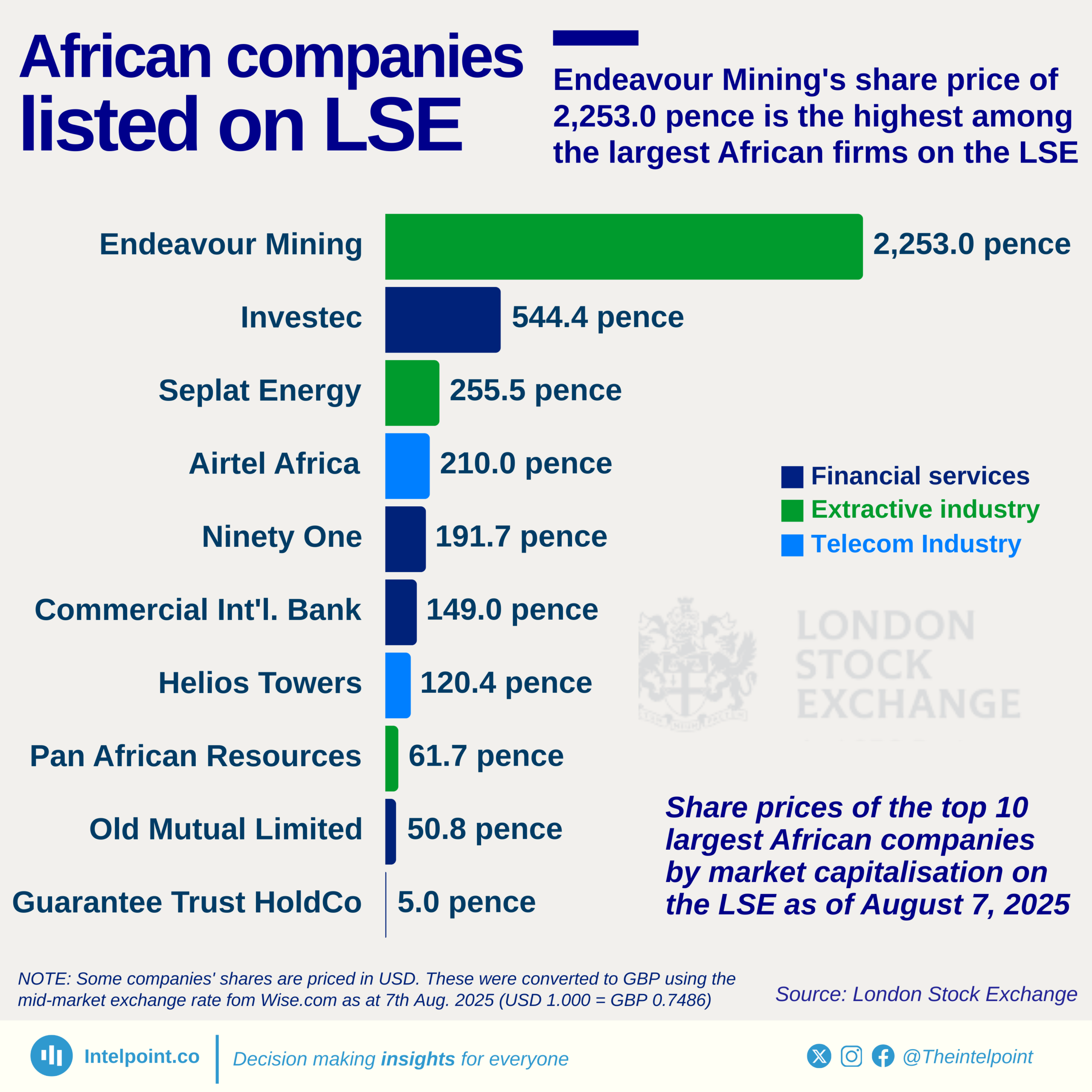

The top 10 African companies listed on the London Stock Exchange (LSE) collectively command a market capitalisation of £29.8 billion. They are led by Airtel Africa at £7.32B, which positions the telecom giant as the most valuable African firm on the LSE, ahead of Endeavour Mining (£5.63B) and Commercial International Bank (£4.27B).

Airtel Africa’s lead mirrors the growing global demand for connectivity and data services, particularly in emerging markets. In many African cities, mobile networks have become as essential as electricity and water, making the company’s commanding market cap easier to understand. The company's dominance also highlights how Africa’s growth story is increasingly driven by digital infrastructure alongside traditional sectors like mining and banking.

Financial services have a strong foothold, with five companies — Commercial International Bank, Investec, Old Mutual Limited, Guarantee Trust HoldCo, and Ninety One — making the top 10. This speaks to the role of African banks and investment firms in driving capital flows and supporting economic development, both domestically and across borders. The extractive industry, represented by companies like Endeavour Mining, Seplat Energy, and Pan African Resources, continues to be a backbone of Africa’s global trade relevance.