Nigeria has 39.65 million small businesses. Yes, you heard right. Thirty-nine point six five million Micro, Small, and Medium Enterprises (MSMEs) are operating across the country.

These businesses are everywhere, and you see them too. They're the roadside food vendor in your junction, the fashion designer in Uyo, the tech startup in Lagos, and the farmers up North. Together, they account for 46.32% of Nigeria's GDP and employ 87.9% of the workforce.

But running a small business in Nigeria isn't easy. At all.

This article breaks down what's really happening with Nigerian MSMEs. You'll see how they're funding operations, how much revenue they're generating, what challenges keep them up at night, and what they actually need to thrive.

All the data here comes from fresh research covering businesses across Nigeria's six geopolitical zones.

Download the full MSMEs in Nigeria report to see every data point and graph.

Key takeaways

- 51.1% of Nigerian entrepreneurs fund their businesses from personal savings, while bank loans account for only 15.7% of business financing

- Average monthly revenue across all MSMEs is ₦1.9 million, but this varies dramatically by region, education level, and sector

- The South West dominates in revenue generation, with Osun State businesses averaging ₦47.82 million monthly compared to ₦52,000 in states like Kano

- Only 25.1% of businesses have benefited from government support programs, with access limited by complex processes and a lack of transparency

- 48.9% of business owners say inflation is their biggest concern for 2025, far ahead of insecurity, foreign exchange rates, or infrastructure

- 69% of entrepreneurs expect their businesses to perform significantly better in 2025 despite current economic headwinds

- Manufacturing leads in revenue with an average of ₦8.27 million monthly, while marketing and advertising businesses average just ₦191,000

- Female entrepreneurs are accessing bank loans less than their male counterparts at 9.7% vs 17.3%, relying more on family support instead

Who's running these businesses?

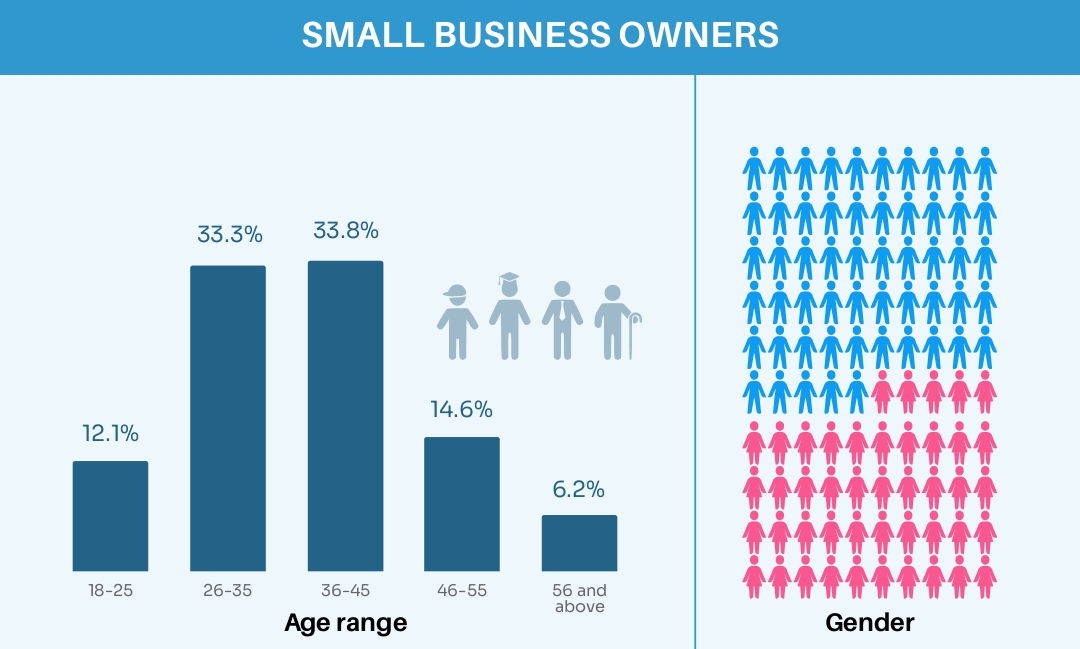

Most Nigerian business owners are between 26 and 45 years old. This age group makes up 67.1% of all entrepreneurs surveyed. Young people aged 18-25 account for just 12.1%, while those aged 56 and above account for 6.2%.

