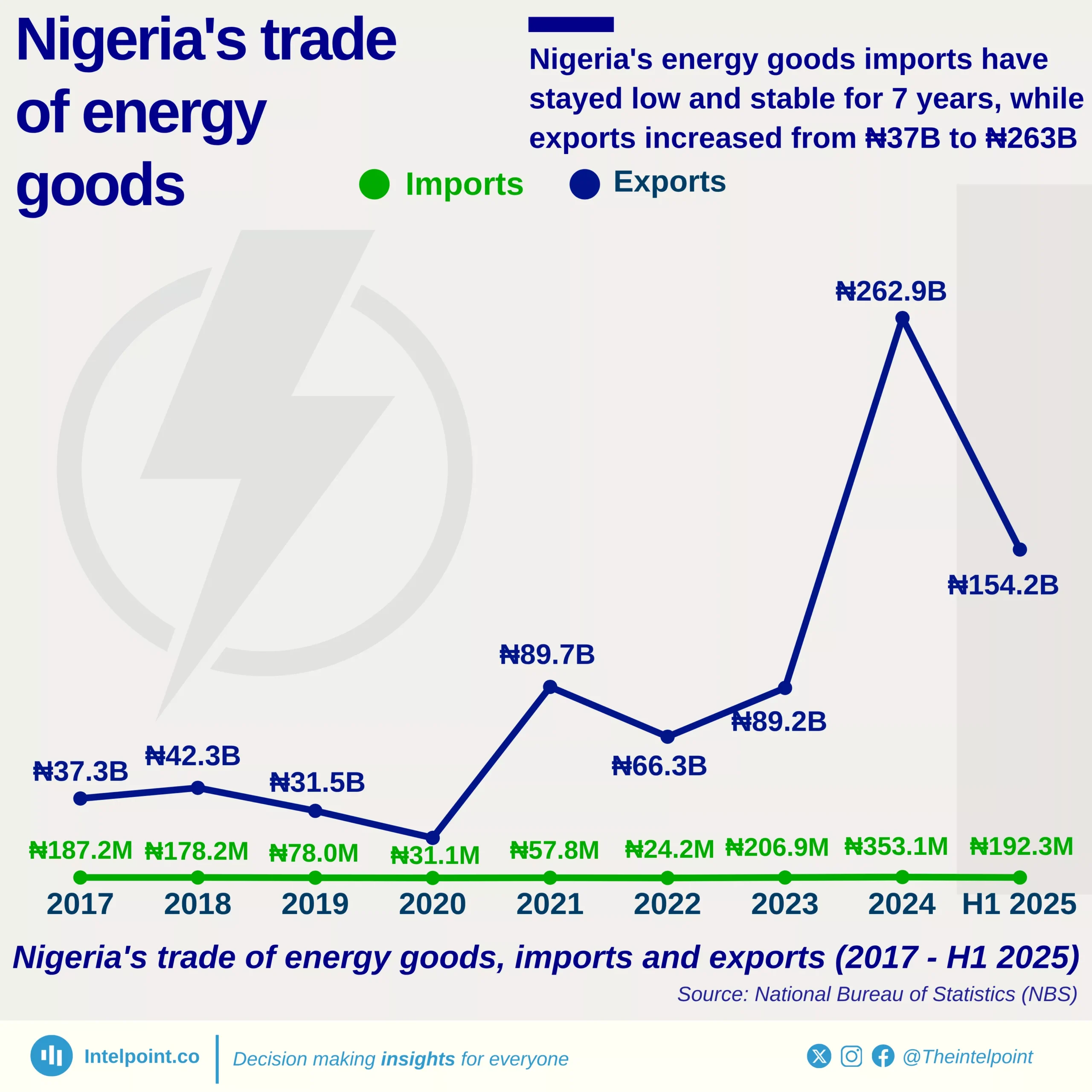

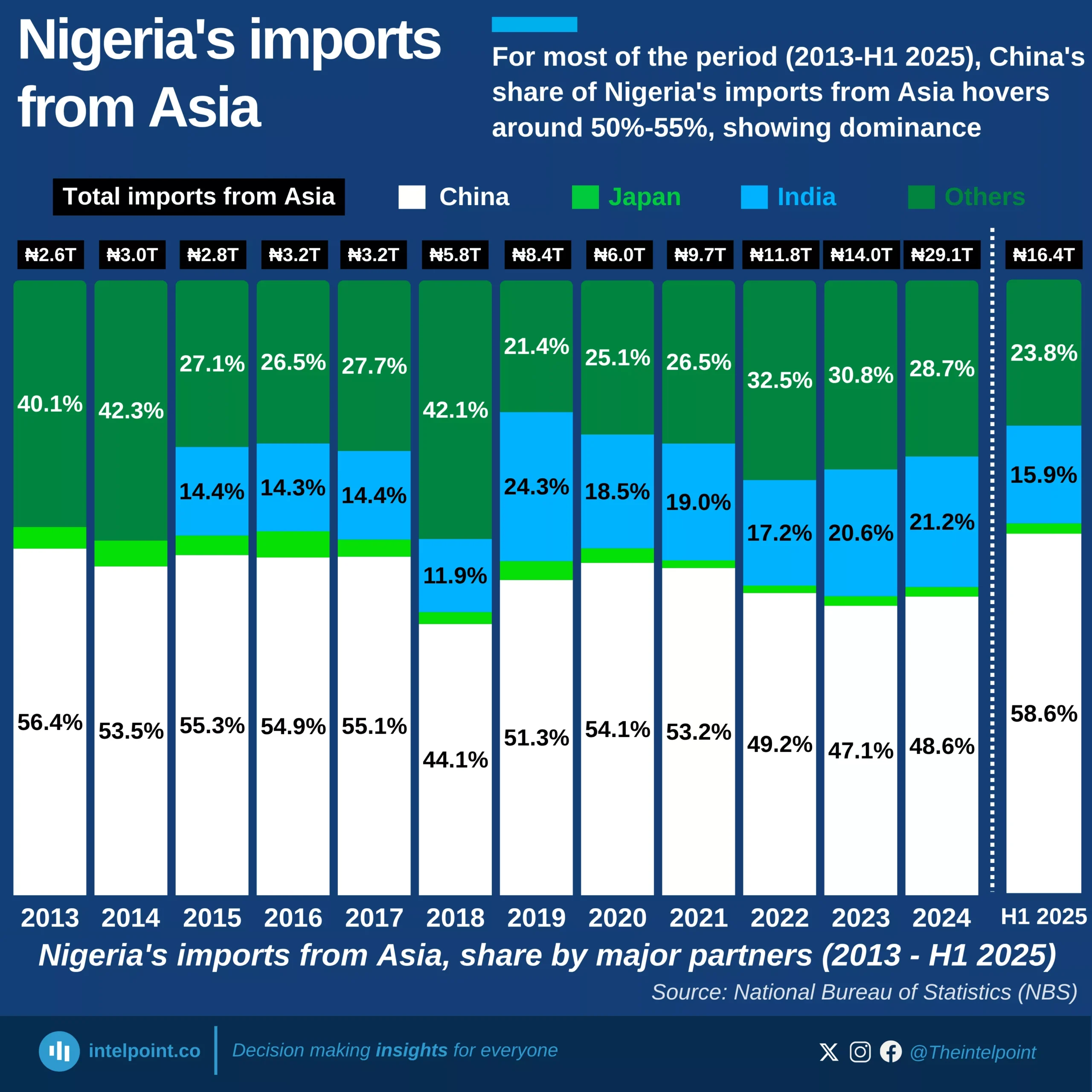

The latest US trade data for the first half of 2025 reveals sharp divergences in how African economies are navigating Trump’s tariff-heavy regime. Egypt and Nigeria emerged as bright spots, recording sizeable surpluses of $2.73 billion and $576 million respectively, thanks to surging exports and softer import growth.

