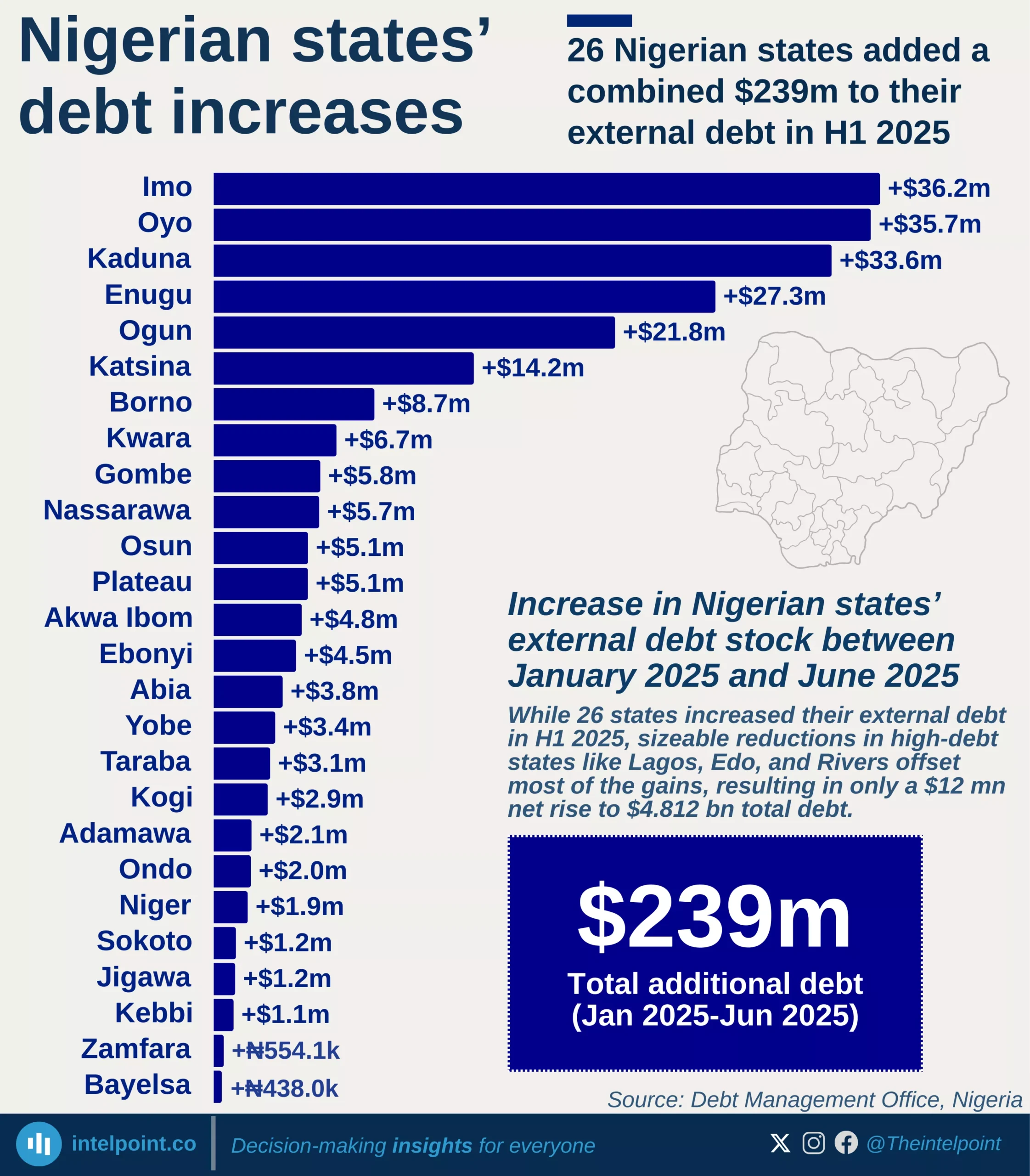

In Q2 2025, Enugu State emerged as the South-East’s most indebted subnational government with a domestic debt stock of ₦180.5 billion, a figure that is over 11 times higher than that of Ebonyi (₦15.8 billion), the region’s least indebted state. Imo State, with ₦97.9 billion, trailed Enugu significantly, while Abia (₦48.6 billion) and Anambra (₦28.1 billion) maintained moderate debt profiles. The combined ₦371 billion regional debt highlights varying fiscal strategies, with Enugu’s heavy borrowing likely tied to infrastructure expansion and governance reforms, while smaller states like Ebonyi continue to pursue leaner fiscal approaches.