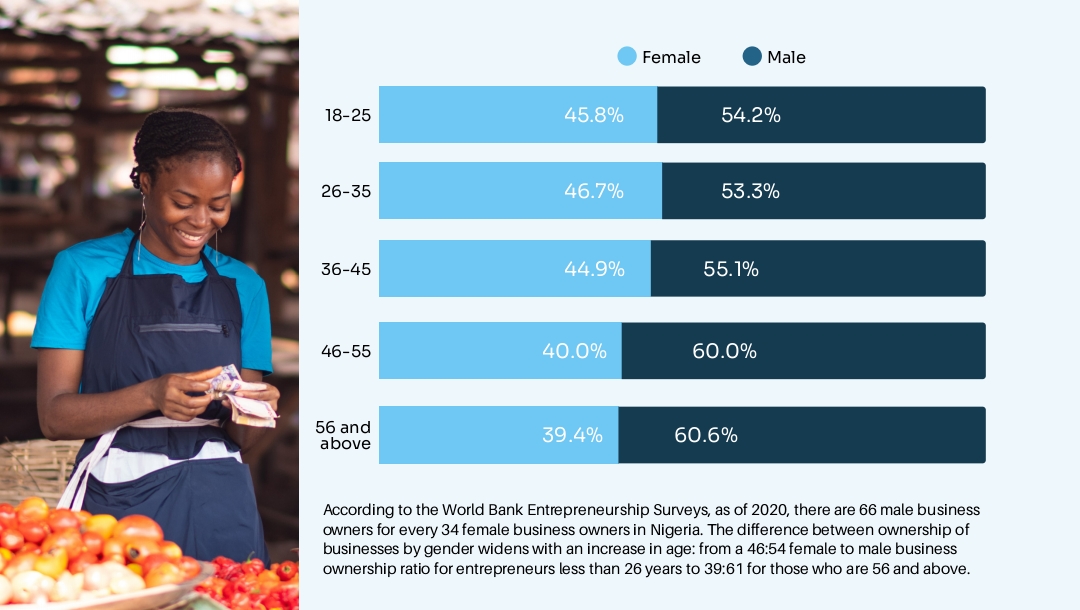

The gender gap widens with age. Among entrepreneurs under 26, women own 46.7% of businesses. But for those 56 and above, women own only 39.4% of businesses. The ratio shifts from nearly equal at younger ages to a clear male majority in older age groups.

Education levels vary widely among business owners. About 32.3% hold an HND or BSc degree, while 25.35% hold a postgraduate degree. But 22.85% have only SSCE/WAEC, and 2.4% have no formal education.

This tells you something important about Nigerian entrepreneurship. You don't need a degree to start a business. But as we'll see later, education does affect how much money businesses make.

How long have these businesses been running?