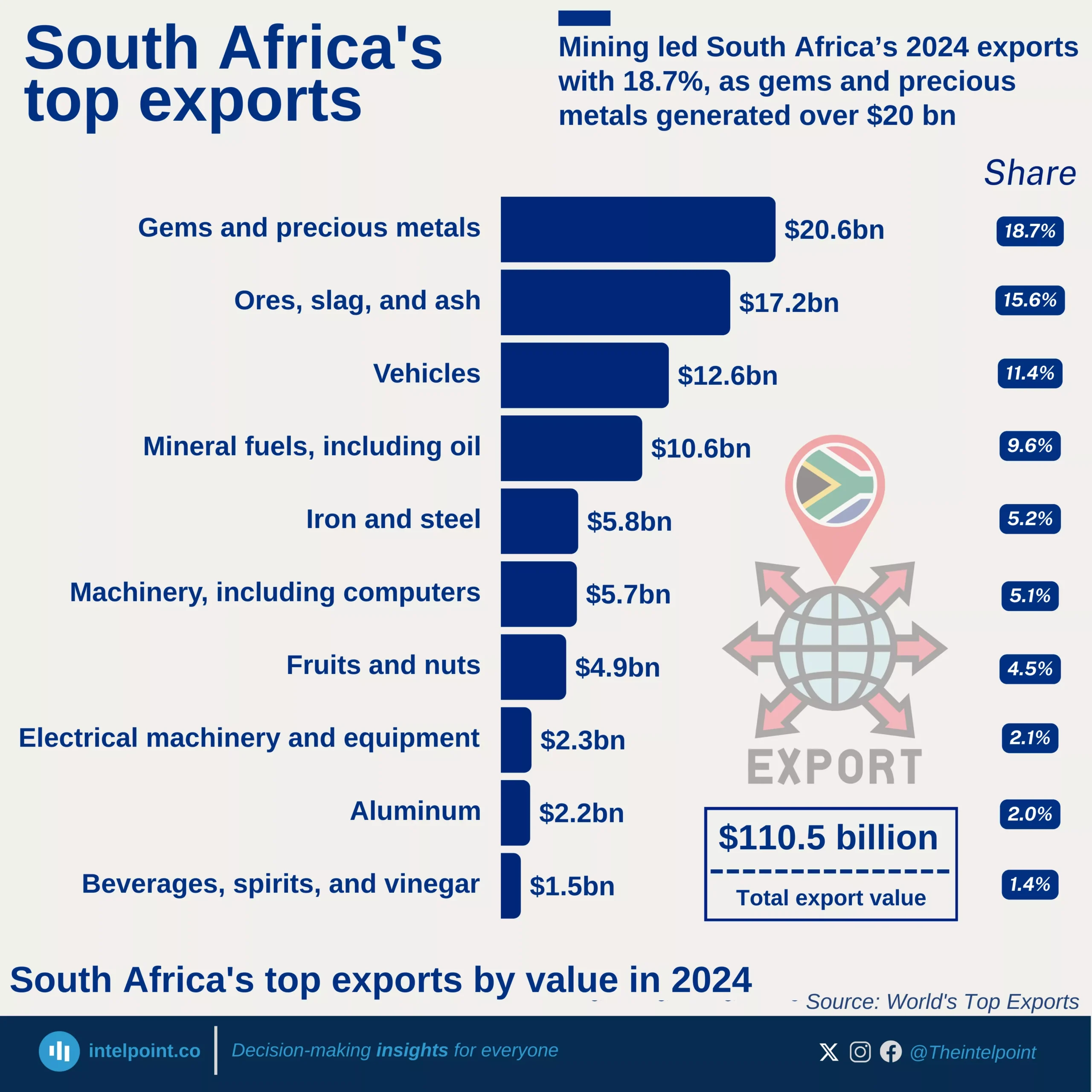

South Africa, however, has become the heaviest drag, with its deficit to the US nearly doubling to $6.32 billion as American imports of South African goods soared far beyond exports. Algeria’s deficit narrowed modestly to $571 million, cushioned by the limited tariff exposure of its oil shipments, while the collective “other Africa” group shifted from a slight surplus to a $108 million deficit.

Taken together, the US posted an overall $3.69 billion trade deficit with Africa in H1 2025, underscoring that while imports from the continent climbed 24% to $23.4 billion, tariffs have reshaped trade balances unevenly across countries.