Africa’s mobile phone market has grown rapidly over the past decade, transforming the way millions connect, work, and utilise digital services.

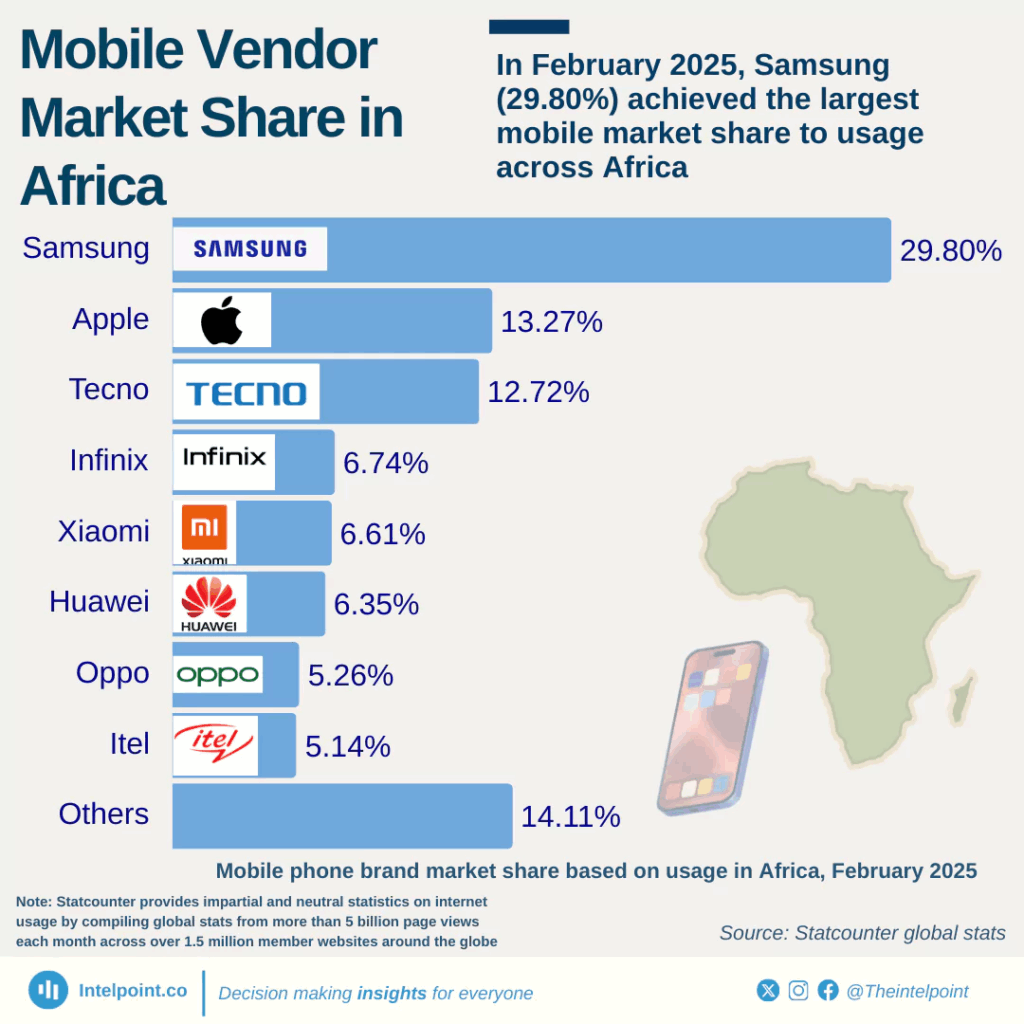

Data gathered by IntelPoint from Statcounter Global Stats revealed that, based on usage, Samsung leads the continent's mobile market with a 29.80% share.

According to the February 2025 data, Apple ranks second with a 13.27% share, demonstrating resilience in markets sensitive to pricing. Collectively, Chinese manufacturers hold more than 45% of the mobile market in Africa.

Mobile vendor market share in Africa, February 2025

Brands under Transsion Holdings (Tecno, Infinix, and Itel) together represent nearly 25% of the total market share based on usage.

The continent has become a critical battleground for smartphone brands, particularly with the increasing penetration of smartphones driving strong demand across all regions.

This article examines the mobile phone market share in Africa, focusing on identifying which brands dominate in various regions and the reasons behind their dominance.

Key takeaways

- Samsung and Apple dominate the mobile phone market in Africa.

