The Nigerian insurance industry has grown significantly since 1990.

By Q1 2024, assets were approximately ₦3.3 trillion, up by 36.9% from ₦2.4 trillion in 2023. Gross premium income reached over ₦1 trillion by 2023, up from ₦790 billion by 2022. Gross premium written reached ₦813.1 billion by Q2 2024, up by 72.7% quarter-on-quarter. However, the industry’s penetration ratio remains very low at approximately 0.34% by 2023.

Here’s a detailed table summarising the key trends of the Nigerian Insurance Industry from 1990-2024:

| Period | Key Developments | Key Trends |

| 1990-2000 | The number of insurance companies operating in Nigeria increased during this period. | Both the insurance companies' income and expenditures rose during this time. They rose from 1.59 to 1.81 in 1990, indicating growth. |

| 2001-2010 | Recapitalisation led to a reduction in the number of insurance and reinsurance companies from 104 to 49. | Strengthened financial stability and operational efficiency. |

| 2011-2015 | Adoption of digital platforms for service delivery. | Enhanced accessibility and customer engagement. |

| 2016-2020 | Implementation of new policies for transparency and consumer protection. | The insurance sector expanded by 3.6% in 2019, outpacing the country's economic growth of 2.3%. |

| 2021-2024 | Gross premium income rose by 22.9% to ₦776.5 billion in 2022 and is estimated to have grown by about 30% in 2023 to exceed ₦1 trillion. | The industry showed resilience and adaptability despite macroeconomic challenges. |

Key takeaways

- 1990-2000: Gross premium income of approximately ₦29.5 billion by 103 insurance companies.

- 2001-2010: The insurance market had 104 insurance firms, but that reduced to 49.

- 2011-2015: Insurance coverage reached approximately 0.5 by 2015.

- 2016-2020: The industry expanded by 3.6% in 2019, outpacing overall economic growth.

- 2021-2024: Gross premium income amounted to ₦776.5 billion in 2022 and exceeded ₦1 trillion in 2023.

