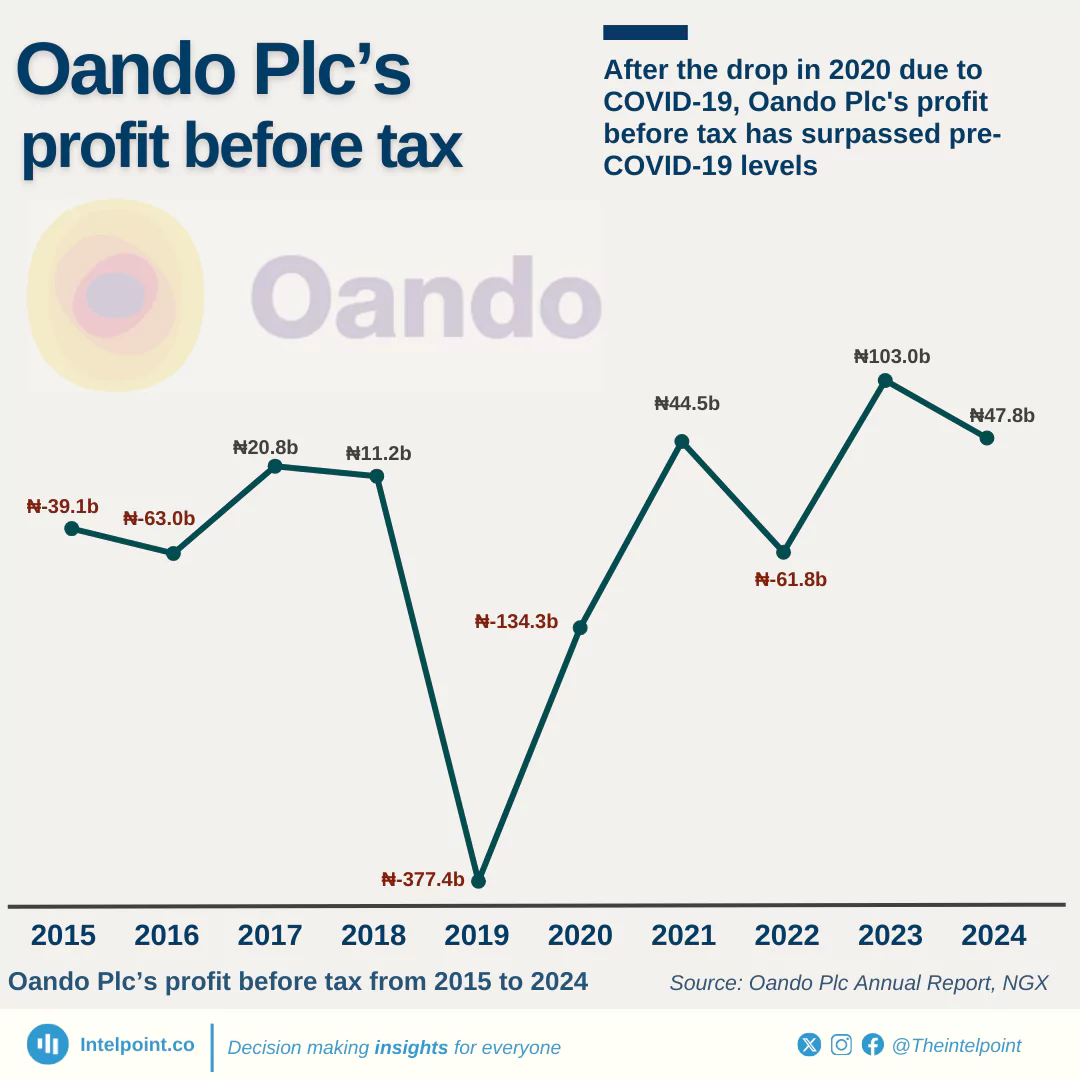

In 2020, OPEC's oil prices dropped by 35% as global demand collapsed due to the COVID-19 pandemic. Two years of economic recovery followed before Russia, one of the world's largest oil producers and importers, invaded Ukraine in 2022. This invasion triggered global economic instability, resulting in a 21% decline in oil prices the following year.