According to UNCTAD, a country is classified as commodity-dependent if over 60% of its merchandise exports come from commodities such as energy, agriculture, or mining. Over 60% of the countries in Africa are commodity-dependent, underscoring the prevalence of reliance on primary exports.

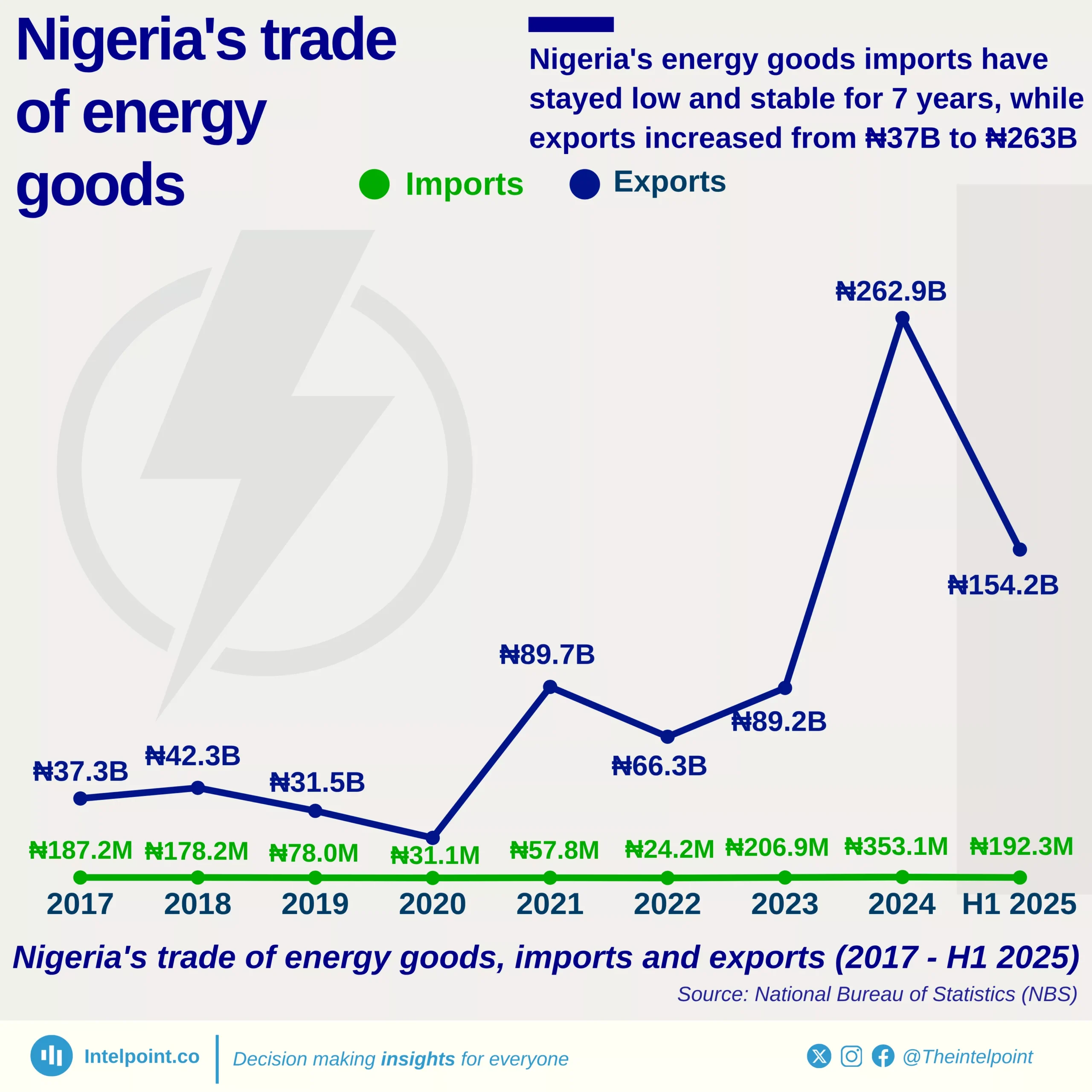

Notably, South Sudan leads the list, with 99.5% of its export revenues derived from commodities, primarily oil (energy/oil - 89.9%, agriculture - 4.6%, mining - 5.0%). Meanwhile, Nigeria’s commodity export dependence is 96.3%, dominated by energy/oil (89.7%), followed by agriculture (4.0%) and mining (2.6%). With energy exports claiming almost nine‑tenths of Nigeria’s trade earnings, the economy remains highly vulnerable to oil price swings. Nigeria’s limited export diversification reflects deep structural challenges, including insufficient value addition in agriculture and mining.

Africa alone accounts for nearly 47% of all commodity-dependent countries globally, highlighting the disproportionate burden borne by the continent. This entrenched dependence undermines resilience, making economies susceptible to external shocks and volatile global markets.

UNCTAD emphasises that value addition and processing raw materials domestically is key to transforming commodity wealth into sustainable development.