In 2000, Nigeria's internet penetration was 0.06%, indicating a backwardness in the nation's digital development. However, it grew to 55.4% in 2021, with 103 million users, highlighting the impressive growth in digital. In 2024, MTN Nigeria led with an estimated subscriber base of about 77 million subscribers, creating a 37% market share.

Here’s a detailed table summarizing the trends of natural rubber production in Africa from 1994-2024:

| Period | Internet Penetration Rate | Top ISPs | Key Developments |

| 2000-2005 | 0.6% to 3.55% | NITEL, MTN Nigeria | The introduction of mobile internet services; MTN Nigeria's market entry in 2001. |

| 2006-2010 | 5.55% to 11.5% | MTN Nigeria, GLO, Airtel, 9Mobile | Increased competition among ISPs; expansion of mobile internet services. |

| 2011-2015 | 13.8% to 36% | MTN Nigeria, GLO, Airtel, 9Mobile | Deployment of 3G networks; significant investments in infrastructure development. |

| 2016-2020 | 25.67% to 36% | MTN Nigeria, GLO, Airtel, 9Mobile | The dominance of mobile internet, smartphones becoming more affordable, and the expansion of 4G services. |

| 2021-2024 | 55.4% to 45.5% | MTN Nigeria, GLO, Airtel, Spectranet, FiberOne, Starlink | The introduction of 5G technology and the entry of Starlink, offering satellite internet services, will be in early 2023. |

Key takeaways

- 2000-2005: Internet penetration rose from 0.06% to 3.55%, with the leaders being NITEL and MTN Nigeria.

- 2006-2010: Penetration grew from 5.55% to 11.5% due to Glo, Airtel, and 9Mobile entering the market.

- 2011-2015: Internet penetration increased from 13.8% to 36% through investments in fiber-optic and 3G.

- 2016-2020: Mobile internet expanded, with internet penetration at 36%. MTN Nigeria led with a vast market share.

- 2021-2024: As of early 2024, Internet penetration was 45.5%, with 103 million users. Broadband penetration was 44.43% as of December 2024, and mobile data usage reached 973,455 terabytes in December 2024.

2000-2005: Emergence and expansion

Between 2000 and 2005, Nigeria's internet penetration grew from 0.06% to 3.55%. In 2001, it was 0.09%, with 113,289 internet users.

There were 740,569 internet users, and MTN Nigeria had over 1 million subscribers in 2003. As of December 2005, it had 4,392,000 active subscribers, a 123% year-on-year growth.

2006-2010: Growth and competition

Nigeria's internet penetration grew from 5.55% in 2006 to 24% in 2010. Internet users went from 7,947,035 in 2006 to 38,261,938 in 2010, a 381% increase.

MTN Nigeria’s subscribers expanded significantly, and this drove the growth. MTN Group had 141.6 million subscribers globally by the end of 2010, and a significant number were in Nigeria.

2011-2015: Expansion and infrastructure development

From 2011 to 2015, Nigeria's internet penetration increased from 28.4% to 38% by 2013 and 32.8% in 2012. The number of internet users increased from 46,560,001 to 65,670,276, a 41% increase.

By 2015, mobile subscribers exceeded 143 million, and 3G network coverage increased significantly. By January 2015, Globacom had 28.49 million subscribers (21% market share), and Airtel had 27.99 million subscribers (20% market share).

2016-2020: Mobile internet dominance

From 2016 to 2020, Nigeria’s internet penetration increased from 25.67% to 36%. Broadband penetration stood at 45.93% in 2020. Mobile internet subscriptions increased massively, with over 104 million active mobile broadband subscriptions in 2020. MTN Nigeria alone had around 50.7 million subscribers, Globacom 37 million, and Airtel 35 million. Internet users increased from 92 million in 2016 to 123 million in 2020.

2021-2024: Technological advancements and market dynamics

From 2021 to 2024, Nigeria's internet penetration increased from 55.4% in 2021 to 45.5% by early 2024. In January 2021, there were 104.4 million internet users, rising to 103 million by early 2024. Mobile connections increased from 187.9 million in January 2021 to 205.4 million by early 2024.