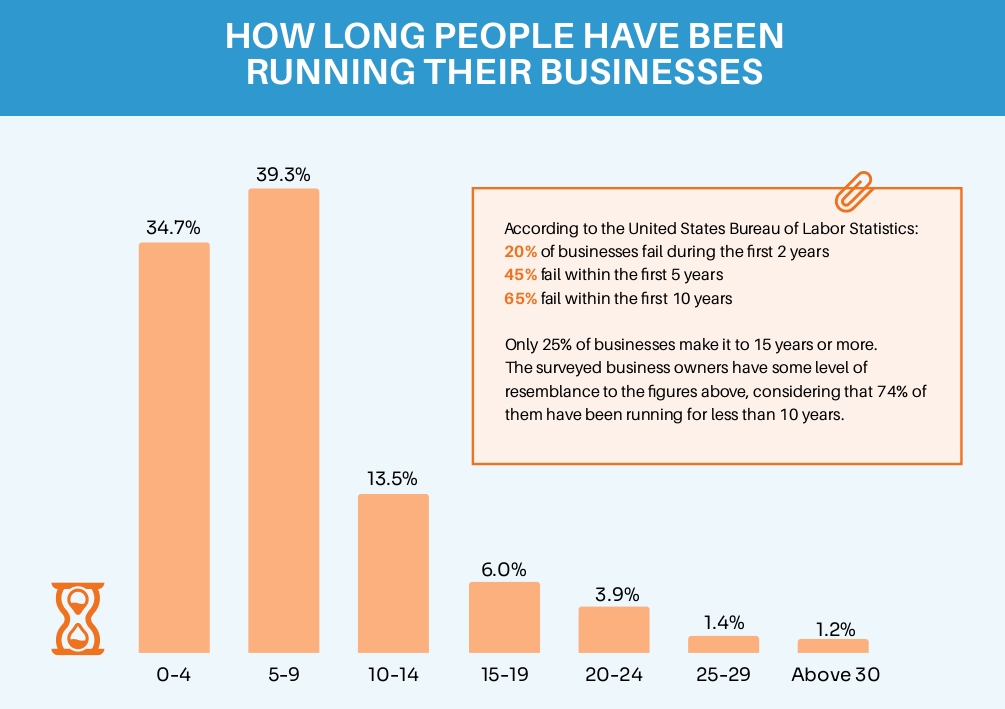

Most Nigerian small businesses are young. Very young. 74% of the businesses surveyed have been operating for less than 10 years.

About 34.7% have been running for 0-4 years, while 39.3% have been around for 5-9 years. This matches what happens globally. According to the US Bureau of Labor Statistics, 45% of businesses fail within the first 5 years. Only 25% reach 15 years or more.

Employee count shows how small most of these businesses really are. 92.3% have 9 or fewer employees.

In fact, 19.2% have no employees beyond the owner and perform all tasks themselves.

Where's the money coming from?

51.1% of Nigerian entrepreneurs are funding their businesses solely from personal savings. More than half of all business owners are reaching into their own pockets right now. They're not getting bank loans or attracting investors.

The full breakdown shows personal savings at 51.1%, support from friends and family at 16.9%, bank loans at 15.7%, investors at 9.7%, and government grants at 6.6%.

In 2023, commercial banks gave out ₦39.29 trillion in credit. But small businesses received only 1.07% of that, amounting to just ₦465.37 billion. There's a ₦13 trillion credit gap for Nigerian MSMEs.

Does gender affect business financing?

Yes, significantly. Both male and female entrepreneurs rely on personal savings at approximately 51%. However, the differences become clear thereafter.

| Source of Finance | Female (%) | Male (%) |

| Personal Savings | 51.5 | 50.8 |

| Friends and Family | 19.3 | 13.7 |

| Bank Loans | 9.7 | 17.3 |

| Investors | 15.0 | 9.8 |

| Government Grants | 5.6 | 7.3 |

19.3% of female entrepreneurs receive support from friends and family, compared to 13.7% of male entrepreneurs. Women lean more on their networks. However, the critical gap appears in bank loans: 17.3% of male entrepreneurs access them, whereas only 9.7% of female entrepreneurs do.

Research shows that female entrepreneurs are 10% less likely to be granted startup loans. Government grants also favor men, at 7.3%, compared with 5.6% for women.

Regional differences in financing

Nigeria isn't one country when it comes to business finance. The South West has the best access to bank loans, as 69% of commercial bank branches are in the South, with Lagos accounting for 42% of those branches.

The South East relies most heavily on family networks at 20.5%, the highest among regions. Meanwhile, the North generally lags in access to bank loans across all three zones.

How much are these businesses making?

The average monthly revenue across all Nigerian MSMEs is ₦1.9 million. But averages don't tell the full story because there's massive variation across sectors, regions, and business sizes.

48.8% of businesses make less than ₦100,000 per month. Almost half operate at that level. These are survival businesses, not growth businesses. Meanwhile, 0.4% earn ₦100 million or more per month, and all are in the South West region of the country.

| Monthly Revenue Range | % of Businesses |

| Less than ₦100k | 48.8% |

| ₦100k - ₦199.9k | 19.5% |

| ₦200k - ₦299.9k | 9.3% |

| ₦500k - ₦999.9k | 6% |

| ₦1m - ₦4.99m | 5.4% |

| ₦100m and above | 0.4% |

Education and revenue connection

Business owners with postgraduate degrees make an average of ₦3.02 million per month. Those with HND/BSc degrees make ₦2.7 million. However, when restricted to SSCE/WAEC, the average falls to ₦653,000.

