Key takeaways:

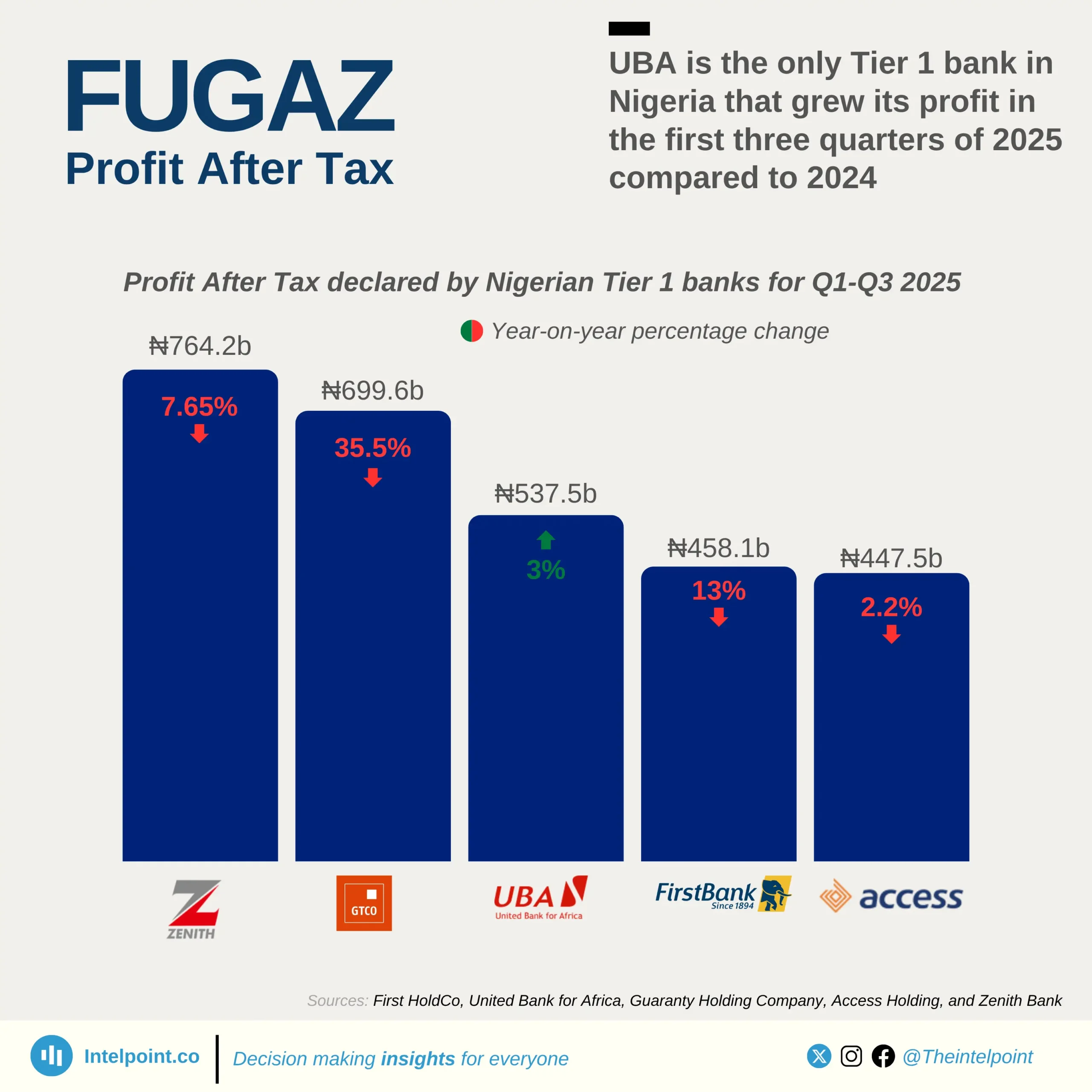

The Nigerian banking sector posted robust financial results in 2024, with the ten most profitable banks collectively reporting a profit after tax (PAT) of ₦5.54 trillion. This marks a significant 53% increase from the ₦3.39 trillion recorded in 2023.

