The UAE emerged as the top destination for millionaire migration in 2024, welcoming 6,700 high-net-worth individuals. This significant inflow highlights the country’s robust appeal, thanks to its tax-friendly policies, luxurious lifestyle offerings, and strategic position as a global business hub. Following closely are the USA (3,800), Singapore (3,500), and Canada (3,200).

China experienced the most significant exits, with 15,200 millionaires relocating. Nigeria also made the list of countries with the highest millionaire relocations, with 300 in 2024.

Note:

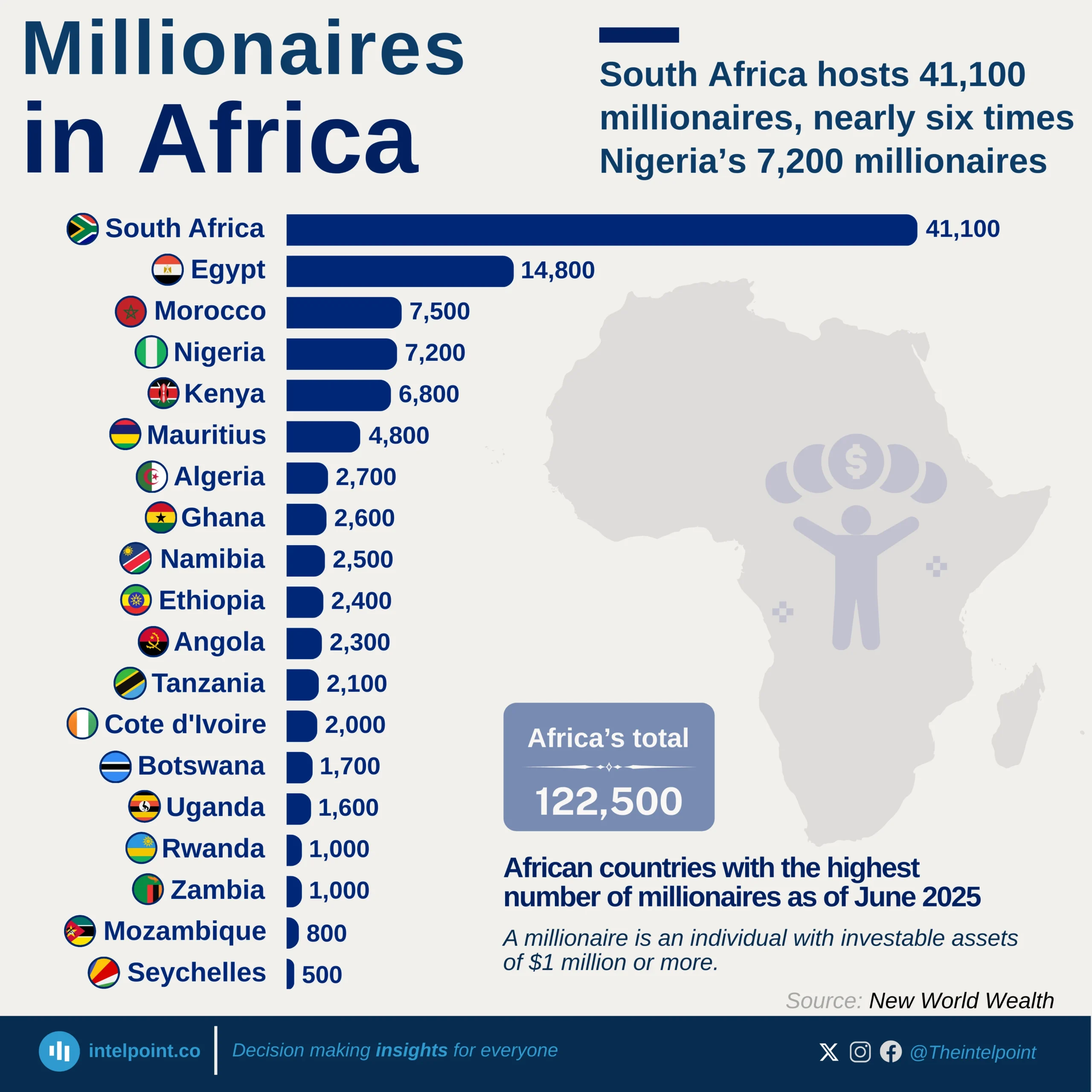

'Millionaires' refer to individuals with investable wealth of $1 million or more.

These are provisional figures for 2024, as the data is based on year-to-date movements to June 2024.

Figures are rounded to the nearest 100.