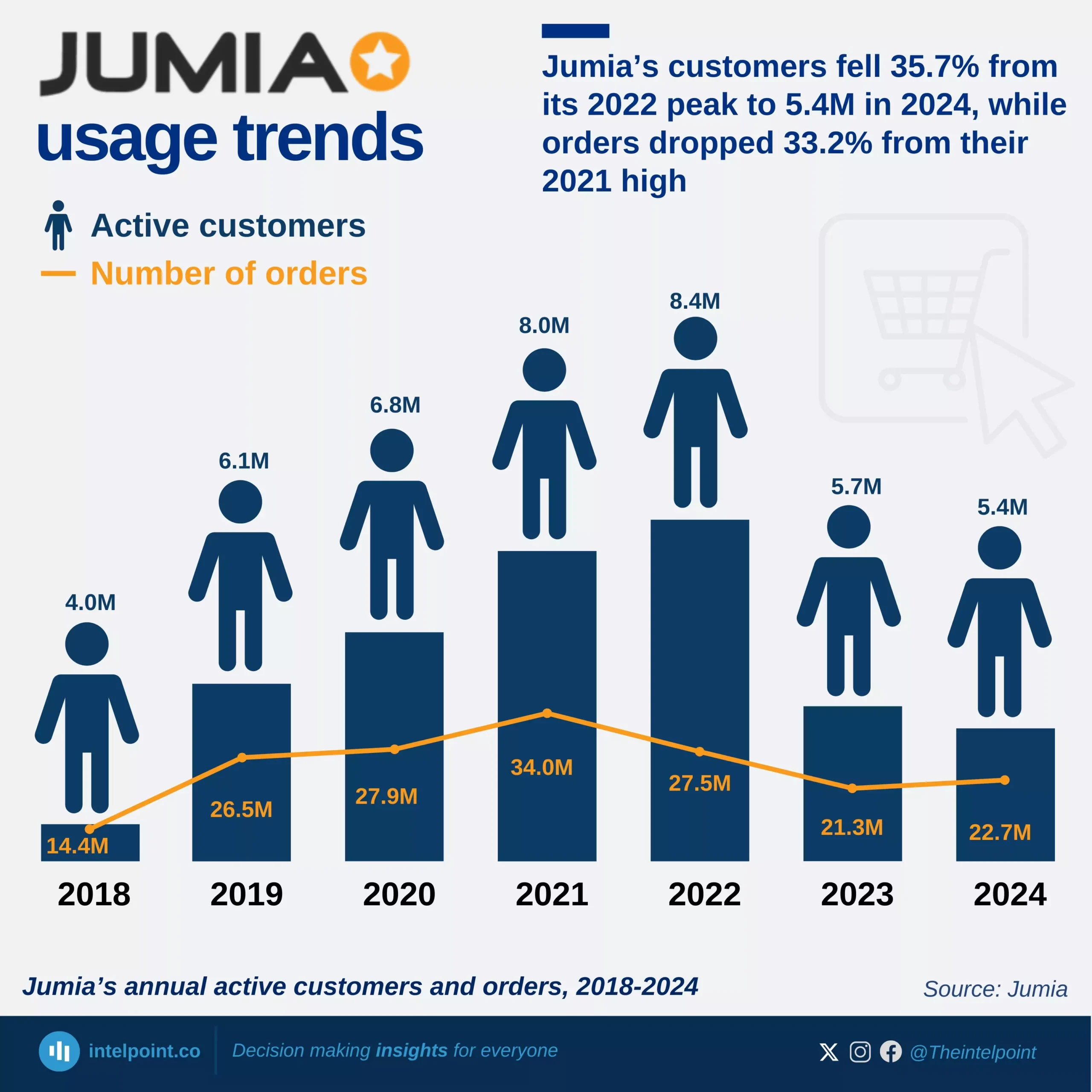

The Gross Merchandise Value (GMV), a key metric for measuring sales volume and evaluating Jumia’s growth and market performance, has experienced a significant downward trend in recent years. After peaking at $1.15 billion in 2019, GMV has steadily declined, with a sharp drop beginning in 2022. In 2023, GMV fell by 26.5% to $749 million, and the decline continued into 2024, reaching $720 million, its lowest level in six years. This represents a 37.6% decrease from the 2019 peak. The decline has been largely attributed to foreign exchange depreciation, as most of Jumia’s operating markets saw their local currencies weaken significantly against the US dollar, particularly in Nigeria, its largest market. This currency pressure, combined with macroeconomic challenges, has eroded the value of transactions despite Jumia’s efforts to maintain platform activity.

Temu has embarked on an extraordinary global expansion, cementing its place as a leading e-commerce platform across multiple markets. From its launch in the US in 2022, Temu has quickly become one of the most downloaded shopping apps in the country.

However, Temu's rapid rise has not been without its challenges. Regulators in the EU, US, and South Korea have closely scrutinised the company, examining potential links to labour issues, data protection concerns, and intellectual property violations. Despite these hurdles, Temu has continued to forge ahead, becoming Meta's top advertiser for the year and making a splash with its second Super Bowl campaign in 2024. As Temu expands into new regions, the company must navigate an evolving regulatory landscape to maintain its momentum and solidify its position as a global e-commerce powerhouse.

Jumia Group has recorded $1b in losses since listing on the New York Stock Exchange in 2019. The eCommerce giant also recorded its highest yearly loss in 2019. In recent years, Jumia Group has shut down some of its businesses across Africa, thus recording its lowest loss over seven years in 2023.