- Chinese manufacturers hold more than 45% of the mobile phone market in Africa.

- When it comes to usage, brands under Transsion Holdings (Tecno, Infinix, and Itel) together represent nearly 25% of the total market share.

Regional highlights

How are these mobile phone vendors performing across various regions of the continent? The data from Statcounter Global Stats presents a surprising story.

Northern Africa

In Northern Africa, Egypt has emerged as the standout performer so far in 2025, recording over 30% yearly growth in smartphone shipments. This surge has been fuelled by policy reforms, including IMEI whitelisting, a more stable macroeconomic climate, and a growing base of local manufacturing.

Algeria has also contributed positively, with healthy double-digit growth, while the Moroccan market is experiencing a slight decline.

Within this region, Samsung has consolidated gains through its affordable Galaxy A-series, now accounting for the bulk of its shipments. At the same time, Xiaomi has surged on the back of aggressively-priced Redmi and A-series models that resonate with younger consumers.

West and Central Africa

In West and Central Africa, Transsion brands (Tecno, Infinix, and Itel) have retained an iron grip on the market. Their deep distribution networks, dual-SIM functionality, and affordability keep them entrenched as the go-to choice in Nigeria, Ghana, and surrounding countries.

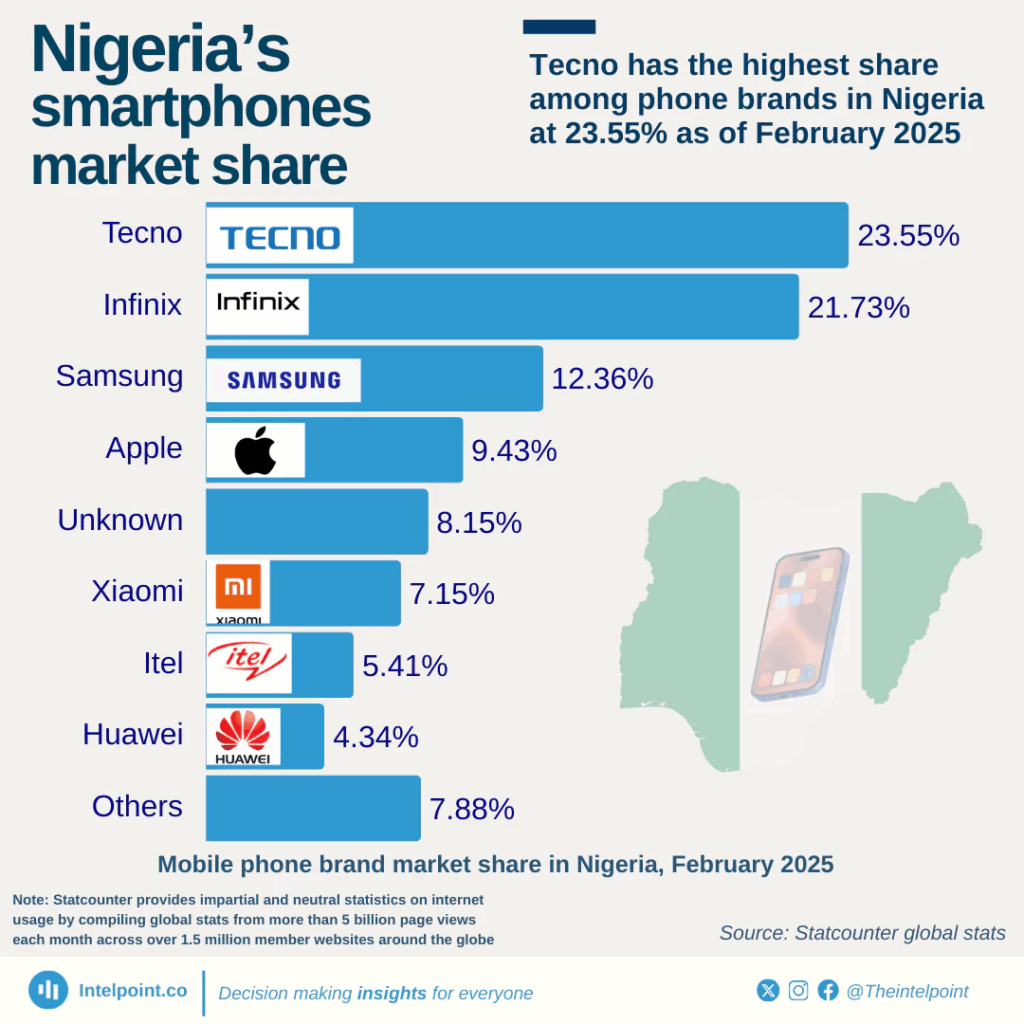

For example, as of February 2025, Transsion Holdings had achieved remarkable market share in Nigeria with its three brands: Tecno (23.55%), Infinix (21.73%), and Itel (5.41%), collectively representing more than half the market at 50.69%.