Business owners with no formal education earn an average of ₦243,000 per month. The pattern is clear: higher education generally means higher revenue, though there are exceptions.

The regional revenue gap

South West businesses average ₦8.3 million per month, while North Central businesses average ₦241,000 per month. That's a 34 times difference.

| Region | Average Monthly Revenue |

| South West | ₦8.3 million |

| South South | ₦831,000 |

| South East | ₦605,000 |

| North East | ₦562,000 |

| North West | ₦479,000 |

| North Central | ₦241,000 |

Osun State dominates, with a k-average of ₦47.82 million. The next highest is Rivers State at ₦3.7 million, which represents a 12-fold difference. At the bottom, you find Kano at ₦52,000 per month, Cross River at ₦47,000, and Plateau at ₦58,000.

Infrastructure, market access, and proximity to commercial hubs drive these differences. States with better road networks, more reliable power supply, and stronger banking presence tend to have businesses with higher revenues. The concentration of commercial activities in Lagos and the South West generally creates a multiplier effect, whereby businesses benefit from larger customer bases and improved supply chains.

Other top-performing states include Kaduna at ₦1.988 million, Bauchi at ₦ 1.8 million, and Abia at ₦1.4 million. These states show that success is possible outside Osun, though the gap remains significant. The lowest-performing states, including Kano, Cross River, and Plateau, face challenges with infrastructure, market access, and limited availability of financial services.

Which industries make the most money?

Manufacturing wins by a significant margin. Manufacturing businesses average ₦8.27 million per month. Healthcare comes in second at ₦5.02 million, followed by transportation at ₦3.7 million and entertainment at ₦2.8 million.

Food and beverages, the industry with the largest share of businesses, averages only ₦440,000 in monthly revenue. It's popular but not particularly profitable. Marketing and advertising sit at the bottom, with a monthly cost of ₦191,000.

Does business age guarantee success?

There's no clear correlation between how long a business has been running and its monthly revenue. This might surprise you. Businesses that have been around for 15-19 years earn the most, averaging ₦4.3 million. But businesses operating for 25-29 years average only ₦2 million monthly.

Young businesses aged 0-4 years average ₦705,000. That's fewer than businesses in their second decade but more than those past 20 years. Longevity doesn't equal success. Adaptation, market positioning, and smart management matter more than just staying open for a long time.

| Sector | Average Monthly Revenue |

| Manufacturing | ₦8.27 million |

| Healthcare | ₦5.02 million |

| Transportation | ₦3.7 million |

| Food & Beverages | ₦320,000 |

| Marketing & Advertising | ₦191,000 |

How do business owners feel about their finances?

Despite everything that happened in 2024, including inflation, the naira devaluation, and the removal of the fuel subsidy, most business owners are surprisingly positive. 58.1% rate their business's financial health as excellent or good. Only 9.1% say it's poor or very poor.

This optimism varies by region. The South West is most positive, with 61% rating their finances as excellent or good. The North East is the least optimistic at 35.2%. This tells you something about Nigerian entrepreneurs and their resilience. They're facing real challenges, but they're not giving up.

What are the biggest challenges?

The high cost of doing business ranks first at 19.4%. This is entirely reasonable given recent events. The 2023 removal of fuel subsidies increased transportation costs. Naira devaluation increased import costs. Inflation was projected to reach 33.99% in some 2025 projections.

Access to finance comes second at 15.4%, followed by inconsistent power supply at 14.1%. Nigeria's national grid collapsed 12 times in 2024. Manufacturers spent ₦1.11 trillion on alternative energy sources, up from ₦781.68 million in 2023.

Competition ranks 12.7%, insecurity 12.3%, inadequate infrastructure 10.1%, regulatory hurdles 8.7%, and lack of skilled labor 7.3%. Nigeria has a 79.5% labor force participation rate, so finding workers isn't the problem. Finding customers and staying profitable is.

