Nigeria’s payment landscape has undergone a remarkable transformation in the past decade. From the dominance of cash and cheque transactions to the explosive growth of digital payments, data shows a clear shift towards more convenient, tech-driven solutions. With web payments, mobile payments, and POS transactions surging, Nigerians are embracing digital financial services at an unprecedented rate.

Key takeaways

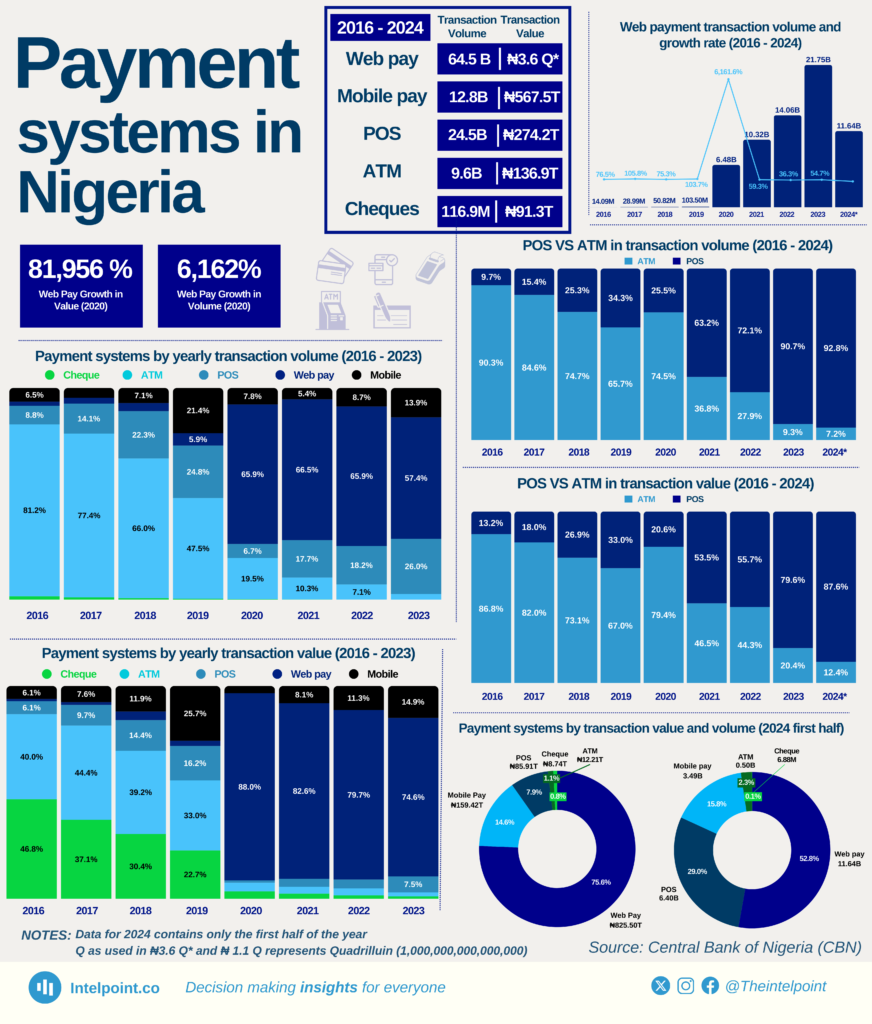

- Web payments dominate transaction volume, with 11.64 billion transactions in the first half of 2024, accounting for 52.8% of total transactions.

- Web payment growth in 2020 was extraordinary, with an 81,956% increase in volume and 6,162% in value.

- Mobile payments are rising fast, hitting 9.8 billion transactions in 2024’s first half, with a transaction value of ₦19.24 trillion.

- POS transactions have completely overtaken ATM transactions, growing from 9.7% of total transactions in 2016 to 92.8% in 2024.

- ATM transactions have declined drastically, now making up only 7.2% of total volume in 2024.

- Cheque usage continues to fade, contributing just 7.0% of total transaction value in 2024.