Samsung maintains its position as the top non-Chinese brand, with a 12.36% market share, followed by Apple at 9.43%.

They are not the only brands in the market, however. Xiaomi is steadily expanding its footprint, particularly in Nigeria, by offering strong specifications at competitive price points and building relationships with local retailers.

Despite economic pressures that caused Nigeria’s market to shrink early in the year, the long-term growth potential remains intact, with device financing and fintech-driven adoption set to play a larger role.

Southern Africa

Meanwhile, in Southern Africa, South Africa remains the region’s anchor market. Smartphone shipments there grew by more than 10% in 2025, boosted by tax reforms and the ongoing migration from 2G and 3G networks to 4G and 5G.

Apple maintains its position in the premium segment. This position has been difficult for competitors to dislodge.

At the same time, Samsung has expanded its reach with affordable A-series devices, supported by financing schemes, and now holds over half of the South African market.

Beyond South Africa, growth trends are uneven; however, the broader region benefits from increasing 5G penetration and operator partnerships that bring smartphones within the reach of more consumers.

Growth trends and Market drivers

One of the most powerful forces shaping Africa’s smartphone market is the rising demand for ultra-low-cost devices.

With inflation and foreign exchange pressures placing a high demand on household budgets, affordability remains the deciding factor for most consumers.

Devices priced at entry level (often under $50) are driving volumes, as they provide first-time smartphone users with access to digital services, mobile banking, and social platforms.

This mass-market appeal continues to expand the customer base, particularly among youth populations and rural communities.

Another major driver is the increasing emphasis on local assembly and manufacturing, which is gaining momentum across multiple countries. Egypt, Ethiopia, and Kenya have taken notable strides by encouraging local smartphone production and assembly plants.

This shift brings two advantages:

- It reduces dependency on imports (which are vulnerable to currency fluctuations and tariffs).

- It allows manufacturers to offer more competitively priced devices tailored to local needs.

In markets where affordability is critical, this localisation strategy is proving essential to sustaining growth and attracting investment.

What this means for the African mobile phone market and users

Africa’s smartphone market is evolving rapidly in terms of growth and where value is being captured. The latest figures paint a picture of adaptation in many ways:

1. Samsung’s dominance shows the strength of mid-range adaptability

Samsung’s 29.8% lead reflects how its Galaxy A-series and other mid-range devices are resonating with Africa’s price-sensitive mass market.

The company has successfully balanced brand prestige with affordable models. For users, it means wider access to global-brand features at competitive price points, reinforcing Samsung’s presence in both entry-level and premium segments.

2. Unsurprisingly, Apple is all about aspirational demand

At 13.27%, Apple’s iPhone penetration in a cost-conscious market is remarkable. It signals a strong aspirational pull: African consumers are willing to stretch budgets, buy refurbished units, or finance purchases just to own the iPhone.

For the market, this is proof that lifestyle branding can overcome price barriers, while for users, it means Apple’s ecosystem will continue shaping mobile habits (particularly among urban elites and younger professionals).

3. Transsion Holdings remains the people’s choice

Tecno, Infinix, and Itel collectively hold 24.6%, confirming Transsion’s role as the “mass-market engine” of Africa’s mobile adoption.

For users, this translates into phones designed with local realities (irregular power, multiple SIM cards) in mind, sustaining digital inclusion.

4. Chinese brands have innovation pressure

Xiaomi, Huawei, Oppo, and Realme together claim one-fifth of the market.

Their presence adds competitive pressure, keeping prices low while driving innovation in specifications such as fast charging, camera quality, and 5G readiness.

African users benefit from broader choice and faster trickle-down of premium technology into budget segments.

5. The market remains fragmented, but affordability drives everything

No single brand dominates beyond one-third of the market, meaning intense competition will persist.

For Africa’s users, this is a positive development: constant price wars, promotions, and financing schemes ensure that access to smartphones continues to expand.

It also implies that after-sales service and ecosystem lock-in (apps, payments, financing) will become more important differentiators than hardware alone.