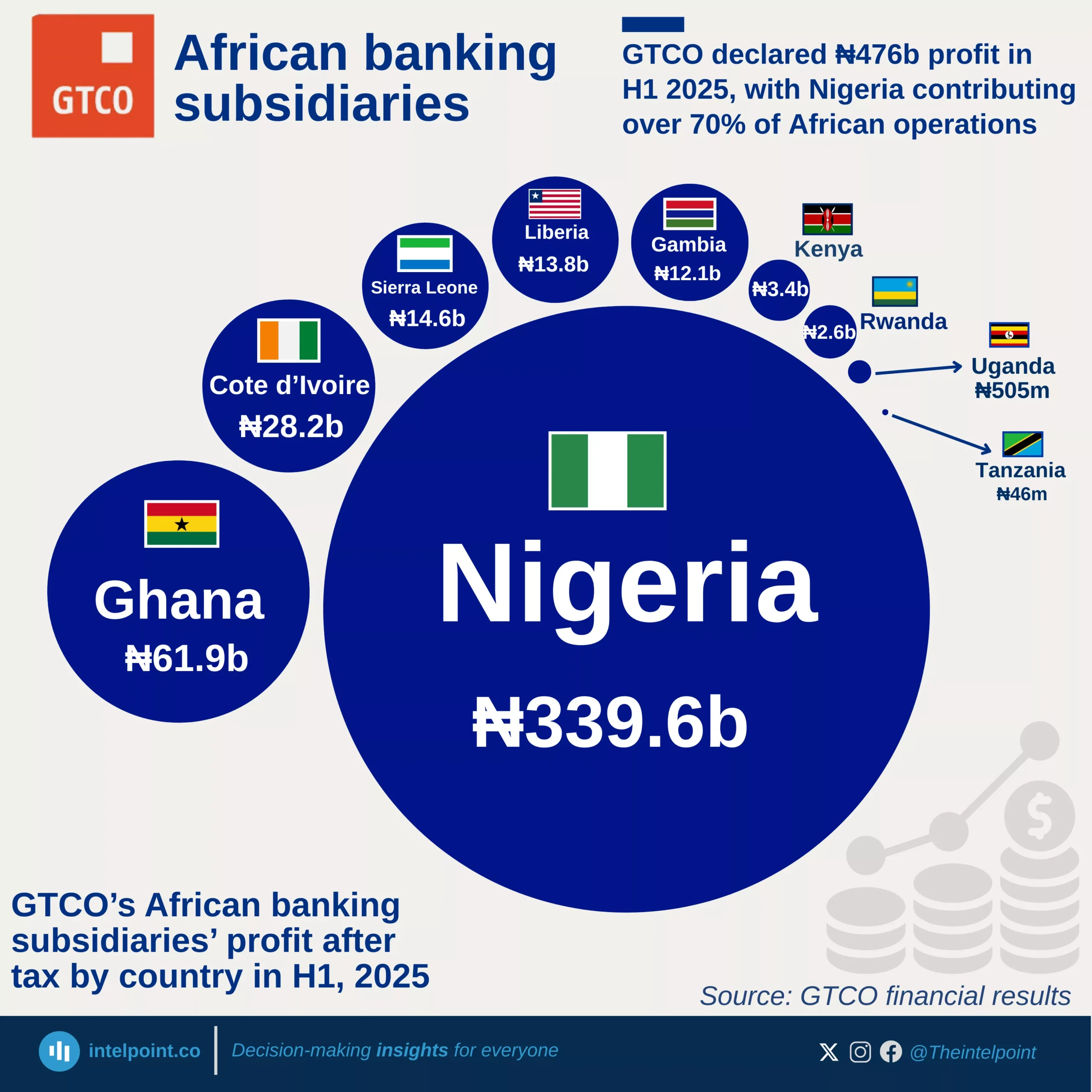

Zenith Bank Plc topped the profitability chart with a PAT of ₦1.03 trillion, closely followed by Guaranty Trust Holding Company, which posted ₦1.02 trillion. United Bank for Africa (UBA) and Ecobank ranked third and fourth with ₦766.6 billion and ₦735.9 billion, respectively. First Holdco Plc and Access Holdings also recorded strong profits, each exceeding ₦600 billion.

Other banks on the top ten list include Fidelity Bank, Stanbic IBTC, Wema Bank, and FCMB Group Plc, with profits ranging from ₦279 billion to ₦73 billion. Notably, FCMB was the only bank on the list to experience a decline in profit compared to the previous year.