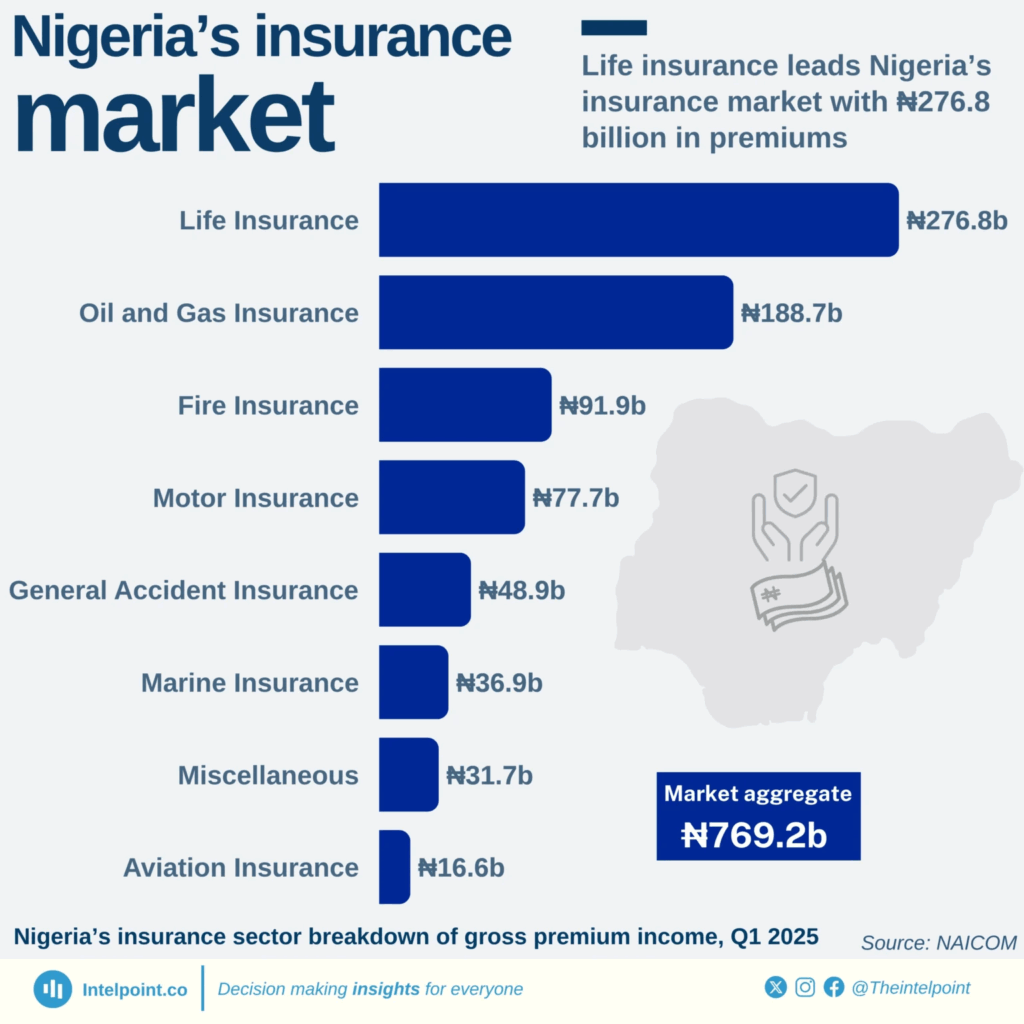

Meanwhile, according to the National Insurance Commission of Nigeria (NAICOM), the industry remained highly concentrated in the first quarter of 2025, with a few sectors driving most of the revenue. Life insurance dominated the market, generating ₦276.8 billion in Gross Premium Income.

Nigeria’s insurance market performance in Q1 2025

Oil and Gas followed closely with ₦188.7 billion, underscoring the sector’s capital intensity and exposure to risk. Fire and Motor insurance also held their ground, jointly contributing over ₦169 billion. By contrast, smaller segments such as Aviation and Marine lagged, pointing to untapped opportunities for growth and diversification.

Trends of the nigerian insurance industry from 1990-2024

1990-2000: Early growth and limited penetration

By 1990, Nigeria had 103 insurance companies, with insurance coverage of approximately 0.55%. The ratio of income to spending increased from 1:59 to 1:81.

The gross income of premiums totalled approximately ₦29.5 billion. The assets were 19.7% up by ₦6.333 billion by 1990. The loss ratio of non-life insurance companies decreased from 35.9% by 1989 to 30.2% by 1990.

2001-2010: Regulatory reforms and industry consolidation

The number of insurance companies reduced from 104 to 49 due to major regulatory reforms. Gross written premiums grew by an average of 23% each year, and the industry's premium income increased from ₦105.37 billion in 2007 to ₦232 billion by 2011.

Industry activity increased after compulsory insurance legislation was enacted in 2003. During this period, the industry's overall assets grew by 55%.

2011-2015: Increased awareness and expansion

Total premiums increased from ₦232 billion to over ₦300 billion in 2011. Non-life insurance accounted for 75.5%, whereas life insurance accounted for 24.5%. By 2014, micro-insurance reached 1.02% of people.

The industry grew at a CAGR of 19.5% from 2005 to 2011. Still, by 2014, only 2.5 million motor insurance certificates were authenticated out of an estimated 12.5 million vehicles on Nigerian roads.

2016-2020: Technological advancements and digital transformation

Technological advancements were instrumental in driving significant changes. Gross premium income increased to ₦371.8 billion in 2017, compared to ₦326.1 billion in 2016.

The insurance penetration ratio increased to around 0.5% by 2017, compared to 0.29% in 2016. InsurTech made insurance more accessible through micro-insurance and mobile-based products. Gross claims paid also increased to ₦148.3 billion by 2017, signalling better industry activity.

