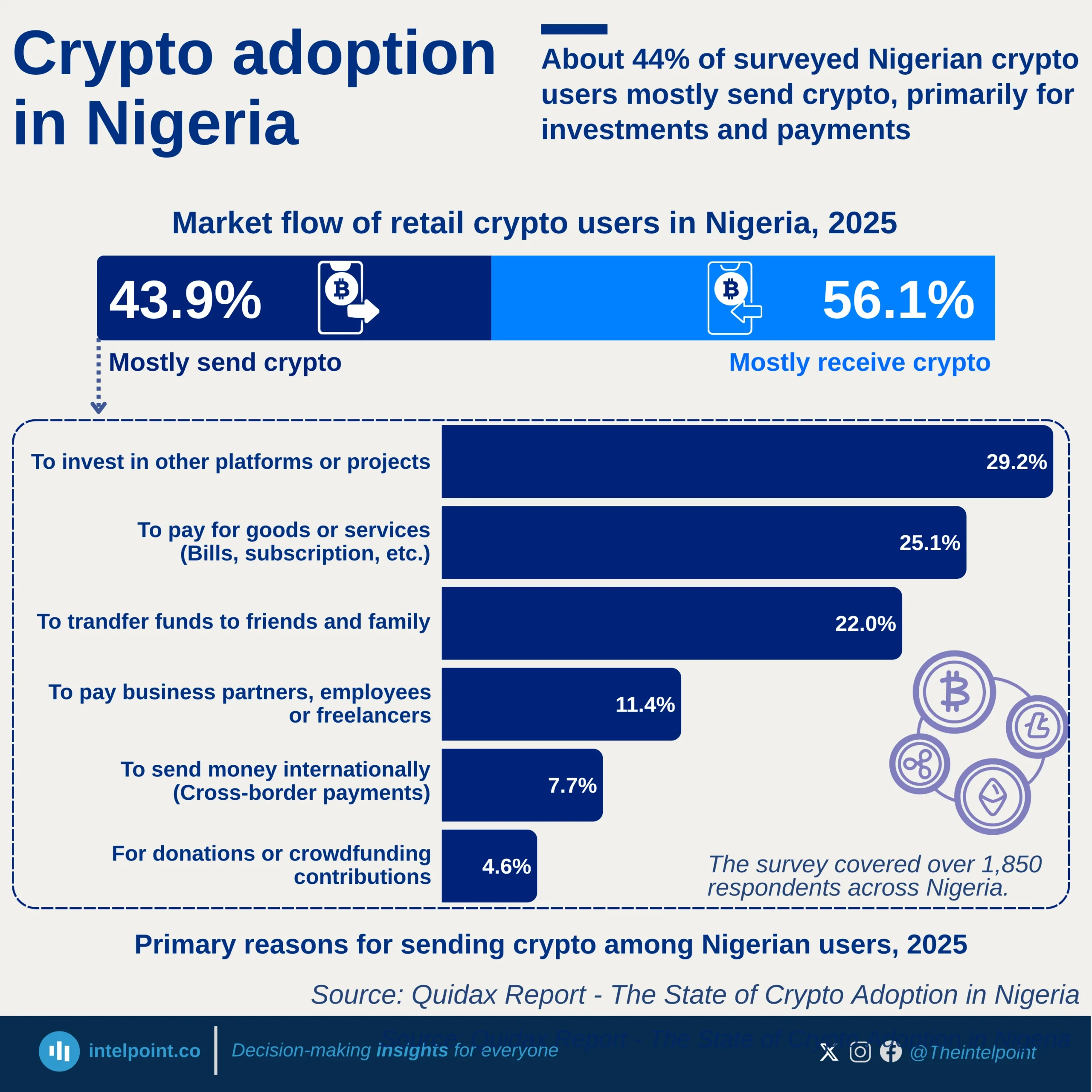

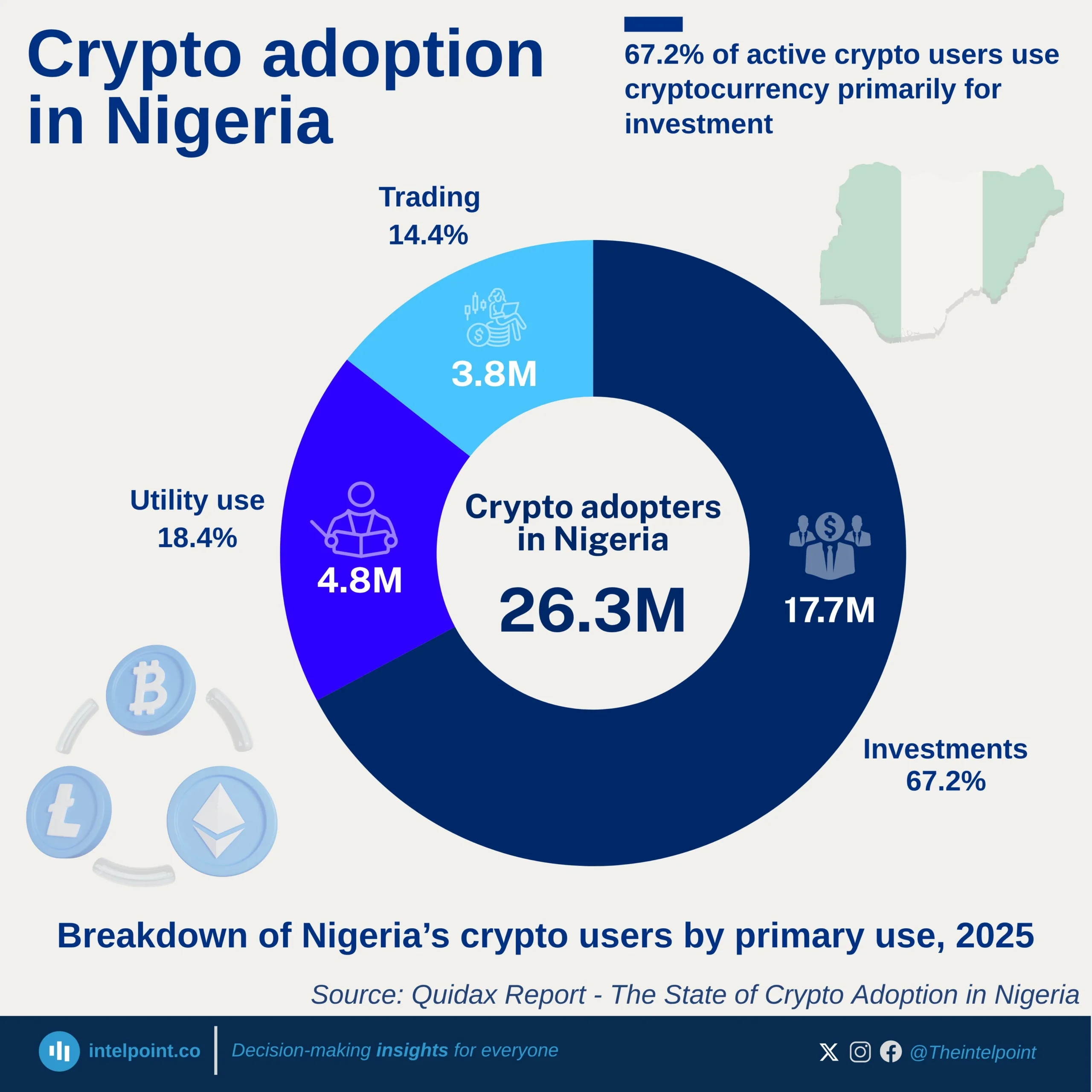

Nigerians are using crypto not just for speculation, but for practical financial movement and stablecoins are at the core of this behavior. With over 38% of all sent transactions denominated in dollar-pegged assets like USDT, USDC, and BUSD, users are clearly hedging against naira volatility while maintaining liquidity across borders. Bitcoin remains the next most common choice, while smaller altcoins, Ethereum, and BNB serve niche roles in trading and network-specific transfers. The trend underscores a maturing retail market where stability, utility, and cost efficiency shape how Nigerians move value through crypto.