What happened in 2024 and what's expected in 2025?

Most business owners are optimistic about 2025. 69% expect their businesses to perform significantly better by the end of 2025. Only 4.3% expect conditions to worsen significantly.

This optimism is highest in the South at around 70-75% and lowest in the North at around 63-65%. Businesses that did well in 2024 expect to do even better in 2025. Of those who rated 2024 as excellent, 88.9% expect significant improvement.

Even among businesses that rated their performance as poor in 2024, 58.4% still expect to do significantly better in 2025. That shows Nigerian entrepreneurial spirit.

What are businesses planning for 2025?

Top goals include improving profitability by 22.7%, expanding operations by 19.9%, increasing revenue by 17.5%, securing additional finance by 14.4%, reducing costs by 14%, and reducing debt by 11.5%.

To achieve these goals, 38% plan to explore new markets and opportunities, which entails identifying new customer segments or geographic areas. Another 34.1% will add more products or services to diversify their revenue streams. Meanwhile, 27.9% will work to reduce operational costs through greater efficiency and waste reduction. These are practical and achievable strategies that don't require massive capital investments.

What worries business owners most about 2025?

Inflation dominates at 48.9%. Nearly half of all business owners say this is their primary concern. Foreign exchange rate, insecurity, government policies, and inadequate infrastructure account for 17.1%, 15.6%, 10%, and 8.4%, respectively.

Insecurity is a bigger concern in the North. 24.4% of businesses in the North Central region are most concerned about it, compared to just 7.6% in the South East. This regional variation reflects the different security challenges facing different parts of the country.

The government support gap

Only 25.1% of businesses have benefited from government support programs. That means 74.9% haven't received any help at all.

Of those who received support, 41.1% received grants, 22.1% participated in training programs, 16% obtained loans, 13.8% benefited from tax breaks, and 6.9% received subsidies.

Why is access so low? Business owners point to complex application processes, limited awareness of available support, inefficient bureaucracy, lack of transparency, and favoritism.

When asked what they want from the government, entrepreneurs are clear. They want access to affordable business finance, reduced tax burden, improved infrastructure, skills development programs, and reduced bureaucracy. They also want faster processing of permits and licenses, as well as more transparent and accountable government officials.

Top financial concerns for 2025

The rising cost of goods and services is cited by 41.1% of business owners. Economic uncertainty accounts for 23.4%, difficulty in accessing credit 17.3%, rising interest rates 14.3%, and increased competition 3.9%.

The cost of goods and services has been rising over the last decade, with the biggest spike happening between 2023 and 2024. Regarding difficulties in obtaining loans, the International Finance Corporation estimated unmet credit demand for Nigerian MSMEs at ₦13 trillion as of 2022. This massive gap shows just how underserved small businesses are by the formal financial system.

How government policies are affecting businesses

58% of businesses say recent government policies have had no significant impact on their operations. Among those affected, 25.4% report a positive impact, while 16.5% report a negative impact.

The South West is most positive about government policies, with 22.6% reporting a positive impact. The North West is the least positive region, with only 11.9% reporting that policies are helping their businesses. This reflects the regional infrastructure and support gaps throughout the data.

What this means for Nigerian MSMEs

Nigerian MSMEs are surviving, and some are thriving. But they're doing it mostly on their own. Personal savings funds account for half of all businesses, whereas government support reaches only one in four. Women face bigger barriers than men, and the North lags behind the South in almost every metric.

Yet entrepreneurs remain optimistic, with 69% expecting improved performance in 2025 despite inflation, exchange-rate challenges, and infrastructure constraints.

For Nigerian MSMEs to unlock their full potential, systemic changes are needed. Better access to finance can help close the ₦13 trillion credit gap. Reduced regional inequality means Osun shouldn't be 34 times as wealthy as other states. Simplified government support is necessary when only 25% of the population can access assistance. Gender equity in lending requires that women shouldn't be 10% less likely to get loans.

Want to see all the charts, regional breakdowns, and sector-specific data? Download the free, complete MSMEs in Nigeria report for the full analysis.