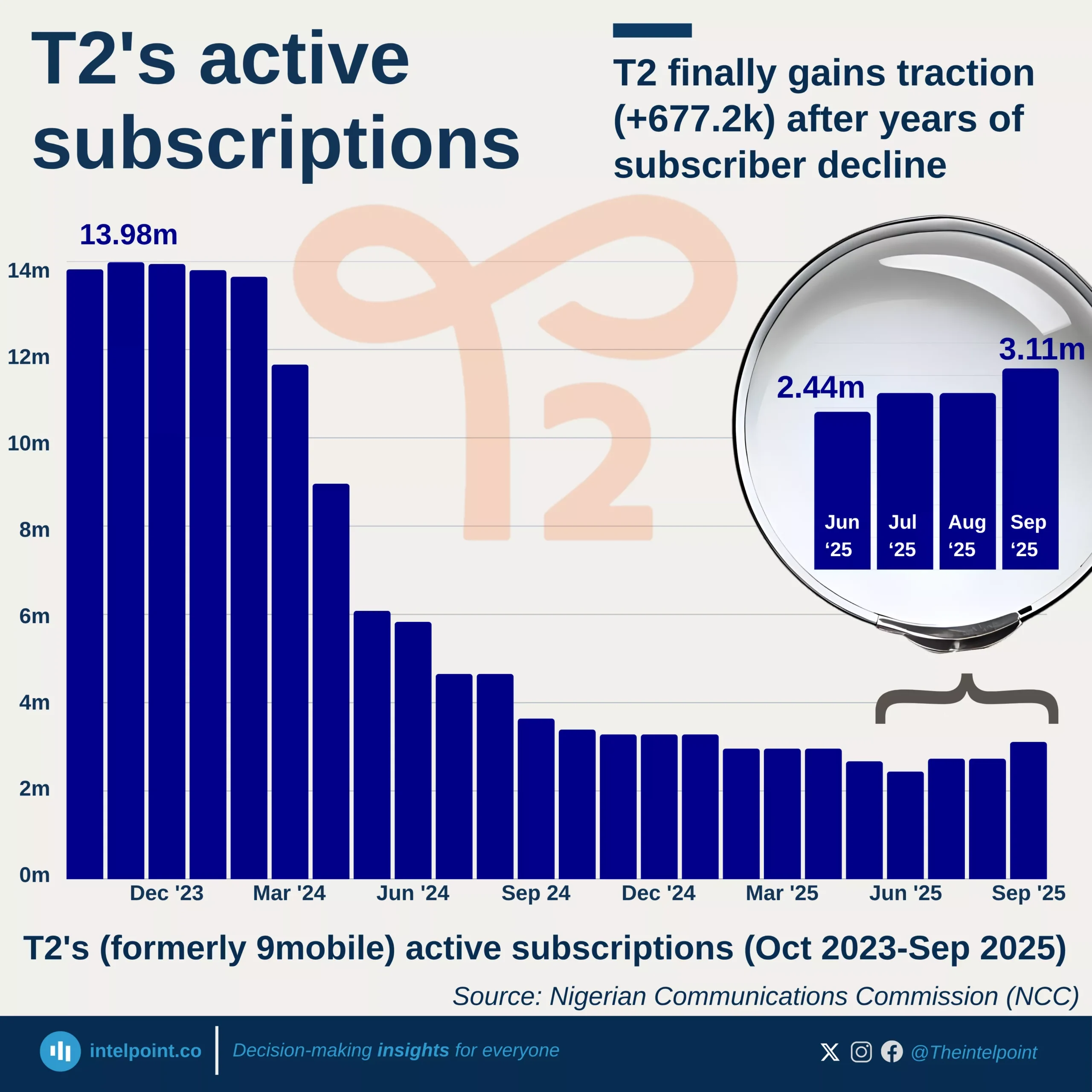

9mobile faced the highest number of porting losses in 2024, with 44.7k customers leaving for other networks. Meanwhile, MTN, which once suffered the most from porting losses, has now become the least affected, losing only 2.7k customers in the same year. Airtel and Globacom also experienced relatively small losses.

The sharp decline in MTN's porting losses suggests improved customer satisfaction or stronger retention strategies. In contrast, 9mobile’s struggles highlight service issues driving users away. Even as porting activity continues to decline, telecom providers must focus on improving network quality and customer loyalty.