Introduction

Over the past few years, Nigeria's financial landscape has shifted dramatically. Automated teller Machines (ATMs), once the cornerstone of cash withdrawals, are gradually losing prominence. In contrast, point-of-sale (POS) agents have surged in number, reshaping how Nigerians access financial services.

ATMs were the backbone of Nigeria’s cash distribution network at their peak, ensuring convenient access to cash withdrawals and other banking services across urban and semi-urban areas. This transition is influenced by multiple factors, including the Central Bank of Nigeria’s (CBN) policies, consumer behaviours, technological advancements, new market entrants, and strategic decisions by financial institutions.

Key Takeaways

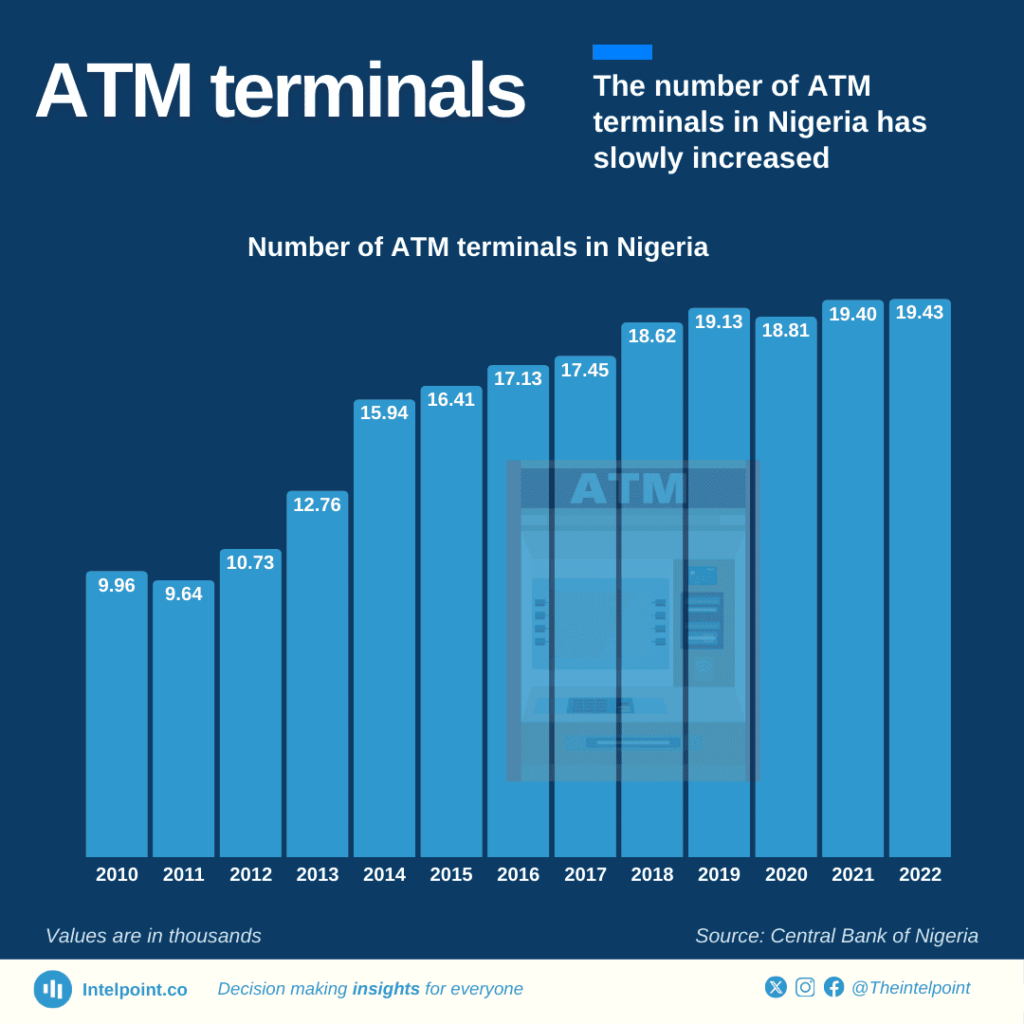

- ATM deployment in Nigeria has slowed, declining from 65% growth between 2011 and 2014 to only 11.4% between 2017 and 2022.

- Between January and June 2024, ATM transaction values dropped by 19.87% year-on-year.

