Nigeria’s oil map tells a story of power packed into a few states and promises lying dormant in others.

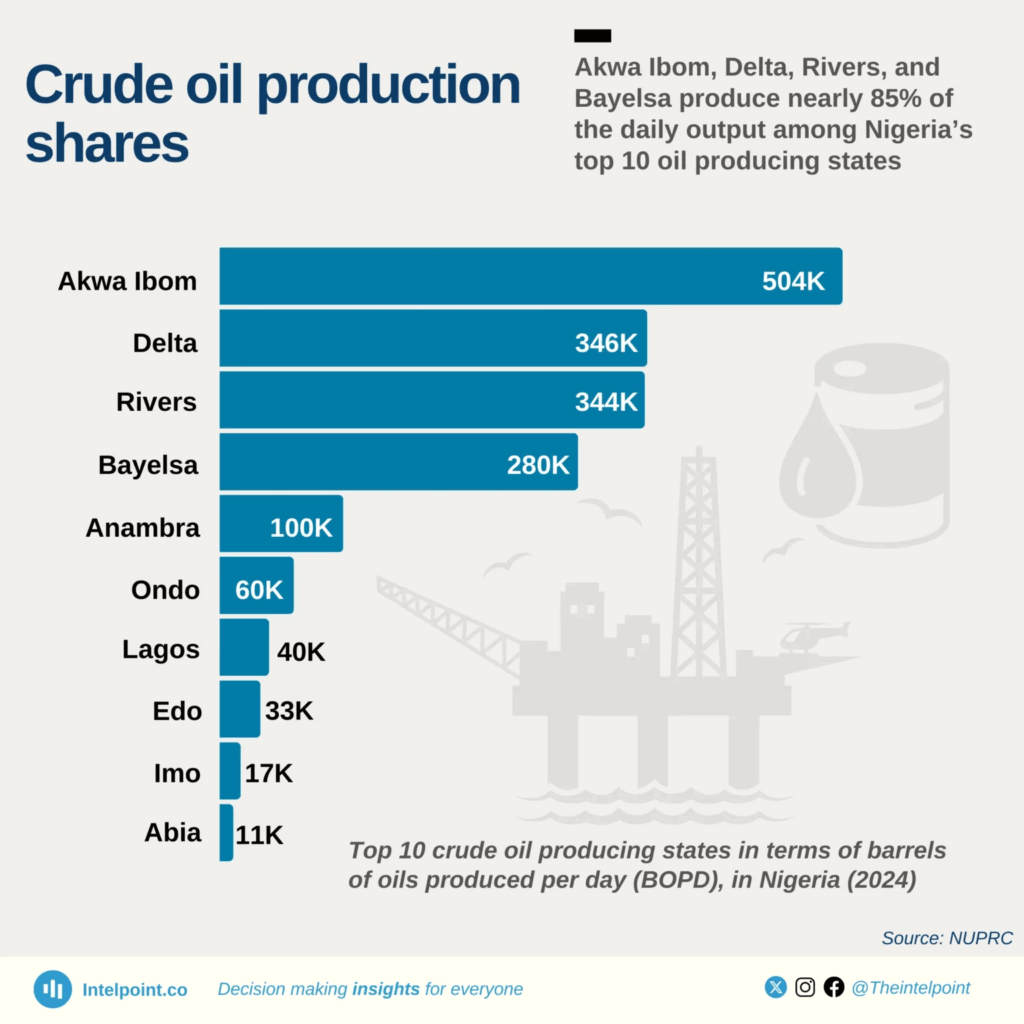

At the heart of the Niger Delta, Akwa Ibom stands tall, pumping an impressive 504,000 barrels of crude oil every day, according to figures released by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), covering the period from November 2023 to September 2024.

Hot on its heels are Delta and Rivers, with daily outputs of 346,000 and 344,000 barrels, respectively. Together with Bayelsa, this quartet is responsible for almost 85 percent of the oil flowing out of Nigeria’s top ten producing states.

