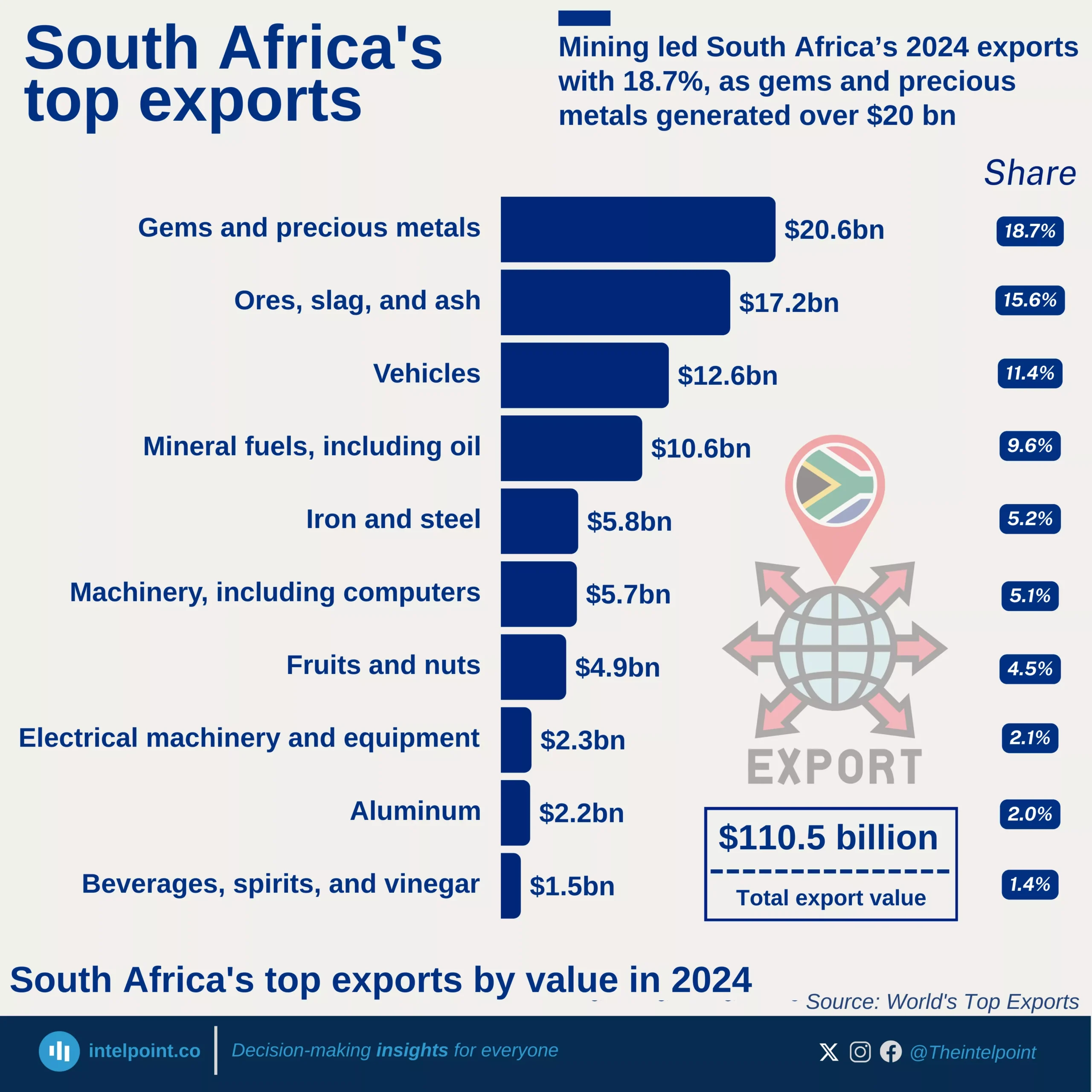

Across Africa, most economies remain heavily tied to raw goods — oil, minerals, and agricultural products — for the bulk of their export revenues. UNCTAD data for 2021–2023 shows that out of 54 countries, only eight managed to keep their dependence below 60%.

These eight are Tunisia, Morocco, Eswatini, Lesotho, Djibouti, Mauritius, Comoros, and Egypt. Their relatively low reliance reflects stronger export diversification, often in manufacturing, services, or re-exports. For instance, North African economies like Tunisia and Morocco benefit from industrial output and trade logistics, while Mauritius and Djibouti rely on services and re-export hubs.

Countries with less dependence on raw goods tend to be less vulnerable to global commodity price swings, giving them more stable revenue bases and resilience in downturns. For much of Africa, however, the dominance of commodities leaves economies exposed, underlining the urgent need for structural diversification.