Key takeaways

- Netflix entered the Nigerian market in 2016, officially launching Netflix Naija in 2020 to deepen local engagement.

- Its first Nigerian original, Lionheart, was acquired in 2018, marking a turning point for Nollywood’s global recognition.

- Nollywood titles gained significant traction on Netflix, with films like Citation (2020), Anikulapo (2022), The Black Book (2023), and Jagun Jagun (2023) topping viewership charts.

- Netflix partnered with top Nigerian filmmakers, including Mo Abudu, Kunle Afolayan, and Kemi Adetiba, to produce original content.

- Netflix raised its subscription prices twice in 2024, with the Premium Plan going from ₦5,000 to ₦7,000, leading to concerns over affordability.

- Netflix announced a cutback on Nigerian original productions in late 2024, sparking debate about its long-term commitment to the market.

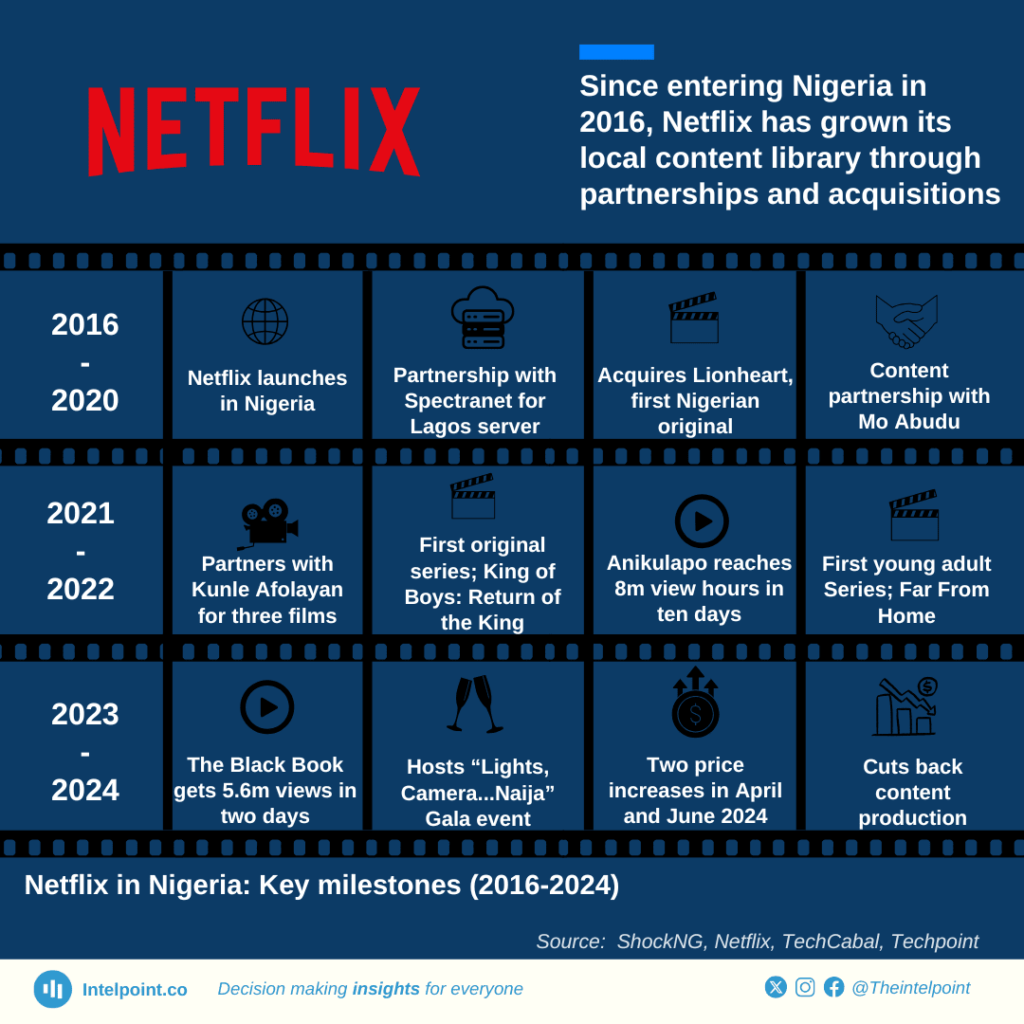

Since its arrival in Nigeria in 2016, Netflix has reshaped the country’s entertainment industry, influencing content creation, distribution, and audience engagement. From acquiring local films to funding original productions and forming strategic partnerships, Netflix’s activities in Nigeria have been both transformative and complex. As its presence grew, so did its role in redefining Nollywood’s global appeal and accessibility.

Netflix became available in Nigeria in January 2016 as part of its global expansion to 130 countries. Initially priced at $8 (approximately ₦2,240 at the time), it introduced Nigerian viewers to its extensive international library. However, a key turning point came in September 2018 when Netflix acquired worldwide rights to Lionheart, marking its first Nigerian original.

By February 2020, Netflix officially launched its local platform, Netflix Naija, signifying deeper investment in the industry. This led to multiple partnerships and acquisitions, including content agreements with top Nigerian filmmakers such as Mo Abudu and Kunle Afolayan.