However, this is just one part of the story, as the data is captured only in terms of barrels of oil produced per day (BOPD).

Overview of Nigeria’s oil industry

In terms of output, Nigeria's average daily crude oil and condensate production for July 2025 was approximately 1.83 million barrels per day (mbpd), surpassing the OPEC quota of 1.5 mbpd.

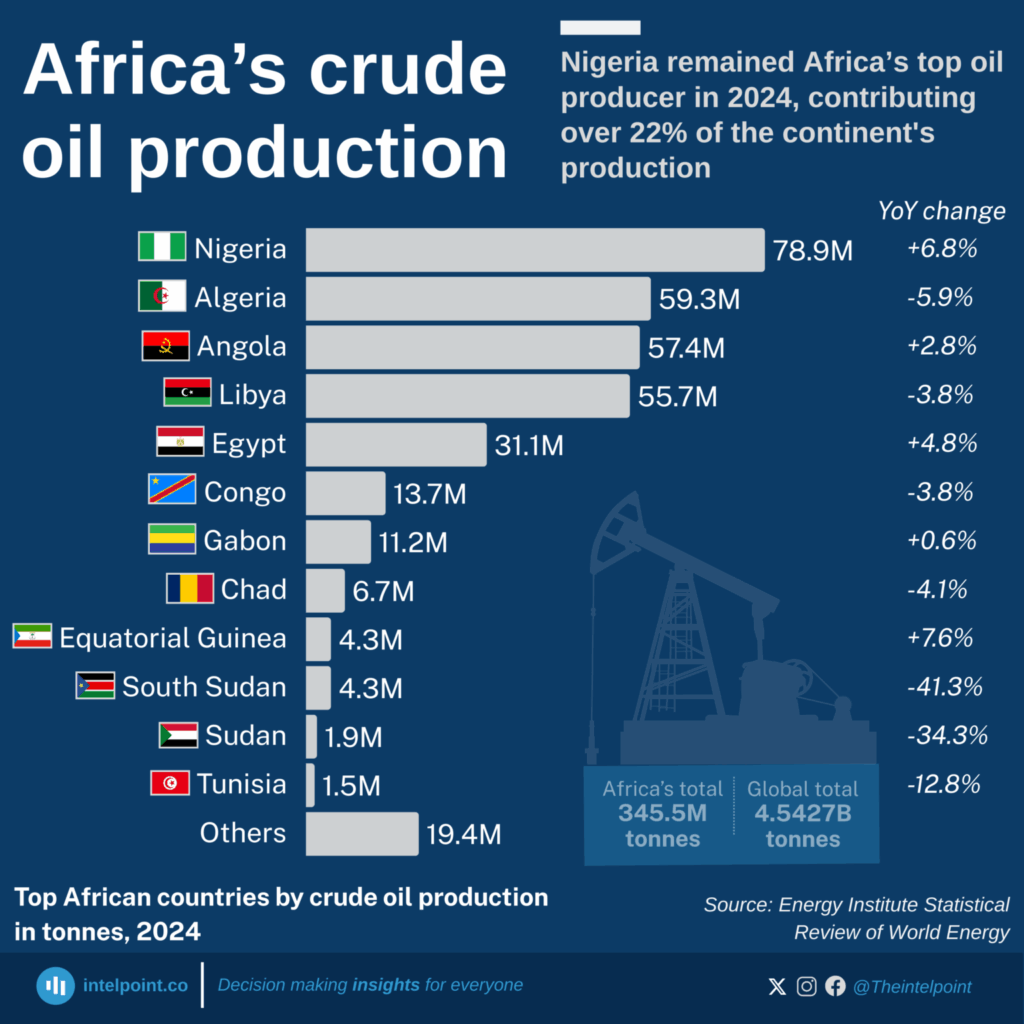

According to the Energy Institute Statistical Review of World Energy, Nigeria led with 78.9 Mtoe in 2024, accounting for over 22% of Africa’s total oil output.

