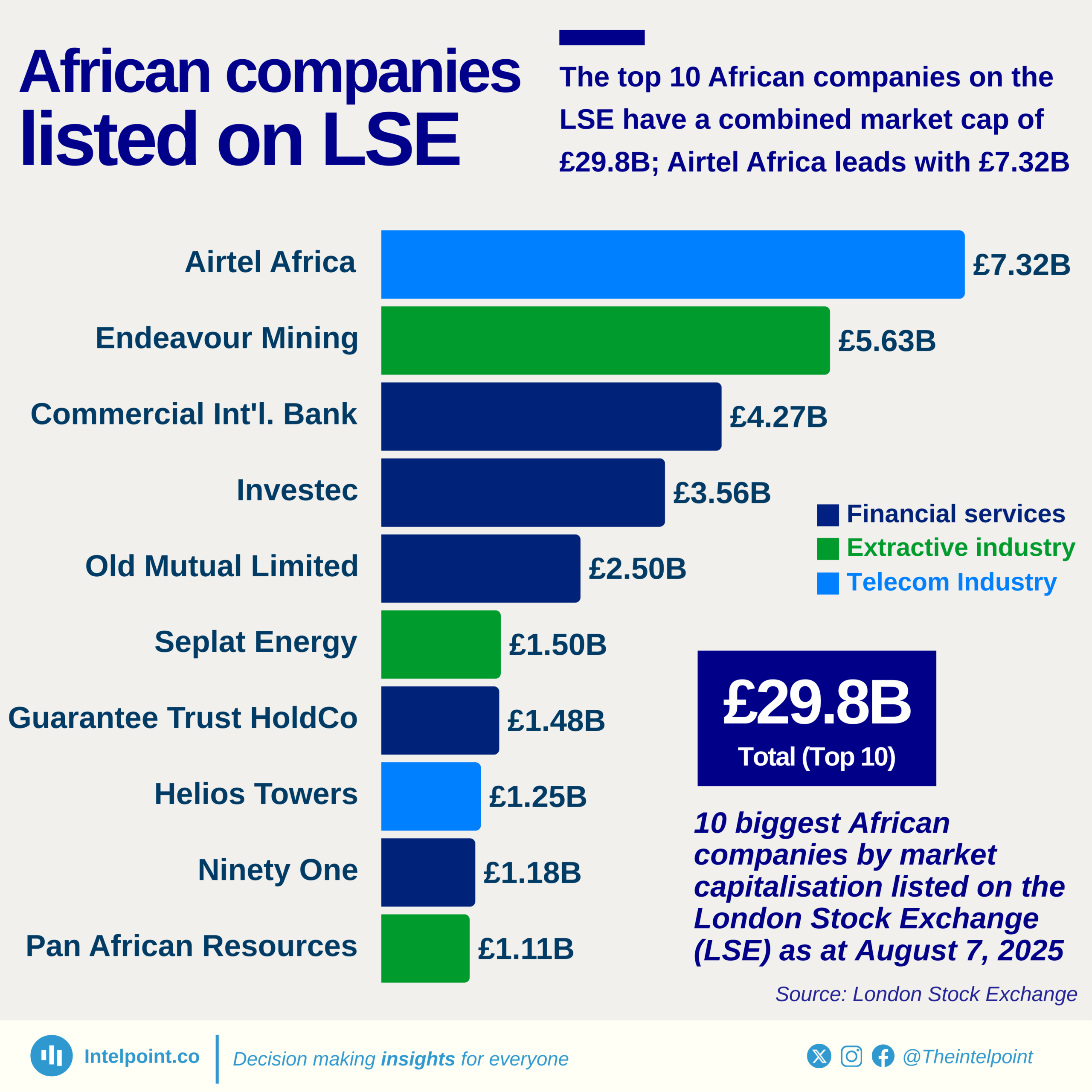

African companies listed on the London Stock Exchange (LSE) show a striking range in share prices, based on the top 10 largest companies by market capitalisation. At 2,253.0 pence, Endeavour Mining’s share price is the highest among the largest African firms on the LSE, significantly outpacing other companies.

There is a diverse representation of industries, from financial services to telecom and extractive sectors. While companies like Investec (544.4 pence) and Seplat Energy (255.5 pence) hold strong positions, others such as Airtel Africa (210.0 pence) and Ninety One (191.7 pence) highlight the contribution of sectors beyond mining.

This distribution of share prices not only highlights the performance of individual companies but also offers a snapshot of Africa’s corporate footprint in international markets. It shows which industries are drawing the highest valuations and where global investors most recognise growth potential.