2021-2024: Rise of insurtech and foreign investments

Gross premium income grew by 23% to ₦631 billion in 2021 and by 22.9% to ₦776.5 billion in 2022. It is estimated to have grown by approximately 30% in 2023, reaching ₦1 trillion.

Gross premiums written hit ₦813.1 billion by Q2 2024, up 47.4% yearly and 72.7% quarter-on-quarter. The industry's assets were approximately ₦2.194 trillion in 2021. The market is poised to hit a gross written premium of ₦2.5 trillion by 2025.

Challenges facing the nigerian insurance industry

During these last few years, the Nigerian Insurance Industry has recorded steady growth. However, it still struggles with several factors that hamper its full potential.

1. Low penetration

Despite the improvement, insurance penetration in Nigeria remains below 1% of the population. Insurance penetration stands at 0.34% because of low awareness. In 2013, 86% of Nigerians did not have health insurance. The industry’s assets were worth ₦2.67 trillion in 2023, mainly from a small number of corporate clients and not from participation by ordinary Nigerians.

2. Trust issues

The main impediment to the industry’s growth is the lack of trust in the insurance companies. The unsatisfied claims decrease trust, with 669.4 billion net claims in 2023. Past experiences raise doubts for future policyholders.

3. Infrastructure challenges

The provision of services is limited by poor infrastructure. A meager 2.5 million of 12.5 million vehicles had their insurance certificates verified in 2014. The half-year gross premiums for 2023 were ₦551.4 billion, but weak infrastructure continues to limit the industry’s reach and effectiveness.

4. Regulatory hurdles

The industry's regulations are complex. The compliance cost is expensive. There are 57 insurance companies, and overall assets increased 10.7% to ₦2.7 trillion as of mid-2023. However, regulatory requirements, such as the adoption of new standards like IFRS 17, demand significant investment in technology and reporting systems, making compliance especially challenging for many insurers. Other hurdles include the high prevalence of insurance fraud, which increases operational costs, and limited product innovation, which restricts the industry’s appeal to a broader segment of Nigerians.

Final takeaway: The outlook for the nigerian insurance industry

The Nigerian insurance industry is poised to grow. Gross premium income increased by 51.1% quarter-on-quarter on a year-on-year basis in Q1 2024. The sector is predicted to have insurance revenues grow by 15-20% in 2025.

Gross premiums written reached ₦813.1 billion by Q2 2024, up by 47.4% on a year-on-year basis and by 72.7% quarter-on-quarter. The industry had ₦1.003 trillion of overall premium income by 2023, up 27% compared to ₦790 billion by 2022. The industry’s penetration is around 0.34%, while insurance density is $7.41 per capita.

FAQs

What is the historical development of insurance in Nigeria?

Insurance in Nigeria started during the colonial era when British firms introduced insurance services to cater to expatriates and businesses involved in trade. After independence, the industry expanded with the establishment of indigenous insurance companies and the creation of regulatory bodies to oversee operators’ activities. The government initiated several reforms to improve industry standards and build public confidence.

How big is the insurance industry in Nigeria?

The Nigerian insurance industry had an asset base of approximately ₦3.3 trillion as of the first quarter of 2024, representing a 36.9% increase from the ₦2.4 trillion recorded in 2023. Gross premium income increased by 22.9% to ₦776.5 billion in 2022 and was estimated to grow by about 30% in 2023 to over ₦1 trillion.

What are the challenges facing the insurance industry in Nigeria?

The Nigerian insurance industry faces various challenges, including low awareness, negative public perception, poor service delivery, unsuitable products, cumbersome claims processes, and unsuitable premium collection methods.

What is the outlook for the insurance industry?

Despite these challenges, Nigeria's insurance industry outlook is still promising, with a CAGR of over 10% from 2023 to 2027. The growth can be attributed to the increasing awareness of the importance of preventive health, which has led to an increased demand for health insurance. However, to sustain such a growth trajectory, issues concerning poor service delivery and limited public awareness must be addressed.