Crude oil & Condensate production among Nigerian states ranked (Nov 2023–Sept 2024)

Source: NUPRC

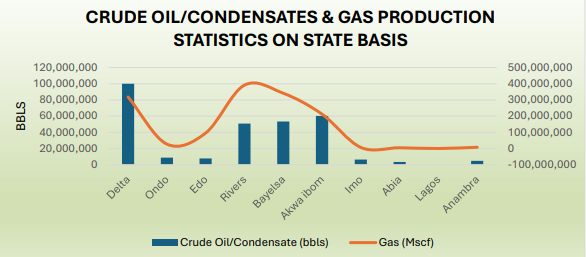

| Rank | State | Volume (barrels) |

| 1 | Delta | 99.90 million |

| 2 | Akwa Ibom | 60.32 million |

| 3 | Bayelsa | 53.28 million |

| 4 | Rivers | 50.84 million |

| 5 | Ondo | 8.71 million |

| 6 | Edo | 7.77 million |

| 7 | Imo | 6.33 million |

| 8 | Anambra | 4.78 million |

| 9 | Abia | 3.42 million |

| 10 | Lagos | 0 |

Why these four states dominate

The gulf between the heavyweights and smaller producers such as Abia and Imo, which contribute only marginal volumes, exposes sharp regional imbalances in Nigeria’s oil geography.

It also explains the vulnerability that arises from relying on a narrow cluster of states for the majority of national output.

Geology of the Niger Delta Basin

Firstly, the geology of the Nigerian Delta Basin, with its subsurface geology that offers multiple reservoirs and facilitates easier extraction, gives it an advantage. These four states all sit at the heart of Nigeria's richest petroleum province.

In fact, they've built up a legacy from early exploration. From the 1950s onward, IOCs such as Shell, ExxonMobil, and Chevron have concentrated their exploration efforts in this region. This has given the Big Four decades of investments, skilled labour pools, and producing assets that other states lack.

Offshore advantage

Another factor is the offshore advantage. As many companies relocated offshore due to community disruption and sabotage, the Big Four benefitted the most, thanks to their coastal location and established offshore evacuation routes.

Additionally, key terminals such as Bonny in Rivers State, Forcados in Delta State, and Qua Iboe in Akwa Ibom State, along with offloading facilities in Bayelsa State, have made it cheaper and faster to transport crude oil to the export point.

What does oil concentration mean for the economy?

The dominance of Akwa Ibom, Delta, Rivers, and Bayelsa in Nigeria's oil production has profound economic and political consequences, as well as benefits.

On one hand, these states are the lifeline of Nigeria's national revenue, sustaining foreign exchange earnings, federal allocations, and much more. On the other hand, the extreme concentration of resources in just a few states exposes the entire economy to regional vulnerability.

The oil earnings are federally collected; however, the 13% derivation principle ensures that producing states receive a direct share of the revenue.

For the Big Four, this means they receive extra revenue that amounts to billions, compared to non-oil states. Despite this, the Niger Delta Paradox of high revenue alongside underdevelopment, poverty, and environmental degradation persists. This has fuelled decades of unrest and pipeline sabotage, which disrupts production and shrinks national earnings.

There are still diversification needs…

Crude oil still sits at the heart of Nigeria’s economy, anchoring export earnings and government revenue despite years of talk about diversification. The country’s dependence means global price swings and production levels continue to dictate much of its economic stability.

Non-oil sectors have been flagged as the next frontier, with non-oil exports earning nearly as much as crude oil in the first half of 2025. Specifically, in the first six months of 2025, non-oil exports generated $3.22 billion, while crude oil sales totalled $3.47 billion.

But capital inflows remain sluggish, revealing a deeper challenge. Without sweeping public sector reforms to boost productivity and efficiency, Nigeria’s ambition to break free from oil dependence risks stalling.