Netflix’s Nigerian content strategy

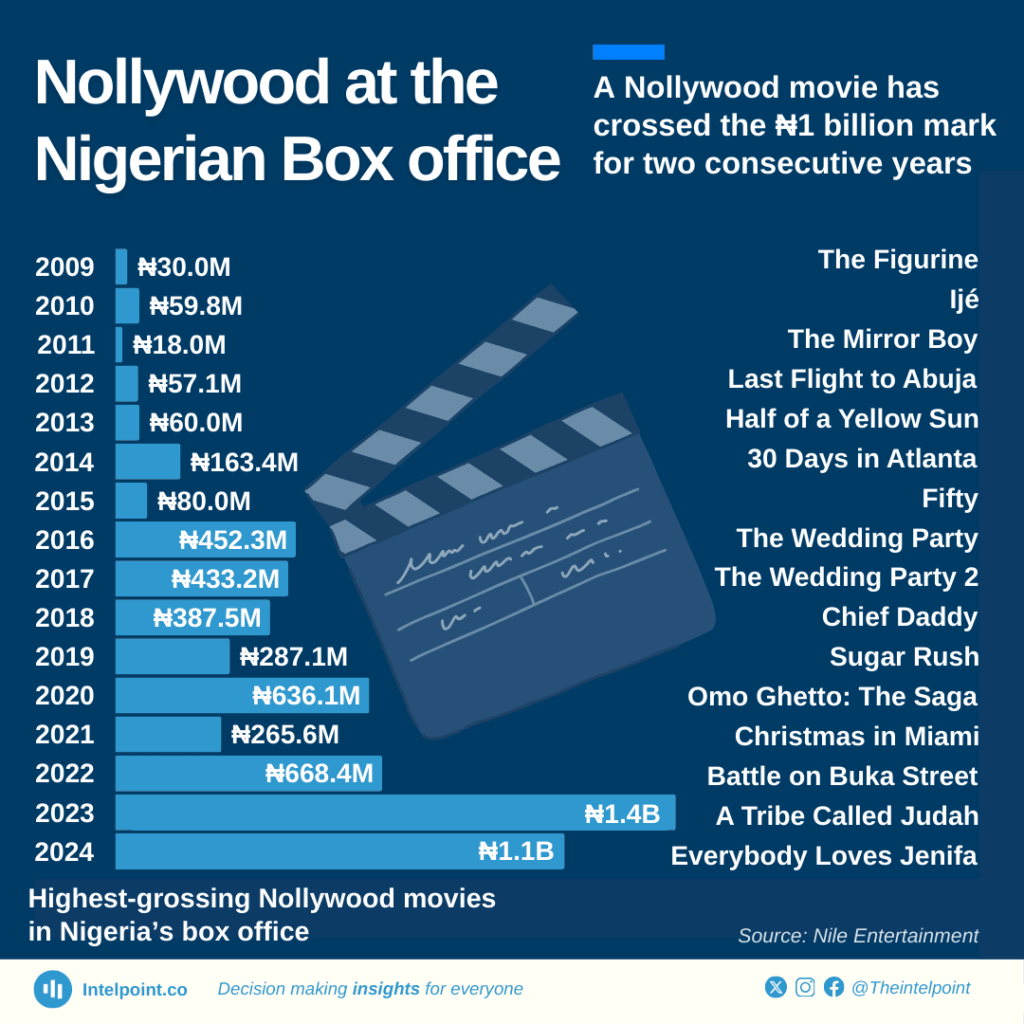

In the early years, Netflix focused on laying the foundation for a strong presence in Nigeria. After its 2016 launch, the company gradually integrated more Nollywood titles into its library, some of which were the highest-grossing Nollywood movies in the cinemas in their years of release. By 2018, the acquisition of Lionheart became a defining moment, followed by an influx of blockbuster Nollywood films such as Merry Men, King of Boys, and Wedding Party 2 to the platform in 2019. Kunle Afolayan's Citation emerged in 2020 as the most-watched movie on Netflix Nigeria, with Nollywood titles comprising 40% of the top 30 films.

Further expansion followed in 2021 and 2022, as Netflix took a more active role in original content production. The company partnered with Kunle Afolayan to produce Swallow and Anikulapo in 2021, while Kemi Adetiba's King of Boys: The Return of the King became Netflix Nigeria’s first original series in August of that year.

Blood Sisters, released in May 2022, reinforced Netflix’s commitment to high-quality Nigerian storytelling. Later that year, Anikulapo reached eight million viewing hours within ten days, securing its position as the most-watched Nigerian movie on the platform for 2022.

By 2023, Netflix had cemented its role as a major distributor of Nollywood films, with several Nigerian titles achieving significant global viewership. The Black Book gained 5.6 million views in just two days in September, eventually reaching 11.2 million by October 1 and securing a spot in Netflix’s global top three English movies.

Meanwhile, Jagun Jagun emerged as the most-watched Nigerian film on the platform in 2023, surpassing The Black Book. Nollywood's dominance continued, with 17 out of the top 30 most-watched films in Nigeria that year being local productions, representing 56.67% of the platform’s top-performing content in the country.