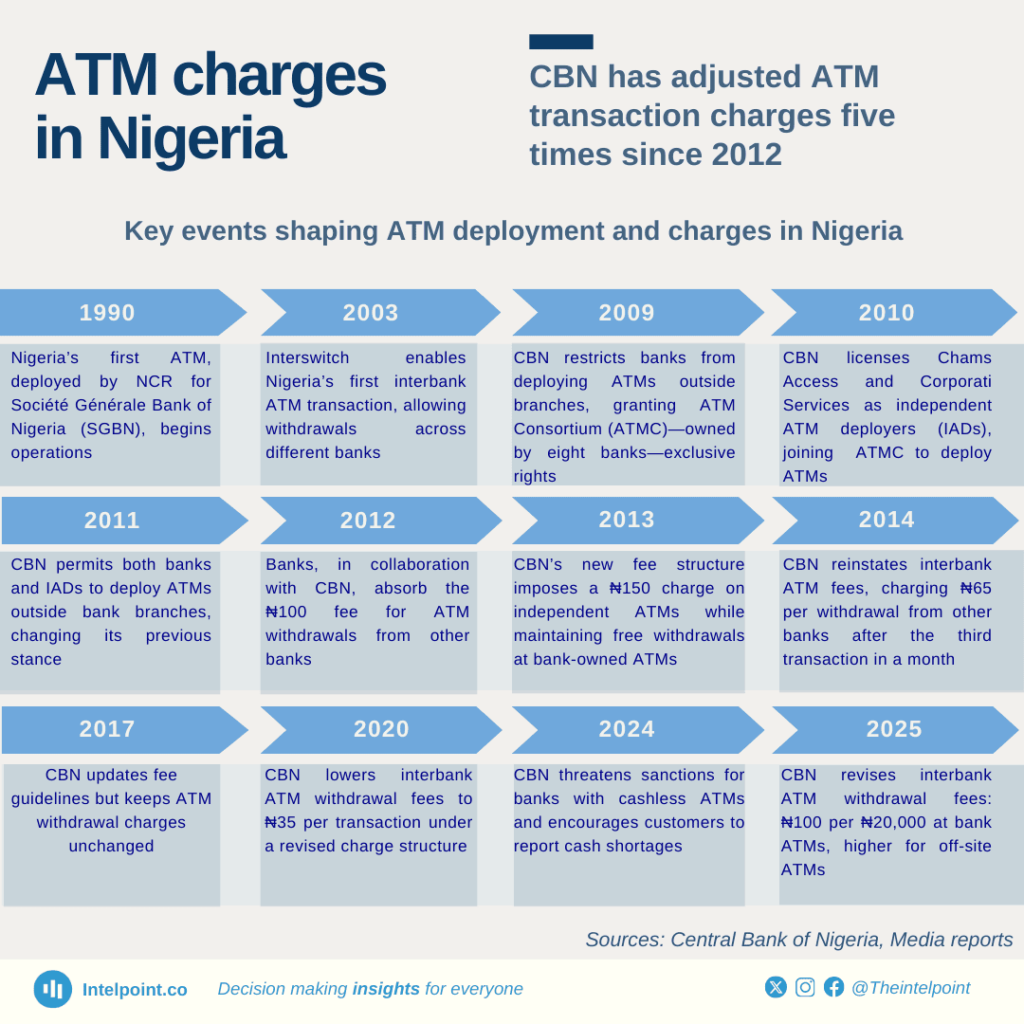

- The CBN has adjusted ATM transaction charges five times between 2012 and 2025.