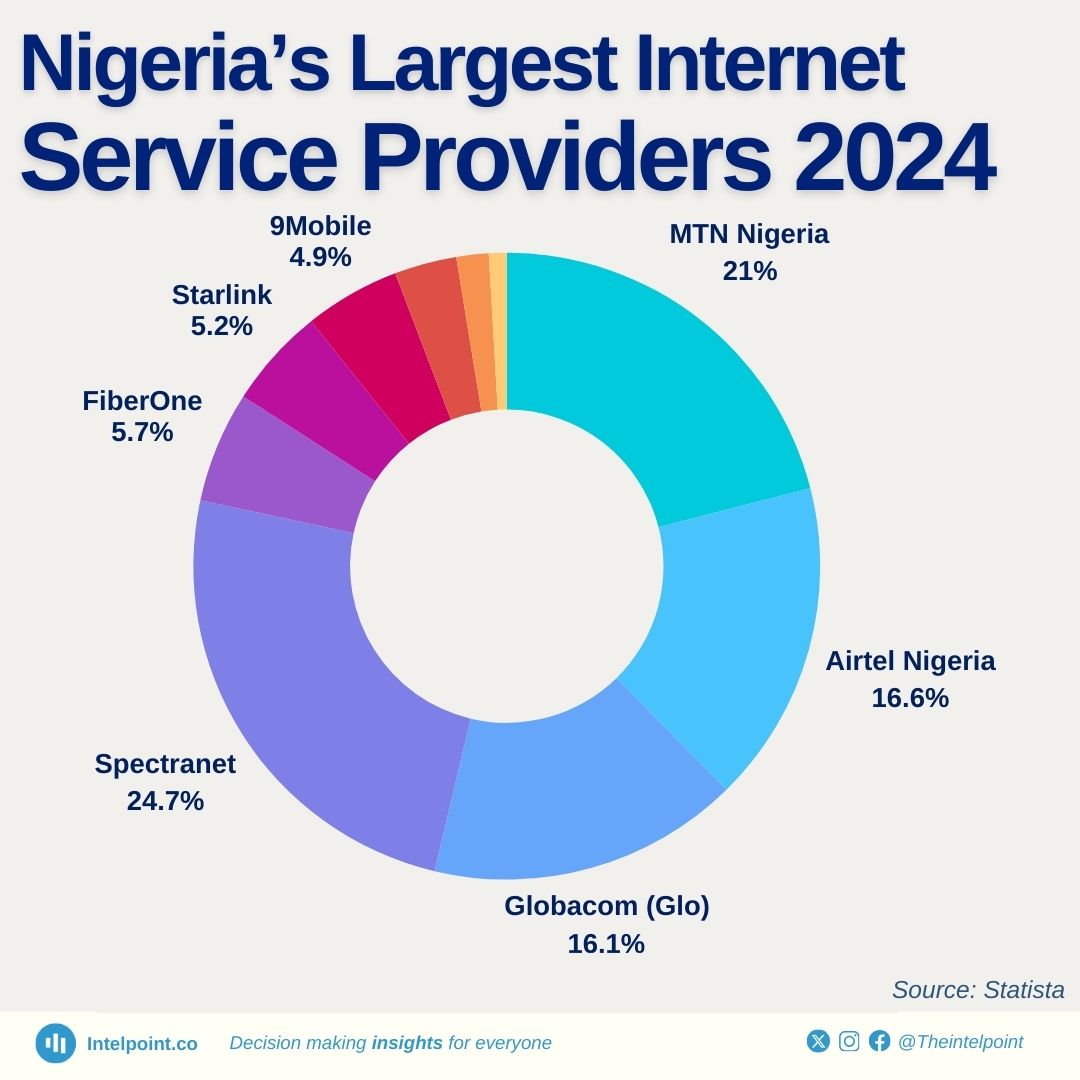

MTN Nigeria led the 5G push, and coverage increased from 3% in 2022 to 11% in 2023. By March 2024, 5G subscriptions accounted for 1.24% of total connections. By Q4 2023, Starlink had grown to be the third-largest ISP in Nigeria, with 23,897 subscribers.

Conclusion

Nigeria's internet penetration grew from 0.06% in 2000 to 55.4% in 2021. As of March 2024, MTN Nigeria controlled a 37% market share. As of January 2024, Nigeria had 103 million internet users. Despite regulatory issues and competition, internet data consumption stood at 973,455 terabytes in December 2024, a 36.5% year-on-year increase.

FAQs

What is the largest ISP in Nigeria?

At the end of Q4 2023, Spectranet was the largest ISP in Nigeria, with approximately 114,000 active subscribers and a market share of 43%.

What year did the internet start in Nigeria?

Internet services began in Nigeria in 1996, launching the country into the digital era of communication.

How many internet users are in Nigeria in 2024?

Nigeria had an estimated 103 million internet users, making about 45.5% of its population online.

How many internet service providers are in Nigeria?

Nigeria has several ISPs, the leading being MTN Nigeria, Airtel Nigeria, 9Mobile, and Glo.