However, Netflix has also faced challenges. In January 2024, it lost 39,451 Nigerian subscribers after banks suspended naira cards for international transactions. Additionally, the company implemented two price hikes in 2024, raising its Premium Plan from ₦5,000 to ₦7,000, the Standard Plan from ₦4,000 to ₦5,500, and the Mobile Plan from ₦1,600 to ₦2,200. By November 2024, Netflix announced plans to scale back its original content production in Nigeria, raising questions about its long-term strategy in the region.

Netflix’s investments and partnerships in Nigeria

As of March 2023, Netflix’s total investment in Nigeria had exceeded $23.6 million, with 283 licensed Nigerian titles on the platform. The company has not only funded productions but also invested in talent development through initiatives like the Episodic Lab (EPL) and Development Executive Traineeship (DET).

Netflix has also played a crucial role in giving Nollywood films international exposure. For example, in 2022, Anikulapo topped the Netflix Nigeria charts, and 53% of the top 30 films on the platform were Nollywood productions.

The future of Netflix in Nigeria: Sustained growth or a strategic shift?

While Netflix’s influence on Nollywood has been significant, challenges such as pricing changes, local economic factors, and increased competition could impact its future growth. The recent decision to scale back on original productions raises questions about its long-term commitment to the Nigerian market.

Despite these hurdles, Netflix remains a major player in Nigeria’s entertainment industry, having redefined film distribution, broadened audience reach, and set new standards for content production. The coming years will reveal whether Netflix will double down on its Nigerian operations or adjust its approach to match evolving market realities.