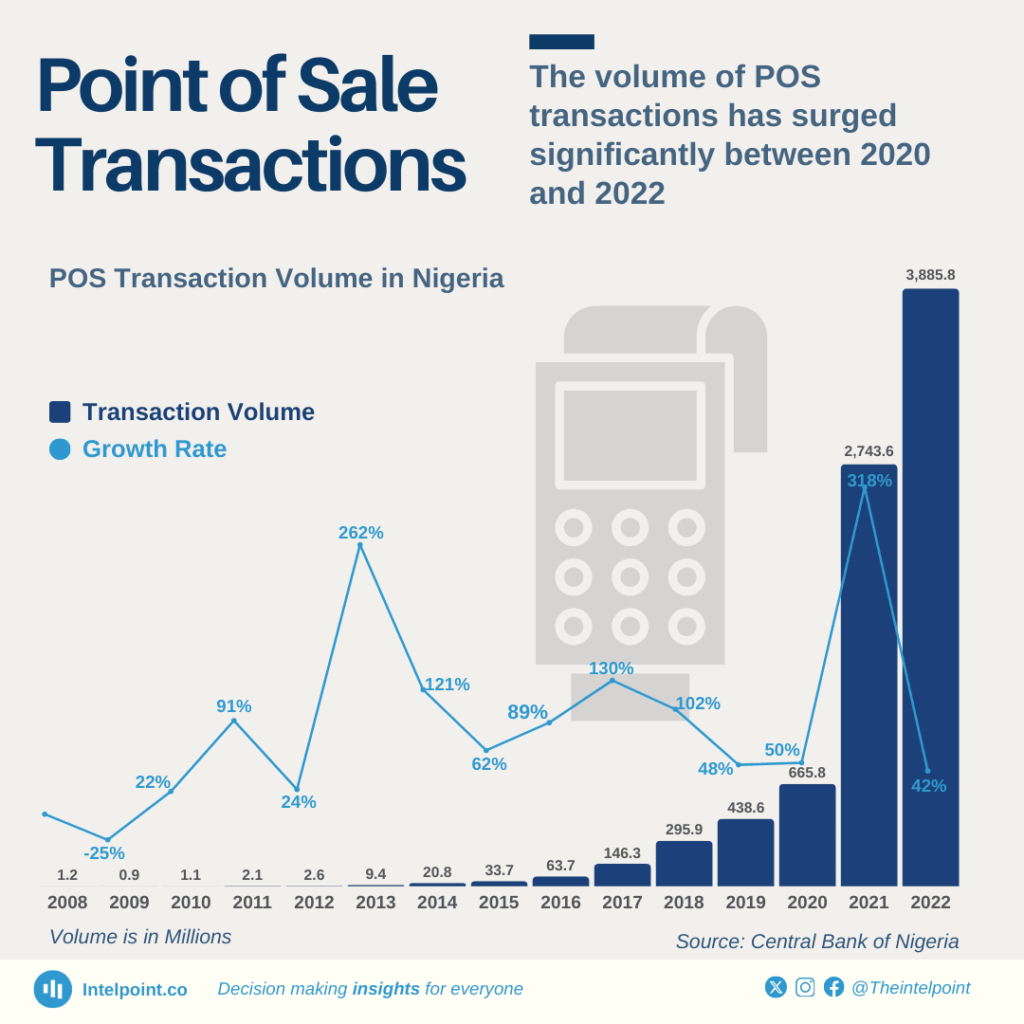

- The volume of POS transactions in Nigeria soared from less than 100 million in 2016 to nearly 4 billion in 2022.

- POS transactions grew by 318% between 2020 and 2021, the highest since 2013.

The state of ATMs in Nigeria

ATMs have long been a crucial component of Nigeria’s banking system, allowing customers to withdraw cash and perform basic transactions. However, data suggests that growth in ATM deployment has slowed. According to the CBN, the number of ATMs in the country stood at 9,640 in 2010, growing steadily to 15,935 in 2014, a 65% increase.

From 2016, the increase in the number of ATM terminals deployed moved from double-digit annual increases to single-digit increases, indicating a slowdown in the rate of expansion — from 2010 to 2015, 6,448 ATMs were added, more than double the 3,027 ATMs added between 2015 and 2022. Between January and June 2024, ATM transaction values dropped by 19.87% year-on-year, totalling ₦12.21 trillion, down from ₦14.63 trillion during the same period in 2023.

Several challenges contribute to this, including the CBN's policy changes. The CBN restricted banks from deploying ATMs outside their branches in 2009, licensing independent ATM deployers to undertake the task. By 2011, it reversed its decision, allowing banks and IADs to deploy ATMs in public places. Between 2012 and 2025, the CBN has adjusted ATM transaction charges five times to incentivise the usage and deployment of ATMs. The CBN's agent banking policy contributed to the growth in agent banking, with POS agents at every street corner.

The POS agent boom

In stark contrast, POS terminals have experienced exponential growth, offering services such as withdrawals, deposits, bill payments, and transfers. The volume of POS transactions in Nigeria soared from less than 100 million in 2016 to nearly four billion in 2022, indicating a significant shift in consumer behavior.

This surge happened because more businesses are now comfortable with digital payments and the CBN's agent banking framework introduced in 2013 allowed businesses to double as agent banks. As they are closer to Nigerians, POS agents offer convenience and accessibility, especially in areas where traditional banking infrastructure is sparse. Unlike ATMs that cannot be deployed by any financial institution, POS terminals are cheaper and are deployed by both banks and fintech startups alike, accelerating adoption.

Conclusion

ATMs and POS agents exist side by side in providing Nigerians with access to cash and other transactions, contributing to a transformative period in Nigeria's financial sector. Frequent network downtime, security concerns, and cash shortages have further eroded public confidence in ATMs, making POS agents a more reliable option in many cases. While ATMs maintain their relevance, their growth has plateaued, whereas POS transactions have experienced a meteoric rise driven by convenience, supportive policies, and evolving consumer preferences.