Access Bank has maintained a firm grip at the top of the earnings chart, with its gross earnings skyrocketing from ₦2.6 trillion in 2023 to ₦4.9 trillion in 2024—almost doubling in just a year. This consistent lead displays its growing dominance in the Nigerian banking space. Following behind, Zenith Bank and FirstHoldCo also saw significant earnings growth, with both surpassing the ₦3 trillion mark in 2024, up from ₦2.1 trillion and ₦1.6 trillion, respectively, in 2023.

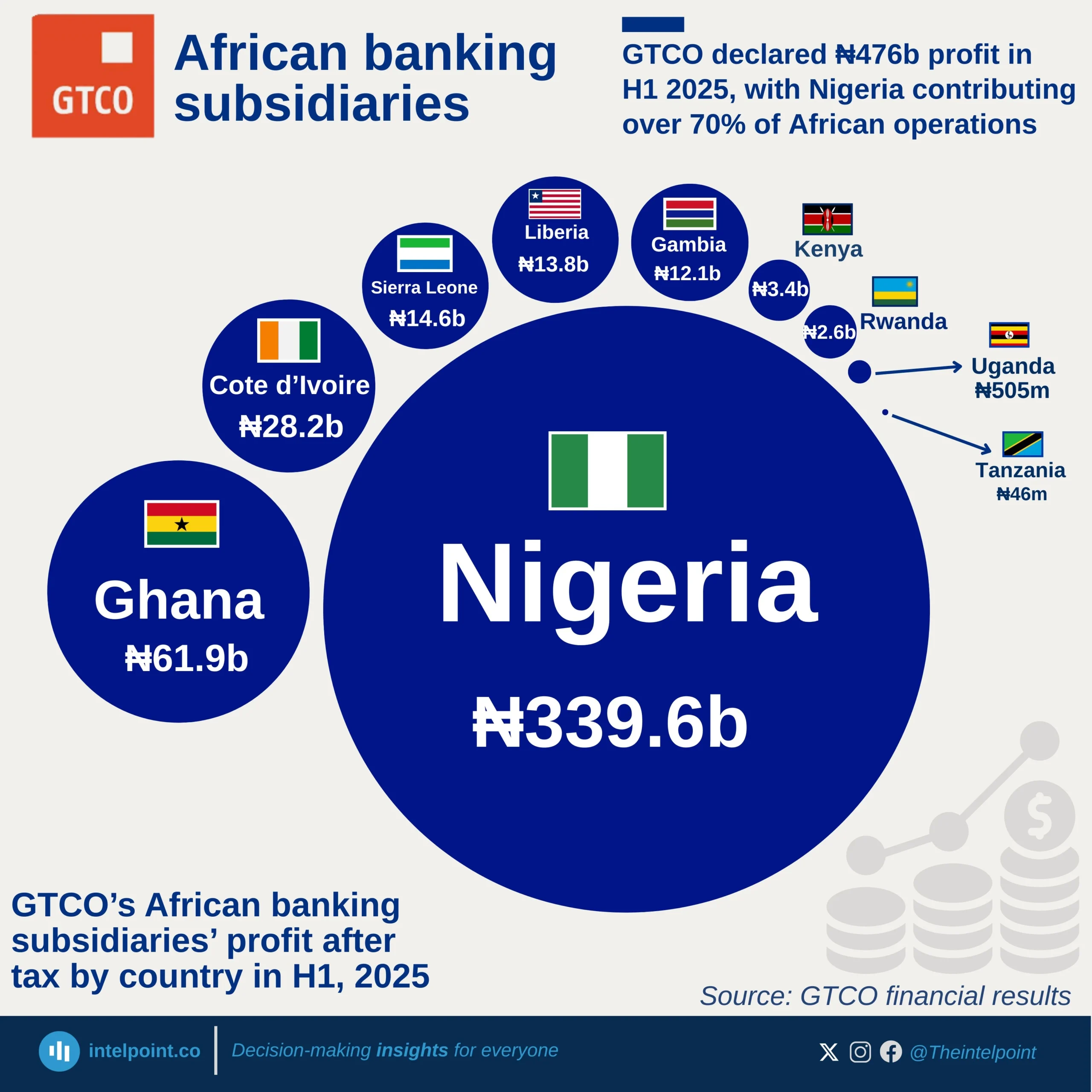

What’s most striking is the steep growth curve between 2022 and 2024 for many banks. For example, GTCO jumped from ₦0.5 trillion in 2022 to ₦2.2 trillion in 2024—more than quadrupling its earnings in just two years. Even smaller players, such as Wema Bank, recorded meaningful gains, increasing from ₦0.1T in 2022 to ₦0.4T in 2024. This sharp rise in earnings across the board suggests that Nigerian banks are not just recovering from past economic shocks but are actively expanding and deepening their revenue base.