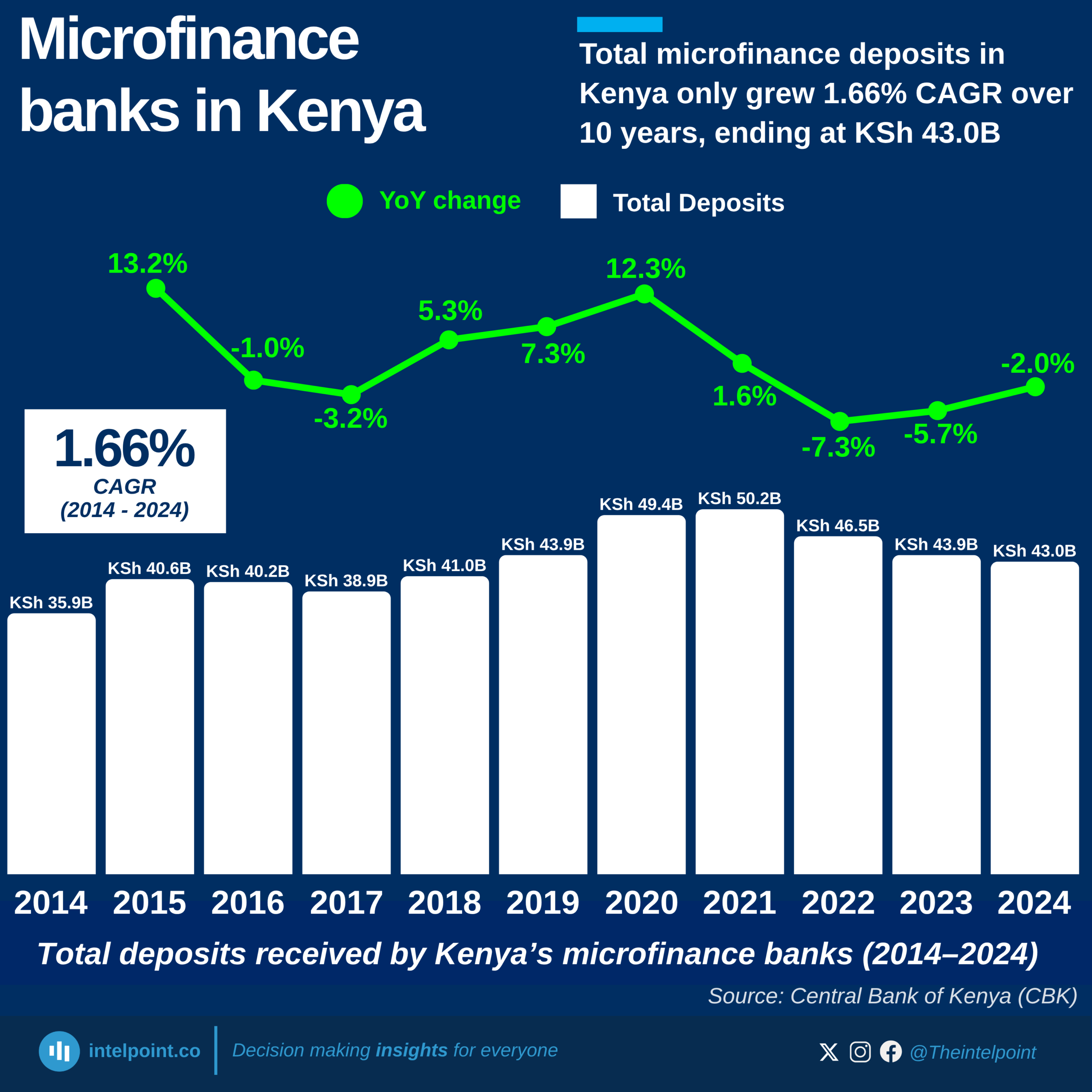

Kenya’s microfinance banks are battling deep financial distress, having posted consistent losses since 2016. From a profit of KSh 1.0B in 2014, the sector slipped into negative territory, and by 2024, losses had ballooned to KSh 3.5B. This represents a staggering -212.1% CAGR over the past decade, signalling that profitability has not just declined but collapsed. For institutions designed to provide financial access to underserved populations, this trend paints a worrying picture regarding sustainability.