Web payments surge: The highest growth

One of the most noticeable insights from the data of the Nigerian payment system is the extraordinary rise in web payments. In 2020 alone, web payment transaction volume grew by a staggering 81,956%, with its value also rising by 6,162%. This indicates an aggressive adoption of online payments, possibly driven by the COVID-19 pandemic, which accelerated digital transformation across industries. The total transaction volume for web payments from 2016 to H1 2024 alone, web payment transactions reached 11.64 billion, accounting for 52.8% of all recorded transactions. This sharp increase reflects Nigeria’s growing reliance on online banking, e-commerce, and digital financial services, making web payments the leading channel in transaction volume.

Nigeria’s payment landscape: The digital dominance

Nigeria’s payment ecosystem has undergone a significant shift, with digital channels now dominating transaction volumes and values. In 2016, cheques and ATM transactions made up over 80% of total payment volumes, but by 2023, their share had plunged to below 1% and 3%, respectively. Meanwhile, web payments, mobile transactions, and POS systems have increased, with web payments alone accounting for over 55% of transaction volume and over 74% of transaction value in 2023. This transformation shows Nigeria’s rapid digital adoption, driven by fintech innovation, smartphone penetration, and a cashless policy push.

Mobile payments gain momentum

Another significant trend is the growing adoption of mobile payments. Between 2020 and 2024, mobile payment volumes experienced massive growth, reaching 9.8 billion transactions in H1 2024. The transaction value for mobile payments was also impressive, hitting ₦567.5 trillion over the years, with ₦19.24 trillion in 2024 alone. Despite this rapid growth, mobile payments are still behind web transactions in total volume. However, with increasing smartphone penetration and fintech innovation, this sector is positioned for even more expansion in the coming years.

POS transactions vs ATM transactions: The shift in preference

The data reveals a major shift in how Nigerians use POS and ATMs. In 2016, ATM transactions dominated, accounting for 90.3% of total ATM-POS transactions, while POS usage was just 9.7%. By 2024, this trend had reversed, with POS transactions making up 92.8%, leaving ATM usage at a mere 7.2%. This shift signals a growing preference for POS terminals over ATMs, likely driven by the rise of agency banking, cashless policies, and the decline in ATM availability in certain areas.

In terms of value, POS transactions have also overtaken ATM transactions. In 2016, ATMs accounted for 86.8% of the total value compared to POS at 13.2%. However, in 2024, POS transactions dominated with 87.6%, leaving ATMs with just 12.4% of transaction value.

Cheques: A dying payment method

While digital payments are thriving, cheque transactions are steadily declining. Cheque usage has remained significantly low, with a cumulative 116.9 million transactions from 2016 to 2024 — a small number compared to web, mobile, and POS transactions. The total transaction value of cheques stands at ₦91.3 trillion, which, while significant, has been overshadowed by faster, more convenient alternatives. In 2026, 46.76% of total transactions in value was in cheque. This fell to 1.06% in 2023, and fell further to less than 1% in 2024. This trend suggests that cheques will continue to lose relevance, making way for fully digital alternatives.

Nigeria’s transition from cash to digital transactions

According to the Worldpay Global Payments Report, Nigeria has seen a dramatic drop in total cash transactions, decreasing from 91% of total transactions in 2019 to 55% in 2023. By 2027, this figure is projected to decline further to 42%, signalling a fundamental shift in consumer payment behaviour. This decline is not unique to Nigeria; countries like Mexico, Thailand, and Japan have also experienced reductions in cash usage. However, Nigeria's shift stands out due to the rapid adoption of digital financial services, driven by factors such as the growth of digital payment platforms, government policies promoting a cashless economy, increased smartphone and Internet penetration, etc.

Conclusion

The evolution of Nigeria’s payment systems is a testament to the country’s digital transformation. Web payments and mobile transactions are redefining financial interactions, while POS transactions have become the go-to alternative to cash withdrawals. The trend signals a move towards a predominantly cashless economy, with traditional methods like cheques becoming obsolete.With fintech innovation, increased smartphone adoption, and government cashless policies, these trends are expected to accelerate. Businesses, financial institutions, and policymakers need to leverage these insights to drive financial inclusion and enhance digital infrastructure.