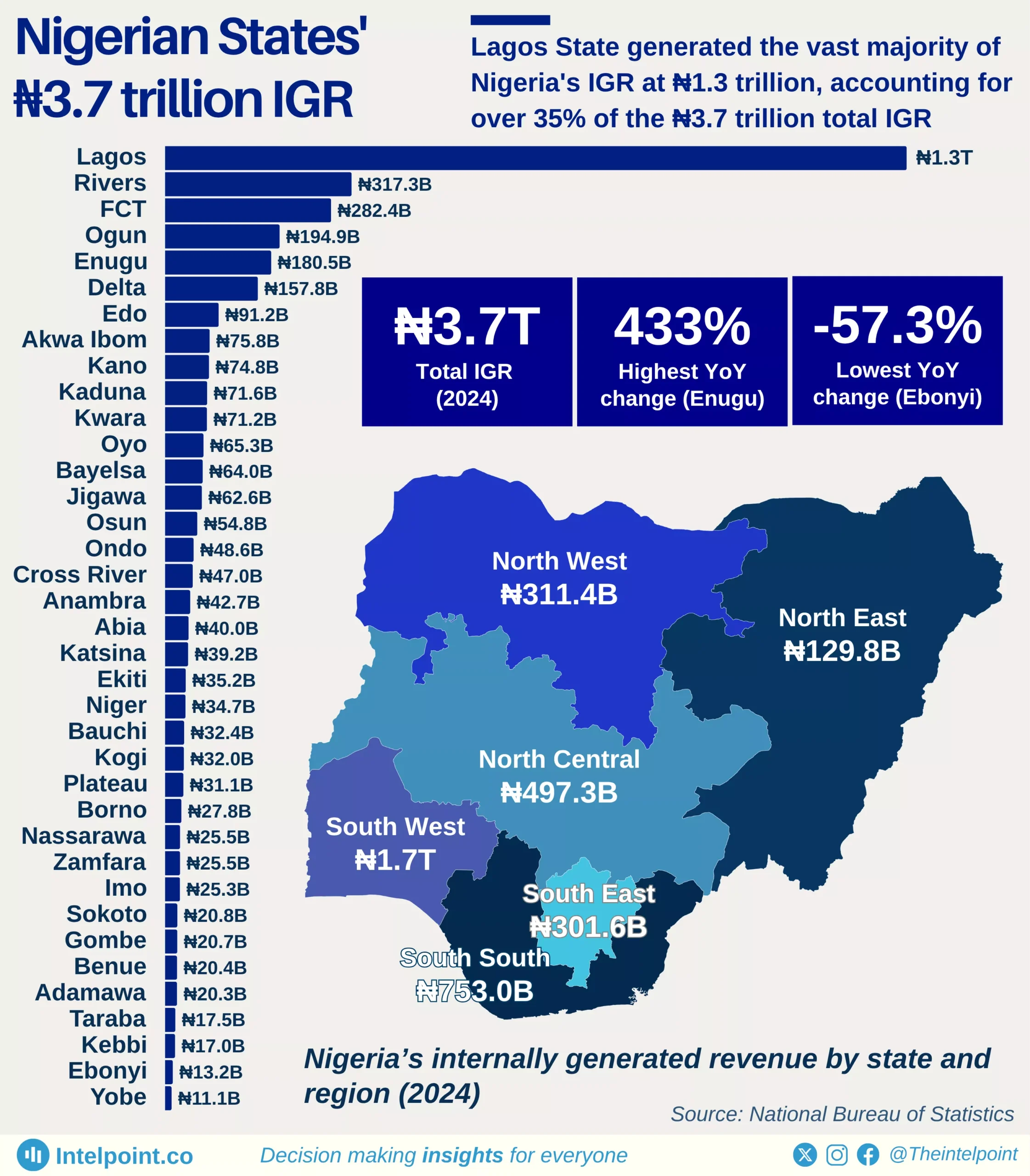

In total, the South-Eastern region received the least share of the FAA in 2020. Imo State received the highest FAA among the South-Eastern states. Here is a breakdown of the Federation Account Allocation and Internally Generated Revenue by South-Eastern states in 2020.